After releasing the report on India Smartphone Market Q3 2020 in early last month, IDC is back again with another report for October 2020. The new report details the growth achieved by OEMs during the pre-Diwali festive season sales in the country. Unsurprisingly, the rankings remained the same with Xiaomi leading the market, followed by Samsung, realme, vivo, and OPPO respectively.

India Smartphone Market October 2020 Shipments

According to the new report by International Data Corporation (IDC), the Indian smartphone market recorded a whopping 42% YoY growth in October 2020 by shipping 21 million units. Above all, it happens to be the highest-ever October shipments and it is only second to the all-time high shipments of 23 million units that took place in September 2020.

Due to the pandemic and great offers, online channels grew 53% YoY and accounted for 51% market share. The offline channels also grew 33% YoY, especially in smaller towns and cities.

The $100-$200 price bracket, which is the hottest segment in India, grew by 60% YoY, and therefore, its market share increased to 58%. Redmi 9, Redmi Note 9, and vivo Y20 were some of the most-shipped handsets. Whereas, the premium segment ($500-$700) was led by iPhone XR, iPhone 11, and OnePlus 8, thanks to exceptional offers.

EDITOR’S PICK: India PC Market recorded its strongest quarter in the last seven years in Q3 2020

India Smartphone Market October 2020 Sell-out Units

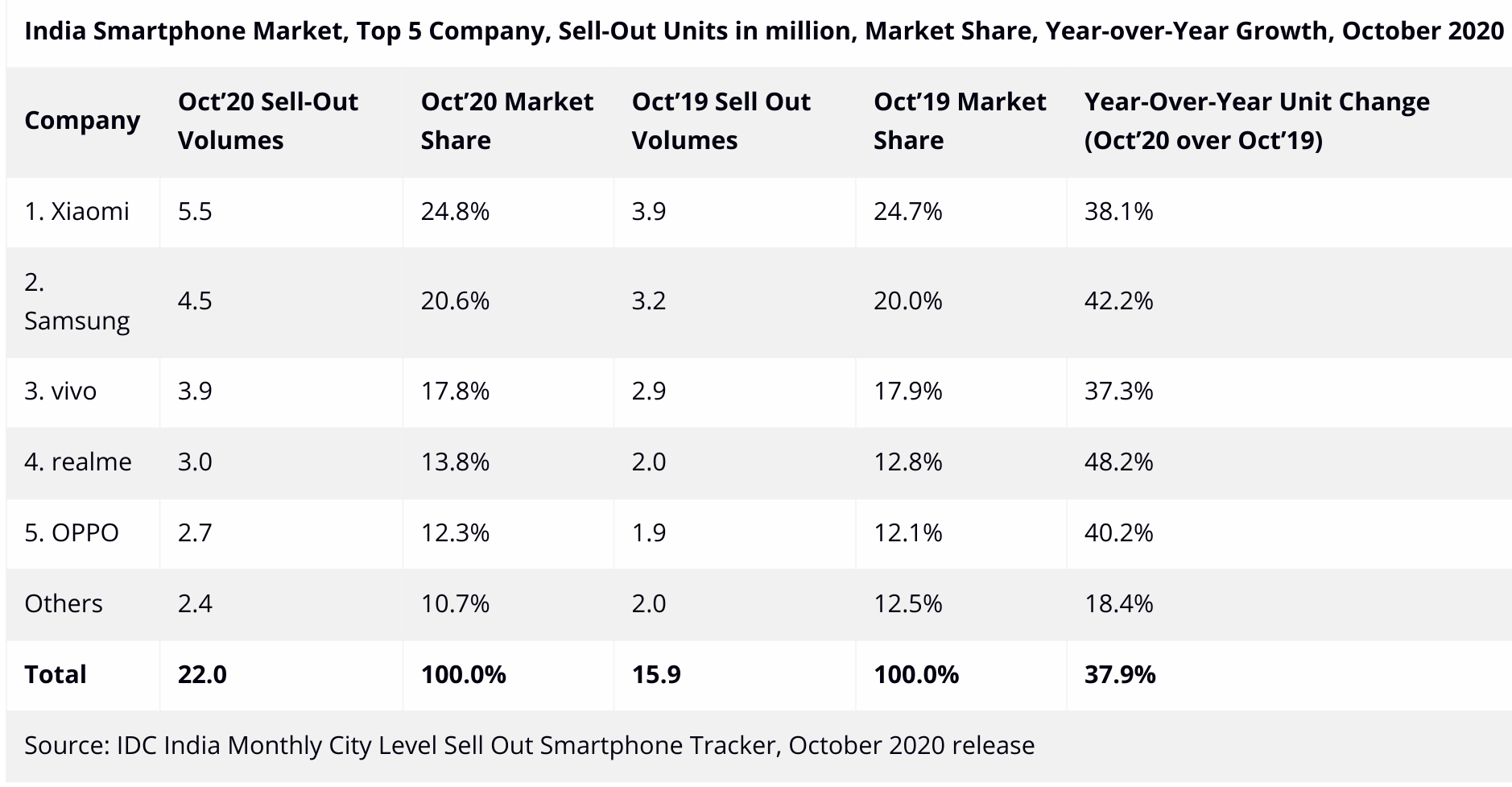

Taking about sell-out units (finale sale to consumers), a record 22 million units were sold in October 2020 in India, registering more than 38% YoY growth. Approximately 55% of the national demand came from the top 50 cities.

Top-tier cities like New Delhi, Mumbai, Bengaluru, Chennai, and Kolkata grew 50% YoY, and therefore, they accounted for 25% of the entire market. Emerging cities like Jaipur, Gurgaon, Chandigarh, Lucknow, Bhopal, and Coimbatore also grew by ~50% YoY bu the rest of the states (up-country markets) only witnessed an average of ~25% YoY growth due to economic factors.

