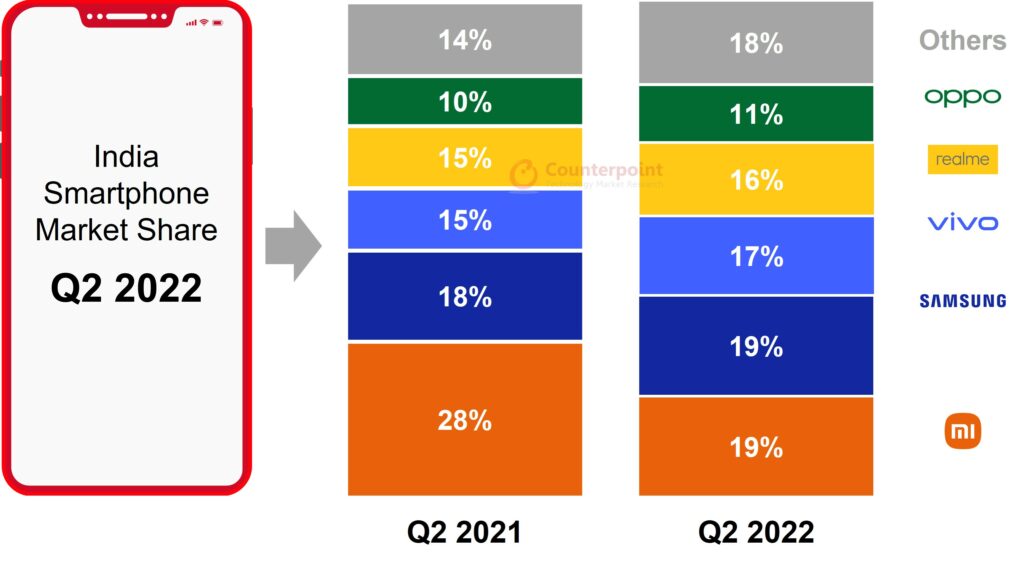

In Q2 2022 (April–June), India shipped about 37 million smartphones, an increase of 9% YoY but a decline of 5% QoQ, per the most recent analysis from Counterpoint’s Market Monitor service. The second COVID-19 wave caused a smaller base in Q2 2021, which was the main factor in the YoY growth. Macroeconomic factors that are impacting consumer demand are what caused the QoQ decline.

According to Counterpoint, Senior Research Analyst Prachir Singh commented on the market dynamics, saying, “We saw the consumer demand declining QoQ during the quarter, especially in May and June. Consumers are preferring to repair their device or buy a refurbished one than make a new purchase. This trend is more visible in the entry and budget segments. Due to this decline in demand, almost all the brands are facing inventory issues. At the end of June, India’s smartphone market was sitting on more than 10 weeks of inventory, more than double the normal inventory size. Brands were seen aggressively promoting offers to clear this inventory and prepare for the festive season.”

According to Counterpoint, Senior Research Analyst Prachir Singh commented on the market dynamics, saying, “We saw the consumer demand declining QoQ during the quarter, especially in May and June. Consumers are preferring to repair their device or buy a refurbished one than make a new purchase. This trend is more visible in the entry and budget segments. Due to this decline in demand, almost all the brands are facing inventory issues. At the end of June, India’s smartphone market was sitting on more than 10 weeks of inventory, more than double the normal inventory size. Brands were seen aggressively promoting offers to clear this inventory and prepare for the festive season.”

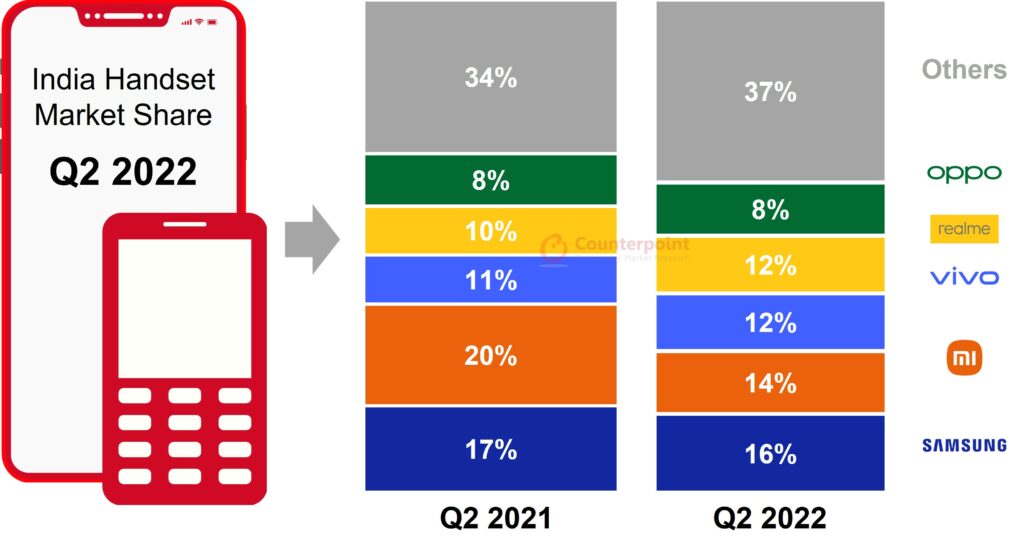

The market for mobile phones in India increased by 6% YoY but decreased by 9% QoQ in Q2 2022. The fall in consumer demand was the main factor in the feature phone market’s QoQ decline of 17%. In Q2 2022, itel has a 25% market share in India’s feature phone market. For ten consecutive quarters, Itel has been the leading feature phone manufacturer.