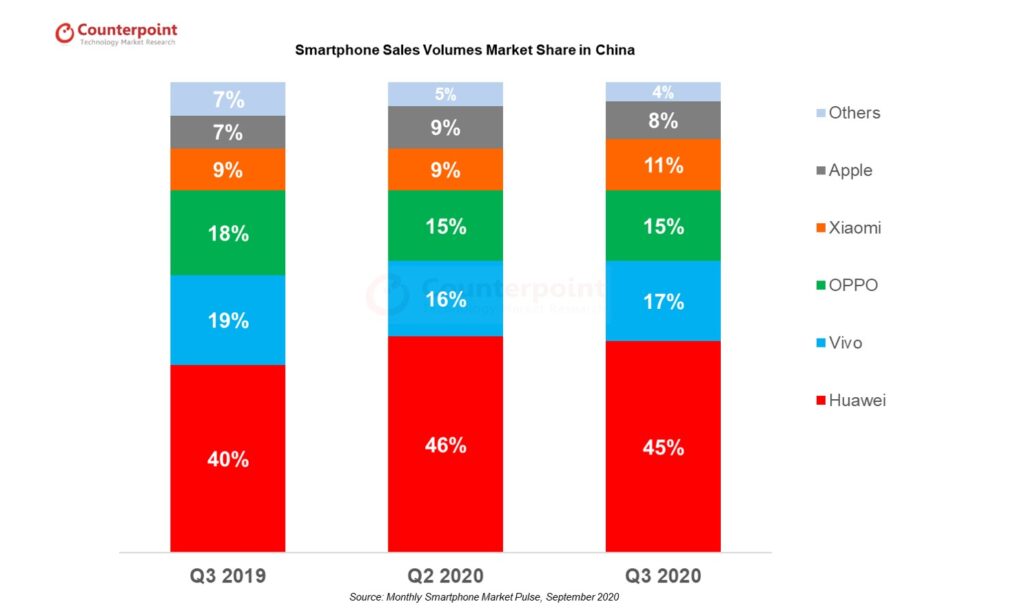

Counterpoint Research has released a report on the China Smartphone Market for Q3 2020. According to it, the market declined 13% YoY but improved 3% QoQ. Huawei was the largest brand but its sales started declining. On the other hand, Xiaomi outperformed all the brands and iPhone 11 was the best-selling smartphone although 5G smartphones accounted for over 50% of the total units sold.

In the report published by Counterpoint, research analyst Flora Tang said that as per the National Bureau of Statistics of China, the country’s unemployment rate increased by 0.2% in urban areas in September. The unemployment rate of college graduates aged between 20 and 24 hiked by 4% during this period. Therefore, smartphone sales remained stagnant despite brands’ efforts to trigger sales.

Talking about the performances of top OEMs, research analyst Memgmeng Zhang commented that Huawei led the China Smartphone Market in Q2 2020 with a 45% market share.

The company’s six models made it to the list of top 10 best-selling smartphones during the last quarter and most importantly, all of them were 5G-enabled. However, the sales of the Chinese telecom giant began to decline as a result of a severe component shortage.

EDITOR’S PICK: IDC: Global Smartphone Market will recover in 2022; 5G handsets will account for 50% in 2023

Further, vivo and OPPO captured second and third positions with 17% and 15% market shares respectively. The OPPO Reno4 series and vivo X50 series helped these two companies gain some momentum compared to the previous quarter.

In the fourth place with an 11% market share, Xiaomi was the only OEM to achieve a YoY growth in Q3 2020, 8% to be exact. But interestingly, none of its phones was a best-selling handset in this period.

As for Apple, its sales dropped 7% YoY due to the iPhone 12 series, which was expected to debut in this quarter back then. Nevertheless, iPhone 11 remained the best-selling smartphone accounting for almost 5% of the market share. Whereas, Apple as a whole managed to claim fifth place with an 8% market share.

Commenting on 5G smartphones, senior analyst Ethan Qi said that the starting pricing of 5G handsets dropped to around $150 with the launch of realme V3 5G. Some of the popular phones in this segment include HUAWEI Enjoy 20 5G, HONOR X10 5G, OPPO A72 5G, vivo Y70s 5G, and Redmi 10X 5G.

According to the Ministry of Industry and Information Technology, Chinese telecom operators managed to build 690,000 5G base stations by the end of September. The 5G smartphone sales (in units) accounted for 50% of the entire smartphone market in Q3 2020, compared to 33% and 16% in Q2 and Q1 respectively.

With the launch of the iPhone 12 series in Q4, 5G smartphones are expected to acquire almost 70% of the market by the end of this year.

Having said that, here’s the list of best-selling smartphones in China in Q3 2020, as per Counterpoint Research.

- Apple iPhone 11 (4G)

- HUAWEI nova7 (5G)

- HUAWEI nova7 SE (5G)

- HUAWEI P40 (5G)

- HUAWEI P40 Pro (5G)

- OPPO A8 (4G)

- vivo Y3 (4G)

- OPPO Reno4 (5G)

- HONOR 30S (5G)

- HUAWEI Mate30 (5G)

UP NEXT: iPhone 12 is expected to beat Galaxy S20+ 5G as the best-selling 5G smartphone in H2 2020