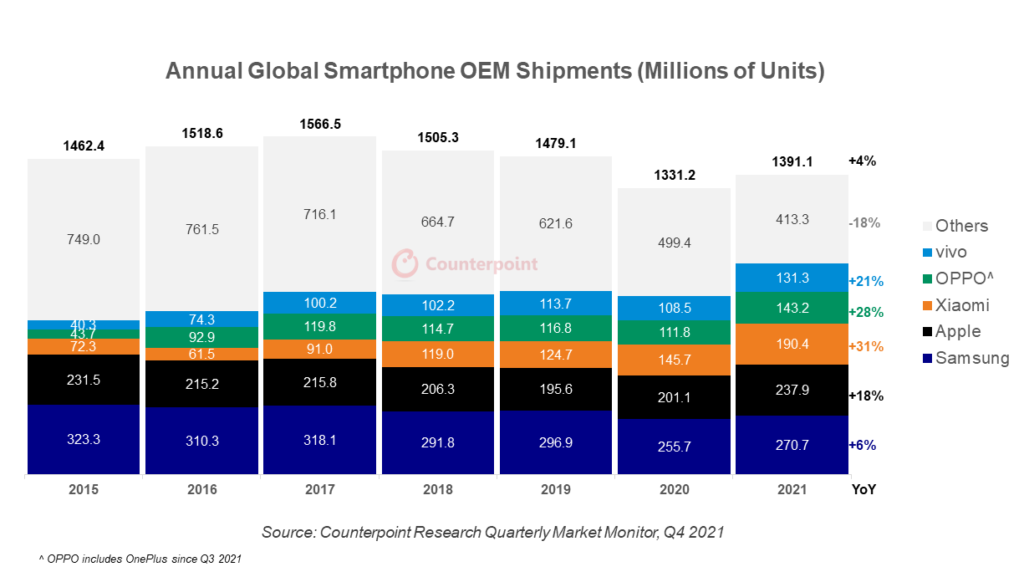

The global smartphone market recorded growth for the first time in almost 5 years, with annual shipments touching 1.39 billion units in 2021. But despite 4% year-on-year growth, yearly sales still remained lower than pre-pandemic levels due to component shortages paired with the impact of COVID-19, Counterpoint has revealed.

For comparison, global smartphone shipments were the highest ever in 2017, reaching 1.55 billion units — a record that remains unbroken.

The restoration of growth was driven to the post-peak-pandemic pent-up demand in regions like North America, Latin America, and India. In the US, it was mostly the demand for Apple‘s first 5G-supporting offering — the iPhone 12 series. And in India, good sales came from higher replacement rates, better availability, and more attractive financing options. China came as a surprise though, with the market shrinking due to supply-side issues combined with demand-side issues from lengthening replacement cycles.

Apple’s global smartphone shipments grew 18% YoY to reach a record 237.9 million units in 2021 due to great response for the iPhone 12 series. The Cupertino-based company even became the top smartphone brand in China, passing vivo, and consequently overtaking Samsung as the #1 phone brand globally in Q4 2021.

Xiaomi‘s global shipments reached a record high as well, totaling 190 million units in 2021, which is a 31% YoY growth. While it performed well in the first half of the year, supply shortages in H2 2021 led it to slip in the fifth position in its home country.

Joining the aforementioned is also OPPO that’s yet another OEM achieving record shipments in 2021, growing by 28% and selling 143.2 million units. OPPO again suffered due to supply constraints in the final quarter and a larger part of its shipments came from H1 2021.

vivo grew 21% YoY, reaching annual shipments of 131.3 million units last year. This was thanks to its strong offline penetration and a wide-ranging product portfolio. However, it declined 9% YoY in Q4 2021, after getting dethroned by Apple in China.

RELATED:

- Apple grabs top spot in terms of smartphone market share in China

- Indian smartphone market sees new record: 162 million units sold in 2021

- Upcoming Smartphones: Redmi Note 11 Series and Micromax IN Note 2

- China recorded a 15.9% YoY rise in smartphone shipments in 2021 despite chip shortage

- Apple iPhone 14 series may have eSIM-only models