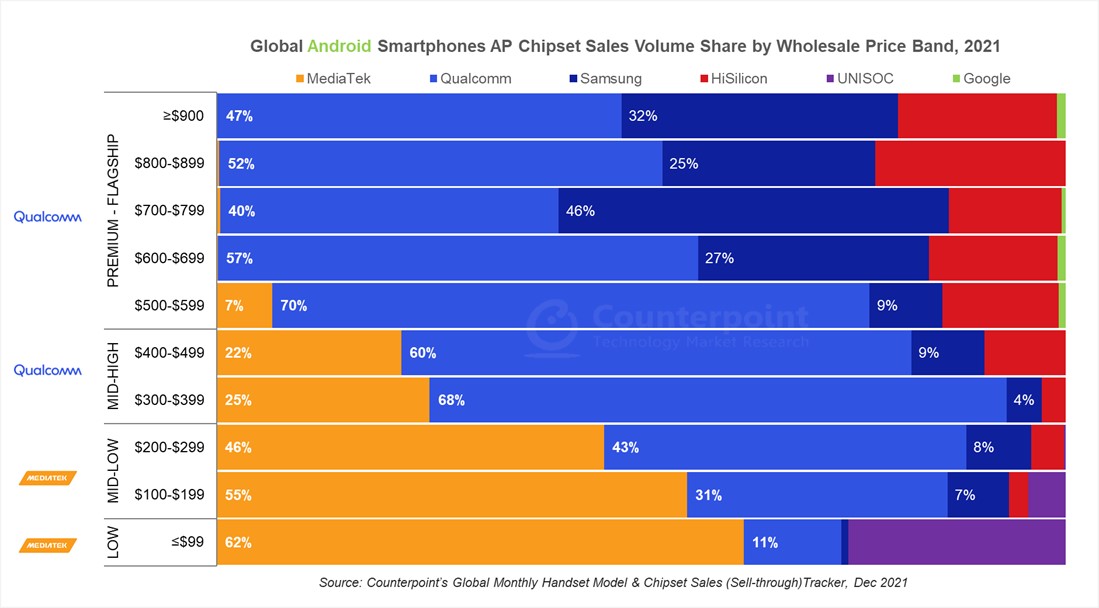

Earlier it was announced that MediaTek had already led the Android smartphone SoC market in 2021 with a 46% share, exceeding its rival Qualcomm, which had a 35% share in the market in 2021. One might think this spell the end of Qualcomm’s dominance in the Android smartphone space.

However, a follow-up report to the research has been published by Counterpoint Research. The report details the price brackets where Qualcomm, MediaTek, Exynos, HiSilicon and UNISOC are leading in the race for the Android chip supplier with the largest market share.

A closer examination of the report reveals that most of the market share growth for MediaTek in 2021 came from the low-mid tier wholesale price segment (sub-$299), driven by strong demand for the Dimensity 700, 800 and Helio series chipsets. Qualcomm on the other hand dominated the mid-range and premium flagship market with around 50% market share across all price brackets above $300, except for the $700-$799 price bracket, in which Samsung had a lead with 46% market share in the bracket.

But the question remains, why has Qualcomm shifted away from the low-end markets and how did MediaTek manage to win the low-end market after Qualcomm’s gradual exit?

The report mentions that the reason behind these changes of trends in the market is because of the global chip shortage. With Qualcomm unable to secure its chip supply from both TSMC and Samsung, the company instead prioritized focus on ramping up supply for its 700 and 800 series Snapdragon chipsets, driving higher revenue and profitability.

However, with Qualcomm not providing much value-to-money in its 400 and 600 series Snapdragon chipsets in 2021, phone manufacturers decided to switch over to its competitor, MediaTek instead for their lower-end budget devices. MediaTek managed to put out capable and affordable 5G chipsets to the market in 2021 with their Dimensity 700 to 1200 series, which could provide performance on par and sometimes exceed competing processors in the same price bracket. And with the reveal of its Dimensity 8000 and 9000 series chipsets in 2022, it is expected that MediaTek could take the stake of the higher-end premium Android market as well in this coming year.

The report also shares some details about Samsung’s Exynos, Huawei’s HiSilicon Kirin and UNISOC chipsets in the industry in 2021. Besides the Samsung Galaxy S21 series equipped with Exynos, most of Samsung’s A, M and F series of smartphones were not equipped with Exynos. In the low-mid segment ($100-$299), its share decreased from 17% to 7%, and in the mid-high segment, its share decreased from 13% in 2020 to 6% in 2021.

UNISOC showed exciting growth in 2021 in smartphones priced less than $200. In 2020, UNISOC chipsets only catered to phones priced under $100. However, in 2021, realme, Motorola and Samsung have launched phones with the Tiger series SoC, citing better performance in the chipsets compared to its similarly priced competitors in the market.

![]()

Last but not least, HiSilicon’s SoCs had a 16% share in phones costing $500 and above in 2021, which was a decline from the 30% share in the previous year, due to the US trade ban. It is running on the inventory it added before the ban. By the end of 2022, HiSilicon’s market share is expected to continue to drop as its inventory gets depleted. Huawei has already started using Qualcomm SoCs in its new launches, but they are limited to 4G.

RELATED:

- Redmi K50 vs Redmi K50 Pro: Specs Comparison

- MediaTek feels days of Qualcomm’s domination over flagship mobile chips are over

- Qualcomm & MediaTek battle for the chip market throne in the US

(Via)