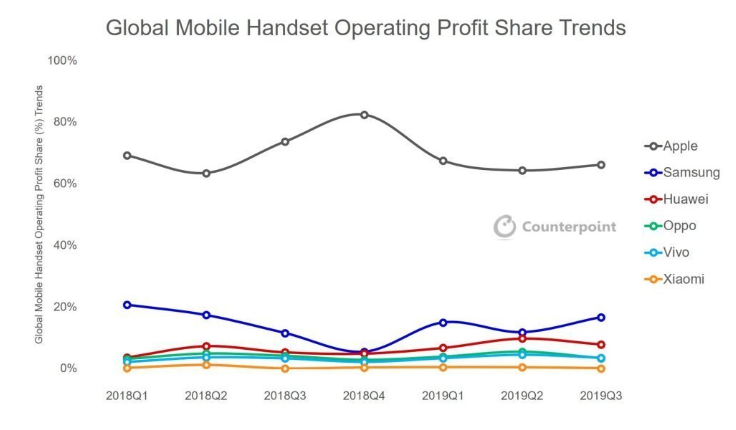

Apple dominated the smartphone market by capturing 66% of industry profits and 32% of total handset revenue in Q3 2019. The latest report from Counterpoint Research comes at a time when overall handset sales declined by 11% YoY to $12 billion due to the entry of numerous mid-range smartphones, and a combination of other factors. Among the major OEMs, Huawei and Samsung were the only ones able to increase their YoY revenue in 2019.

“Apple loyalists in Japan, the EU, and the US ensure that the company still operate at profit levels that other manufacturers only wish for”, revealed Counterpoint research analyst Karn Chauhan. Based on its current form, Apple is likely to maintain a steady lead of revenue inflow in the next few years. “With the holiday season right around the corner, Apple’s profits will only increase as the new iPhone lineup gains traction with the market,” Chauhan added.

A major factor contributing to the general fall in smartphone sales is the increased average life cycle of premium smartphones. Customers are yet to find a reason to upgrade, considering no major hardware changes recently. The situation is likely to improve with the rapid introduction of the 5G bandwidth. Samsung comes in second with a decent 17% share of the revenue, thanks to the Galaxy A-Series and Note 10 sales picking up.

In recent times, Chinese OEMs have introduced budget smartphones with top-end hardware, which are quite popular with customers. Chinese manufacturers have the luxury of operating at slim profit margins, helping them penetrate the global market. A few Chinese OEMs that have been following this strategy for the past couple of years, and developed a strong foothold outside the domestic market, have begun monetizing their user base by introducing financial services, and more.

However, the Chinese firms are finding it difficult to increase the retail price of smartphones due to the average customer holding on to existing devices for a longer duration. The only way out of the sticky situation is the introduction of 5G. Most of the major OEMs have already begun preparations in the wake of 5G commercialization. Perhaps the best demonstration of this strategy is the big four Chinese firms’- Huawei, Xiaomi, Vivo and Oppo– aggressively working on implementing the 5G spectrum to increase the MSRP on upcoming smartphones. However, with rising equipment costs, profit margins might not rise as expected.

UP NEXT: Apple kills app that turns your iPhone into an iPod Classic

(source)