Indian smartphone shipments shrunk by 2% YoY and recorded 52 million units in sales in Q3 2021. The decline can be attributed to higher pent-up demand last year due to COVID-19. Another major contributing factor is the component shortages that worsened this quarter, thanks to brands aggressively working to secure as much stock as they could.

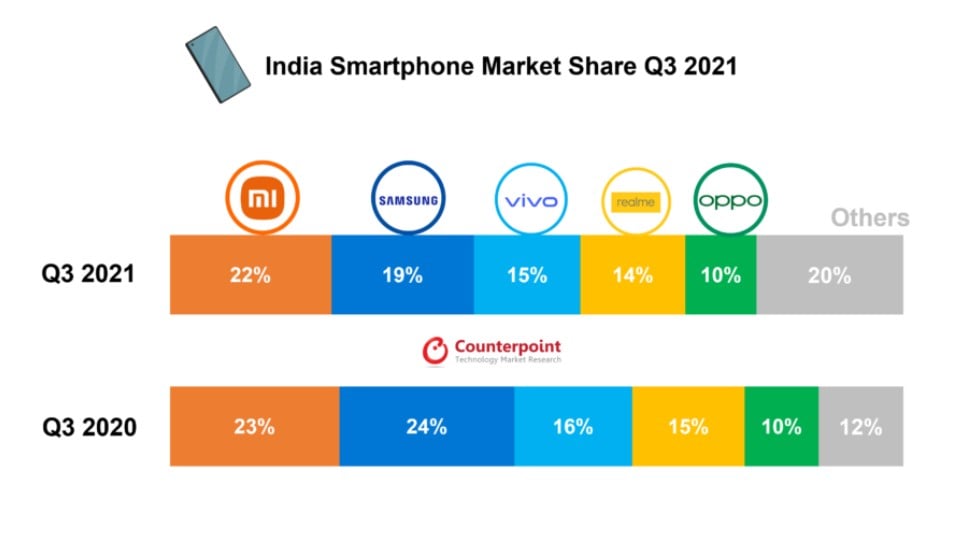

Chinese brands have continued to have an iron grip over the Indian smartphone market and held a 74% share in Q3 2021.

Among these, Xiaomi has the biggest slice with a 22% share driven by excellent sales of the Redmi 9A, Redmi 9 Power, Redmi Note 10, and Redmi 9 models. The Redmi 9A has been the best-selling model in 2021 till date. The company also recorded its highest-ever shipments in the premium segment in Q3 2021 thanks to the Mi 11x series.

Samsung stands second with a 19% share. The newly launched Galaxy M series and Galaxy F series drove much of its sales in the online channels while the Galaxy A series sold well offline. Samsung’s USP has been support for a wide number of 5G bands on most of its 5G smartphones. The company was the top smartphone brand in the INR 10,000 – INR 30,000 segment.

Vivo ranked third in Q3 2021 with a 15% share. It became the top 5G smartphone brand for the first time ever, while remaining the top offline smartphone seller. Its premium segment sales were driven mainly by the Vivo X60, V21, and iQOO series.

Realme has secured fourth place in Q3 2021 in Indian smartphone shipments with a 14% share. It was the top 5G smartphone brand in the sub-INR 20,000 segment. The Realme 8 5G and Realme 8s 5G were the top two 5G smartphone models in the sub-INR 20,000 segment and captured nearly half of the market.

Apart from this, the Transsion Group brands (itel, Infinix, and Tecno) registered 72% YoY growth and captured a 9% share collectively in the overall India smartphone market.

Other honorable mentions include Apple and OnePlus, with Apple actually being the fastest growing brand in Q3 2021 with 212% YoY growth. The company led the premium smartphone market (> INR 30,000) with a 44% share. Strong demand for the iPhone 11 and 12 was the driving factor for the growth.

As for OnePlus, it grew 55% YoY in Q3 2021 thanks to the great reception of the OnePlus Nord series. The company also registered its highest ever shipments in India and bagged the second spot in the premium (> INR 30,000) segment.

RELATED:

- Xiaomi 11T Pro Indian variant may launch in November

- Redmi Note 11 Pro, Pro+ India launch could be nearing, Note 11 could be a POCO device

- Samsung Galaxy M52 5G gets ₹5,000 ($67) discount in India ahead of Diwali

- Realme might be planning to launch an Electric Scooter in India

- Nokia T20 tablet India launch teased by Flipkart