China’s smartphone shipments have been declining this year and now a new report from Counterpoint’s China Channel Service shares that online sales in China’s smartphone market decreased to 24 percent in Q1 2019 from 28 percent in Q4 2018.

It says that China’s smartphone market continued to slow down from H2 2018 due to sluggish demand from consumers as well as seasonality and factories being closed down for the Chinese New Year.

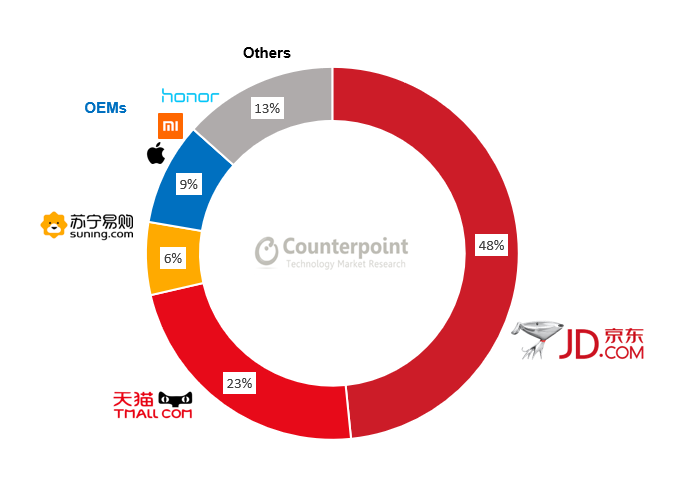

Also, Counterpoint’s Market Monitor Report indicates that the sales in Q1 2019 registered 8 percent year-on-year decline in China. However, JD.com and Tmall.com, two of the biggest eCommerce platforms in China, continue to be the leading platforms. Both the platforms together dominated the market with over 70 percent of the market share.

However, other popular app platforms such as Pinduoduo, Vipshop, and Xiaohongshu have started to carry a variety of brands on their marketplace. The report goes on to add that along with JD, Tmall, and Suning, these apps have become the official online retailers for new model releases.

James Yan, Research Director at Counterpoint, says that “the importance of these third-party apps cannot be underestimated as an important marketing channel for OEMs due to the large userbase of these apps.”

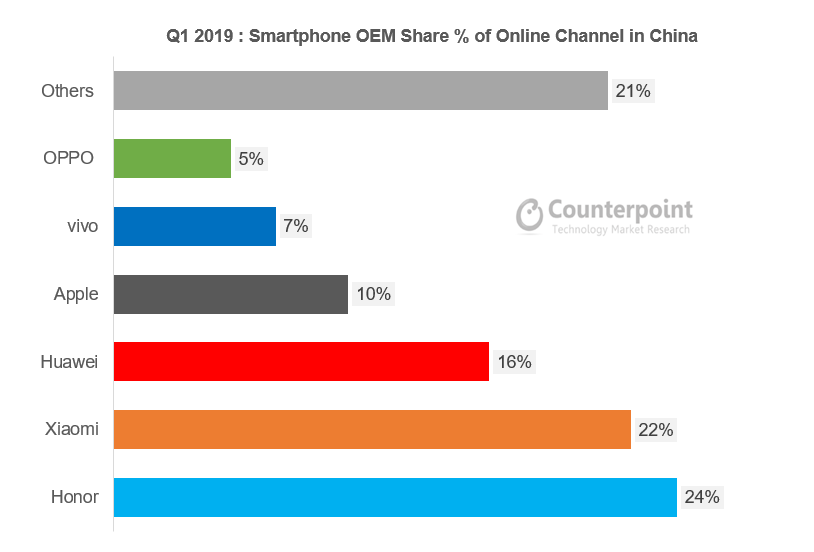

As for the market, the brands that led the market, which includes Honor, Xiaomi, Apple, and Huawei, accounted for 84 percent of the market. Also, Honor has retained the title of the number one online smartphone brand in China with 24 percent of the market share.

Interestingly, Huawei’s market share in the online channel increased in Q1 as the company tries to strengthen position amid an overall market slowdown. Xiaomi’s online market share also increased in Q1 to 22 percent owing to strong demand for the Redmi Note 7.

Also, other brands such as Oppo and Vivo continued to expand into online channels. After achieving initial success with online-focused budget smartphones, such as Vivo Z series and Oppo K series, both the smartphone brands are venturing into launching flagship models in online channels. Vivo and Oppo currently account for 7 percent and 5 percent of the online market share respectively.

Apple, on the other hand, has 10 percent of its sales through the online channel in China while other smartphone brands apart from these six account for around 21 percent of the sales in China through online channels.

Up Next: Xiaomi Mi 9 Android Q Priority Experience Version rolling out now

(Source)