Despite the myriad of challenges the US is throwing Huawei‘s way, the Chinese company has continued to blaze the trail in terms of smartphone market share. Research firm TrendForce project that the Chinese company will lead the 5G smartphone market this year against all odds.

5G development has been rapid in China due to the government’s aggressive approach in proliferating 5G base stations and network coverage across the country. Thus, 5G rolled out in China earlier than in other countries. This also resulted in Chinese smartphone manufacturers releasing 5G phones earlier than competitors. Chinese OEMs hold a 75% share in the global 5G smartphone market in 1H20.

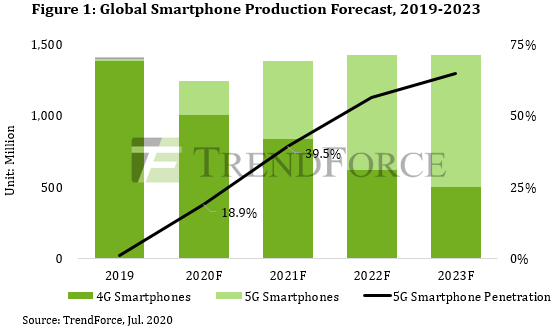

TrendForce indicates that, aside from the various Android-based smartphone brands, Apple’s new models will also join the ranks of 5G smartphones. Given the total smartphone production forecast of 1.24 billion units in 2020, 5G handset production is expected to reach 235 million units, an 18.9% penetration rate.

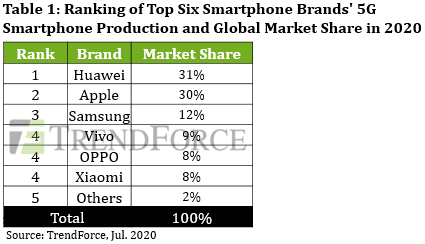

Chinese brands are expected to occupy four out of the top six spots of 5G smartphone brands ranked by production volume. An analysis of the projected top six smartphone brands ranked by 5G smartphone production volume shows Huawei firmly sitting in the first place. Huawei has shifted its focus to the domestic Chinese market under the impact of U.S. sanctions and in preparation for China’s active 5G commercialization efforts. The company is expected to produce about 74 million 5G smartphones this year.

Apple’s yearly 5G smartphone production is expected to total about 70 million units in 2020, which lands the company in second place. However, 5G functions will increase the production cost of smartphones accordingly. If Apple decides to directly reflect this added cost on the retail prices of the iPhone 12 series, it may lower its consumers’ willingness to purchase, in turn affecting the sales performances of the new iPhones.

Samsung has been experiencing setbacks in the Chinese market in recent years. Although these setbacks have not seriously affected its global market share and revenue, they have considerably slowed Samsung’s growth in the 5G smartphone market. Samsung’s 5G smartphone production this year is forecasted at 29 million units, placing the company in third place globally. Vivo, OPPO (including OnePlus, OPPO, and Realme) and Xiaomi are tied for fourth place.

As Huawei’s aggressive domestic expansion in the past few years has compressed the market shares of the three brands in the Chinese market, they have been actively focusing on increasing overseas market shares to maintain their yearly production performances. Vivo, OPPO, and Xiaomi’s yearly 5G smartphone production volumes are projected to reach about 21 million, 20 million, and 19 million units, respectively.

Mid-to-low end 5G chipsets released by AP suppliers are expected to raise the penetration rate of 5G smartphones in 2021. MediaTek is expected to lead this push with the company rumoured to announce its low-end 5G chipset later this month.

UP NEXT: India smartphone market declined by 48% in Q2 2020, Realme slipped to the fifth position