Display revenues have hit a new high due to LCD panels according to the latest DSCC report. China’s BOE trails behind Samsung Display in the second spot in overall sales for Q3 2020. Similarly, CPT China reported a Net Profit despite an operating loss for the said quarter.

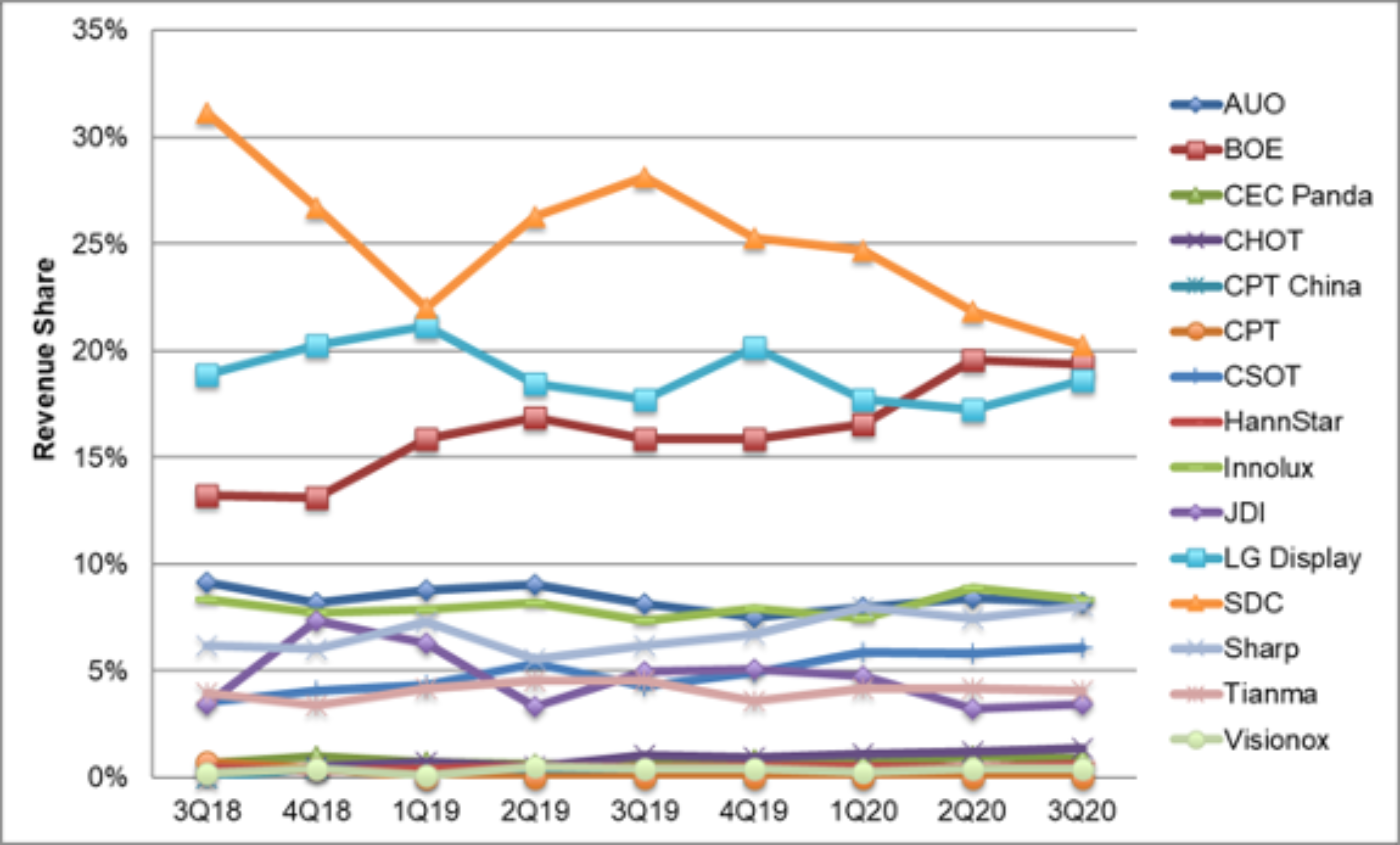

According to the report(via TheElec), the industry revenues for Display sit at $30.5 billion for Q3 2020. This is reportedly a 21% QoQ, and 11% YoY increase. Apparently, this is an all-time high since Q4 2017, and DSCC believes that an increase in LCD TV panel prices is the reason. In terms of revenue share, Samsung leads the pack yet again but Chinese companies like BOE and CSOT managed to grab a place in the top 10. This development comes at a time when China’s display panel sales are expected to reach $42.5 million in 2020.

In fact, BOE outperforms LG display in the overall revenue share to take the second spot. These two are the only non-Samsung companies to have double-digit shares. That said, the list has others like AUO, Innolux, CSOT, and Sharp who’s share percentages are between 5-8%. Besides, the Gross profits of display panels, as per the report, has grown 106% QoQ(Quarter over Quarter) from Q2.

Precisely, the Gross profits(profit-making & selling costs) of Q3 2020 are at $2.7 billion which is a 182% YoY(Year on Year) growth compared to 2019. Accordingly, every panel maker except CPT China reports positive gross margins in Q3. However, as mentioned earlier, CPT China reported a net profit albeit having operating loss.

That is, it gained close to $211 million by selling long term assets. This meant that the entire industry(except Samsung, CSOT, Sharp) posted a net profit of $545 million in Q3 2020. As per the report, this is a first after losses for seven consecutive quarters in the industry. Also in terms of area shipments, BOE is very close to LG with a shipment of 8.1 million square meters followed by Innolux, and CSOT.

In any case, China is trying hard to overpower the South Korean counterpart at least in the LCD segment. The recent acquisition of fabs by BOE, and CSOT from CEC-Panda and Samsung respectively in China means it will likely have 28% of the World’s Large-sized panel capacity. As a result, it will probably hold 70% of Global LCD panels production capacity soon.