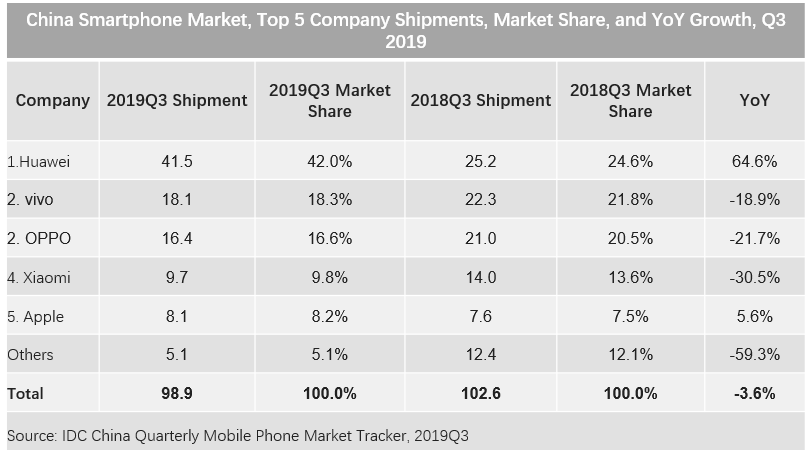

According to the latest statistics from International Data Corporation (IDC), the Chinese smartphone market recorded a year-on-year decline of 3.6% in the third quarter of 2019. Although the market is still in decline, it is starting to show signs of recovery. This is in part due to Huawei’s strong performance in the third quarter.

Huawei currently holds a massive 42% of the Chinese smartphone market, up from 24.6% last year, recording a mammoth 64.6% increase in shipments year-on-year. The company managed to attain this feat with stronger channel partnerships and increased brand appeal. While the Nova and Changxiang series accounted for the maximum sales volume, the high-margin P-series and Mate devices compensated the channel partners financially. According to IDC, this was Huawei’s winning strategy in China.

Coming in second place with a market share of 18.3%, Vivo continues to focus on the middle-weight contenders, priced between $150 to $400, with its Y and Z series. The 5G-ready iQOO devices were quite popular with the tech-savvy youth, helping Vivo gain traction in the market. The company’s year-on-year shipments were still down by 19% to 18.1 million units.

Sister-concern OPPO was still struggling to establish the Reno brand in Q3, making the A-series the vendor’s primary sales driver in the low-price range. Although OPPO remained primarily focused on selling 4G devices, the company implemented inventory control keeping in mind the highly-anticipated 5G boom of 2020. OPPO’s year-on-year shipments were down by 22% to 16.4 million units while the market share reduced to 16.6% from 20.5% in 2018.

Xiaomi’s shipments dropped by 30.5% to 9.7 million units while its market share dropped to 9.8%. The company currently struggles with internal organizational changes, brand differentiation between Redmi and Mi, and offline channel management.

Apple painted a positive picture by recording a 5.6% year-on-year growth in Q3 2019. Competitive pricing and improvements to the battery life and camera hardware on the iPhone 11 series seem to have worked in the Cupertino-based tech giant’s favor. Apple’s new entry-level iPhone also shipped a quarter ahead of schedule, supporting the year-on-year growth. As a result, the company’s market share increased to 8.2% from a measly 7.5% back in 2018.

According to the IDC, the upcoming upgrade to the 5G-spectrum will further boost the Chinese smartphone market in the upcoming quarters. As most smartphone manufacturers are gearing up to launch their full weight behind mid-range smartphones running on the 5G spectrum.

UP NEXT: Again, Huawei Mate X release rumoured to have been postponed

(source)