Recent data from research firm Counterpoint Research shows that shipments in the premium smartphone segment grew astronomically by 66% YoY. This segment is comprised of smartphones with retail prices between Rs. 30,000 (roughly US$493) or higher

According to the report, the segment’s massive growth was aided by new launches, aggressive offers, and channel push, before the important festive season. Smartphone OEMs had begun to promote aggressively mouthwatering offers on premium smartphone well-ahead of the festive season, most of them as early as the last week of September. Offers included payment plans (EMI), cashback and exchange offers.

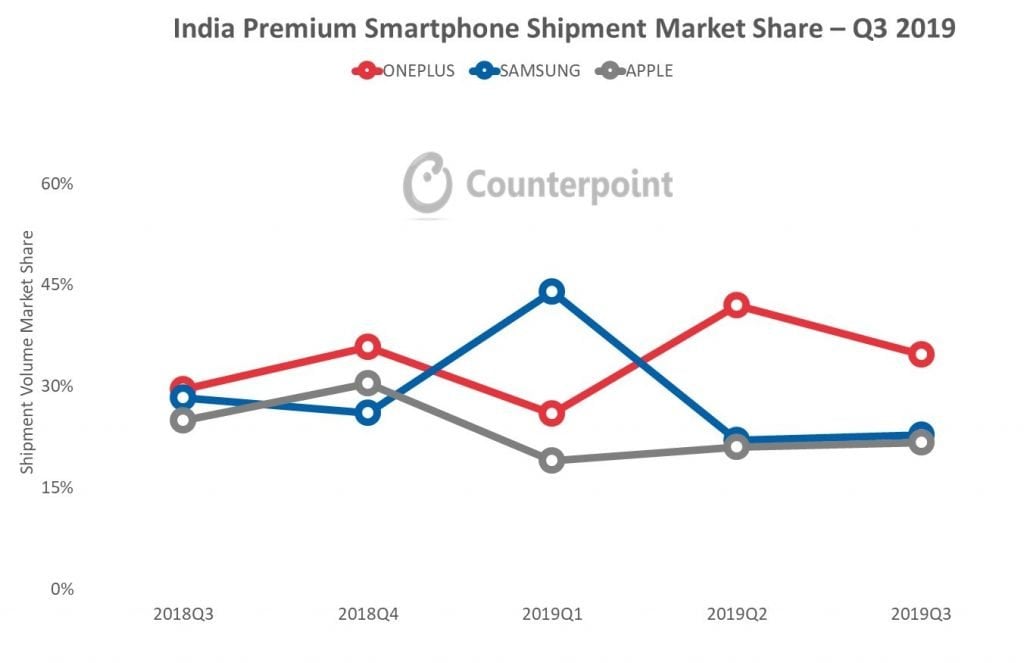

The data also showed that OnePlus‘ rise in the premium smartphone market continued in Q3 2019. The OP 7T and 7T Pro played huge roles in giving OnePlus its widest ever portfolio in the Indian market which accounts for a quarter of its global shipments. The OnePlus 7 and OnePlus 7 Pro were the best-selling and third best-selling models during the quarter, respectively.

EDITOR’S PICK: First Samples from the 108MP Mi Mix Alpha is here & we are not impressed!

OnePlus cornered a market share of 35% to lead the premium market segment, representing a 95% increase YoY. This is followed by Samsung with a 23% market share and Apple in third place with 22% market share. OnePlus grew faster (+95%) than the segment (+66%) and remained the fastest-growing brand, driven by strong performances of both the 7 and 7T series. Samsung shipments were helped by the new Galaxy Note 10 series, while the price cut for iPhone XR drove Apple’s shipments. However, the cumulative share of top three brands declined to 79% in Q3 2019 as compared to 83% in Q3 2018, highlighting a growing presence of other brands in the segment, mainly OPPO, Xiaomi, and Asus. More than 20 flagship phone variants launched in Q3 2019, the highest ever in a single quarter.

OnePlus cornered a market share of 35% to lead the premium market segment, representing a 95% increase YoY. This is followed by Samsung with a 23% market share and Apple in third place with 22% market share. OnePlus grew faster (+95%) than the segment (+66%) and remained the fastest-growing brand, driven by strong performances of both the 7 and 7T series. Samsung shipments were helped by the new Galaxy Note 10 series, while the price cut for iPhone XR drove Apple’s shipments. However, the cumulative share of top three brands declined to 79% in Q3 2019 as compared to 83% in Q3 2018, highlighting a growing presence of other brands in the segment, mainly OPPO, Xiaomi, and Asus. More than 20 flagship phone variants launched in Q3 2019, the highest ever in a single quarter.

Counterpoint Research notes that the Indian premium smartphone market still has a long way to go despite the amazing Q3 2019 outing. The segment contributed just 5% of the entire market in terms of volume. In comparison, the premium phone segment accounts for 50% and 22% of the smartphone market in the US and China respectively.

UP NEXT: Samsung trademarks ‘Space Zoom’; yet another Galaxy S11 camera feature?

(source)