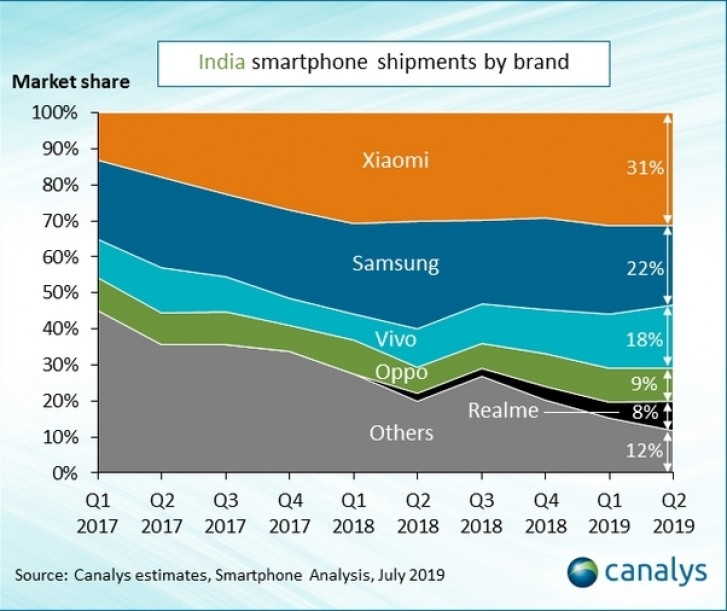

A couple of days back, research firm Strategy Analytics released its research data for the second quarter of 2019. The data reveals a strong showing for Chinese phone manufacturer, Xiaomi as well as other positive outlooks. Another research firm, Canalys has released its own report which throws more light on the performances of the top OEMs slugging it out in India at the moment.

The analysis covers the second quarter of this year and it shows smartphone shipment slumped 0.5% as a result of the reluctance of feature phone users to upgrade to smartphones. The data again confirms Xiaomi still is the number one phone vendor in India in terms of shipment volume. The research firm also did point out that this is the eighth consecutive quarter the company is attaining this feat. Xiaomi shipped an estimated 10.3 million smartphones in Q2, slightly higher than the 9.9 million units it shipped in the same period last year.

Fellow Chinese phone makers, Vivo also recorded a massive increase in its sales by 63%. While Oppo and Realme, all BBK subsidiaries, equally grew significantly. Vivo flourished in the INR10,000 – INR15,000 price category, with impressive sales of the Vivo Y17 and Vivo Y91, bringing the Shenzhen company very close to Samsung.

EDITOR’S PICK: Xiaomi crowdfunds the Zhibai Three-layer Hydrating Hair Dryer for 799 yuan

Samsung still ranks as the second-biggest phone manufacturer in India but the firm’s shipments in Q2 2019 experienced a decline in sales and market share. Canalys says Xiaomi controls 31% of the market while Samsung manages to achieve a 22% market share.

Also worthy of note is that almost the entire smartphone market in India is controlled by the top 5 brands which accounted for 88% share of the market. This is a solid 8% increase YoY.

According to Canalys’ Reseach Director, the bulk of growth in the market comes from users who upgrade their entry-level to mid-range devices, priced between INR15,000 and INR20,000 (that’s around $200-$300). There are also speculations that manufacturers will stop producing phones for less than INR10,000 (about $150), so the market will get even more sluggish.

UP NEXT: OPPO K3 Radio Blue new color variant’s sale to begin on August 1

(source)