Chinese AMOLED display-producing factories had an annual average utilization rate of 53.7% in 2021, which is a 10% increase compared to 2020.

Among them, the utilization rate improved the most for TCL CSOT, from 32.7% annual utilization in 2020 to an impressive 74% in 2021, the latest report from CINNO Research shows (via IT Home).

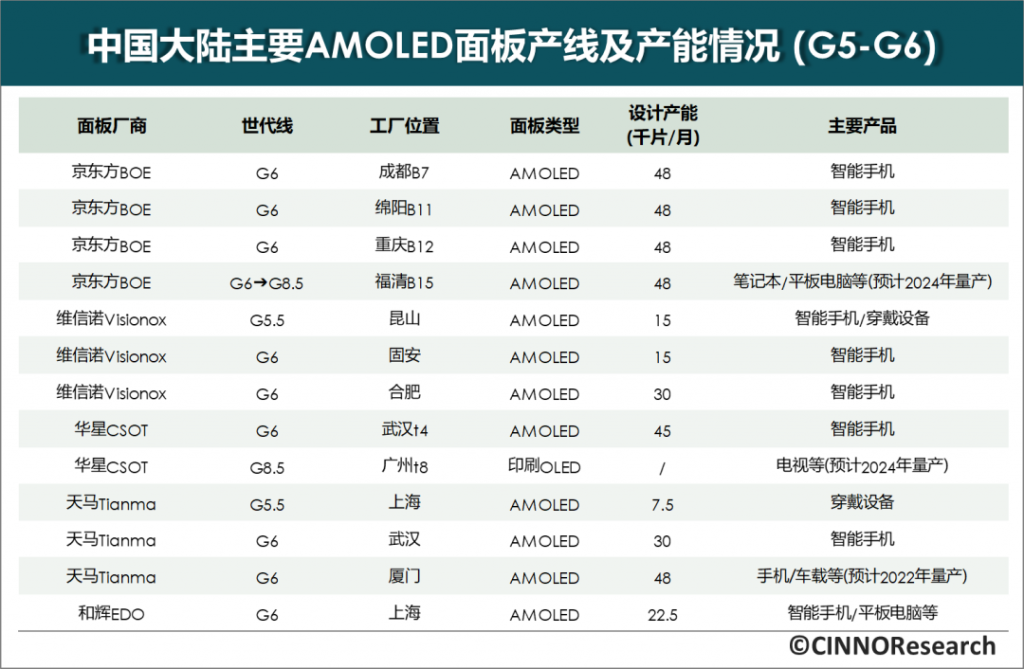

However, it is BOE that continues to be the manufacturer with the largest production area among AMOLED panel factories in China, with a market share of 37.4% in 2021. This share is down 7.6% compared to 2020, though.

BOE is followed by Visionox, with an 18.3% share in 2021, which is an increase of 1% when compared to 2020. Standing third is Hehui Optoelectronics EDO whose share in 2021 stood 15.6% — a decrease of 1.8% from 2020.

The data also shows that the overall installed capacity area of domestic AMOLED panel factories rose by 26.9% in 2021, while the production area increased significantly by 57.0%.

BOE has currently locked horns with Samsung, with the former trying to secure more orders for the latest iPhones. A new report suggests that BOE will supply Apple with OLED LTPO displays for its higher-end iPhones in 2023. But presently, the company is having to put up with the global chip shortage resulting in significant production cuts.

RELATED:

- HONOR Magic4 series gets its LTPO displays from BOE and Visionox

- OPPO Find X5 uses OLED panels from BOE

- BOE facing iPhone display production issues due to chip shortages

- BOE showcases the world’s highest refresh rate display – 500Hz+

- Apple iPhone 15 Pro displays will be supplied by BOE in 2023: Report