Online channels accounted for 50% of entire sales by growing 23% YoY. In the top 5 metro cities, it had a 57% share. This happened despite delayed deliveries as supply constraints had impacted offline sales. As for brands, Xiaomi led in 34 of the top 50 cities in the online channel, whereas vivo topped in 44 of the top 50 major cities in the offline channel.

Further, the MOP (Market Operating Price) was $190 in October 2020 and 68% of total sales occurred in the sub-$200 price segment. Almost half of the sales of the $100-$200 price segment happened online, recording 93% YoY growth. Lastly, Xiaomi was the leading brand in the sub-$200 in 30 of the top 50 cities in India.

Whereas, the mid-range segment ($200-$300) accounted for almost a fourth of the smartphones sold in the period. Samsung led this segment in 36 of the major 50 cities. On the other hand, the premium segment ($500+) accounted for only 5% of the total sales in the top 50 cities and less than 1% in the rest of the cities. Apple topped this price bracket in 49 of those top 50 cities. However, it is worth noting that this segment grew 16% YoY.

India Smartphone Market October 2020 5G Sales

Interestingly, half a million 5G handsets were sold in October 2020 and almost 80% of those sales happened in the top 10 cities of the country. Although the report does not mention the best-sellers, the only phone we could think of is the OnePlus Nord.

Because this device was the top-seller in its segment in Q3 2020 and there was not a single phone cheaper than it with 5G connectivity during the period. The only other 5G handsets were flagships.

And since sales in the premium segment were lower compared to budget and mid-range categories, OnePlus Nord is our strong contender for the best-selling 5G smartphone in India in October 2020. Whereas, the runner-ups could have been the OnePlus 8T, OnePlus 8 series, and the then newly launched Mi 10T series.

Anyway, at the end of the day, consumers cannot make use of the 5G radio present in their devices as the Indian government is yet to allocate spectrum to the carriers.

UP NEXT: TWS shipments grew by a whopping 1156.3% YoY in India in Q3 2020