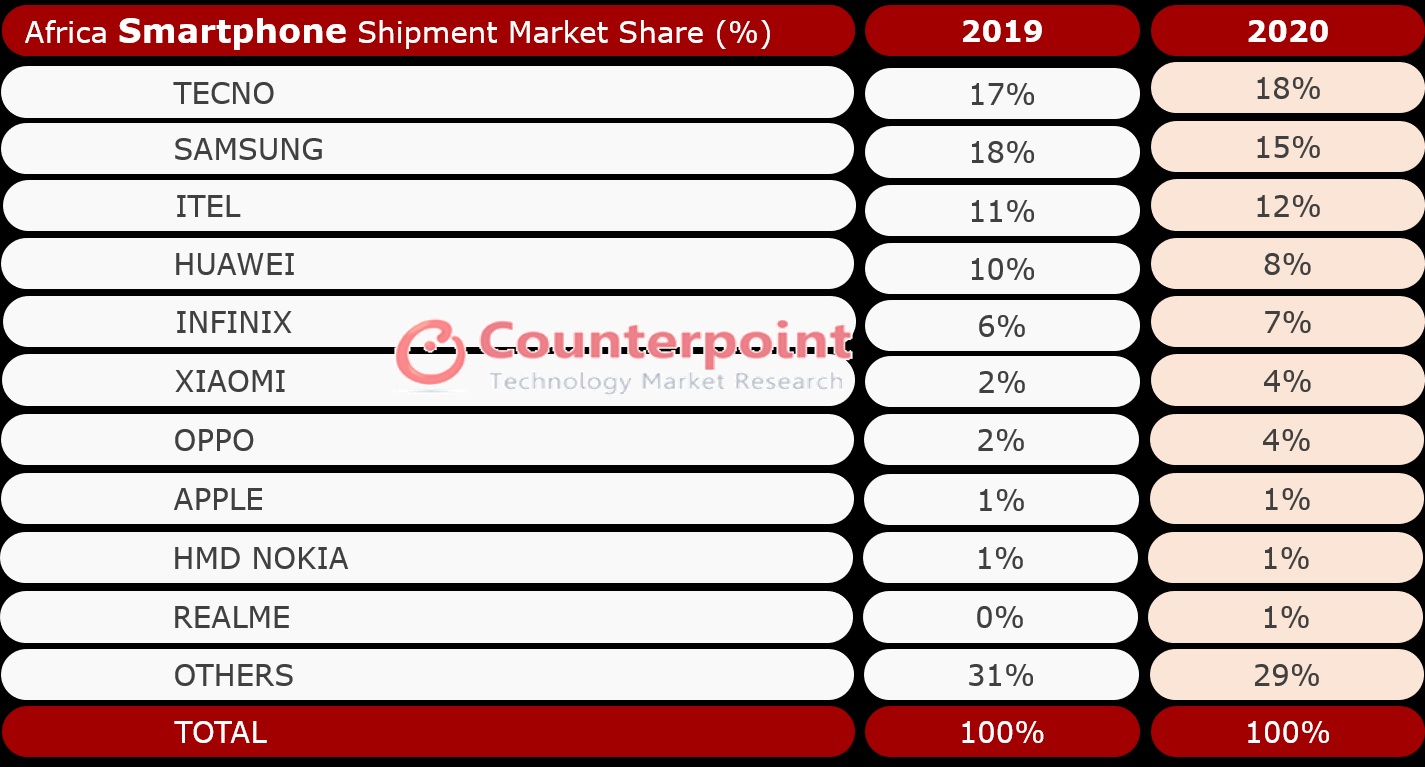

Transsion Holdings has been the market leader in Africa for a while now with its three brands Tecno, Itel, and Infinix. The combination of these three brands gives it the largest market share in the continent. However, 2020 was the first time one of its brands actually took the top spot and overtook Samsung.

According to a Counterpoint report, Tecno toppled Samsung to claim the top spot in 2020. The smartphone brand saw its market share rise to 18% even though the market experienced a 6.7% drop in smartphone shipments YoY. The report revealed the COVID-19 pandemic also disrupted the market in the first half of 2020 with the second quarter being the worst as countries went into lockdown. However, by July, sales significantly improved. The market even recorded a 1.5% gain YoY in the fourth quarter of the year.

Samsung who had a market share of 18% in 2019 saw it drop to 15% in 2020 no thanks to issues with supply chain due to the pandemic and a slow reaction towards the end of the year. Things should get better for Samsung this year as it has already launched its new Galaxy A smartphones in multiple markets in the continent.

Itel, another Transsion Holdings brand takes the third spot with a market share of 12%. Itel offers more affordable phones than its sister brands Tecno and Infinix. You wouldn’t be wrong to call its lineup entry-level and as we can see, that segment has helped it enter the top three.

Huawei still keeps the fourth spot in Africa despite the challenges it is facing. Counterpoint says the first three quarters were strong but its shipments declined significantly in the fourth quarter. We can attribute that to the trade ban which has prevented it from getting components and thus affected the launch of new models in the market. Its market share has dropped from 10% to 8% and is expected to drop even further as things haven’t improved this year even with the new U.S. administration.

Infinix, the third Transsion Holdings brand closes the top 5 with a market share of 7%. Counterproint reports that they recorded strong market gains in the second half of the year and it is the transsion brand with the highest average selling price. However, it has begun to lower its prices based on market realities and is expected to grab a larger share of the market this year.

Xiaomi saw its market share double from 2% in 2019 to 4% by the end of 2020. Its shipments increased by 126% YoY, thanks to increased sales in key markets such as Egypt, Kenya, Morocco, and Nigeria. Xiaomi is also said to be expanding its offline presence in the continent and by directly managing channels, it should record an increase in market share this year. Xiaomi has already announced its Redmi Note 10 series in key markets like Nigeria where they will slug it out with Samsung’s new Galaxy A series smartphones.

OPPO also doubled its market share from 2% to 4% and saw its shipments grow 57% YoY. It made its entry into the continent a few years ago and has already recorded success in markets such as Egypt and Algeria. OPPO is also building its offline channels and is partnering with key operators in the continent.

Apple and HMD Global (Nokia) both retain their 1% market share. The latter hasn’t recorded significant success in the continent, no thanks to better offerings at lower prices from the competition. Another name on the list is Realme who didn’t have a market share in 2019 but now controls 1%. The brand is yet to launch in some markets such as Nigeria but we won’t be surprised if they do so this year.

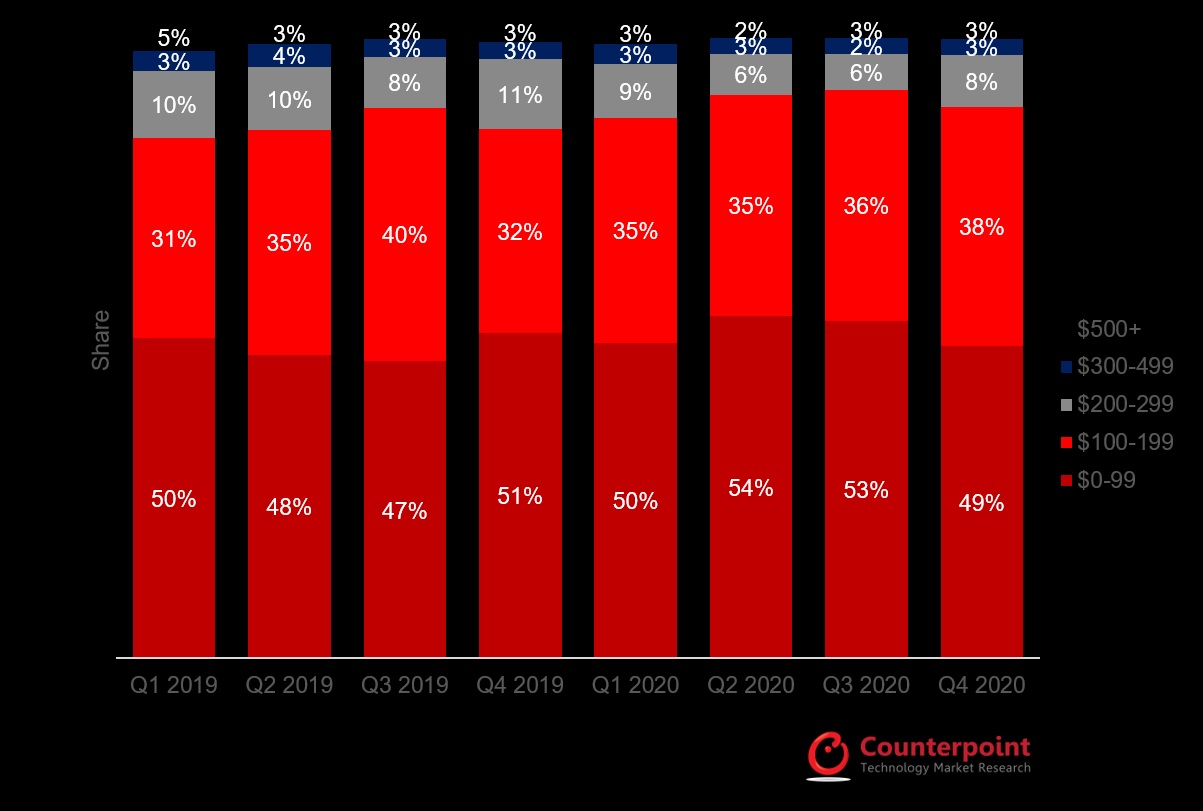

Counterpoint also revealed that most of the sales recorded, over 80% to be specific, come from smartphones in the sub-$200 category and that trend is expected to continue. 5G smartphones are not popular yet in the region and will most likely not be in the next few years since deployment is yet to commence in several countries, nevertheless, a few 5G devices are already being sold.

RELATED: