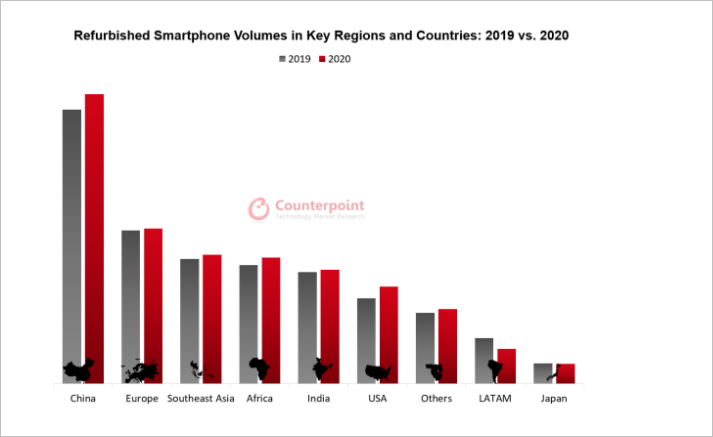

Research firm Counterpoint Research has released its outlook of the global refurbished smartphone sales for 2020 and 2021. The research covered global sales of refurbished smartphones in 2020, with some solid projections for 2021.

The Counterpoint research showed a jump of 4% in global sales of refurbished phones in the second half of 2020, compared to the first half of the year. The overall performance in 2020 was also better than the previous year, 2019, which globally saw a decline in the market volume.

As a result of the coronavirus pandemic, many countries worldwide experienced substantial dips in their economies, with significant job losses reported in all the regions. This could have contributed to the rise in the patronage of refurbished phones, as shown by the Counterpoint research. Counterpoint also notes a sharp rise in demand and supply of refurbished smartphones in 2020, mainly in the second half of the year. Resell volumes and trade-ins were observed to have gone up in all the regions covered by the survey.

The regions covered by the Counterpoint research are the US, Latin America, Europe, Southeast Asia, India, and Africa. With the average selling price of Apple refurbished phones up to three times higher than the average of other brands, greater preference was observed for the brand ahead of other brands in the secondary market. The more extensive rollout of 5G technology across 150 mobile operators in 70 countries did not affect the increased appetite for Apple phones, as shown by the numbers released by the Counterpoint Research.

The outlook for 2021, according to the research, remains bright within the secondary phone market globally. The sometimes significantly lower average selling prices of products in the secondary market could be fuelling the demand for products from the market. At the same time, supply may have been driven by several possible factors, including a dip in the global economy that has limited the purchasing power of some segments of consumers.

RELATED:

- Xiaomi could offer 100W fast charging support to Redmi Note series smartphones

- Most Flagship smartphones will still feature punch hole cameras in 2022: Tipster

- China smartphone shipments in May fell by 32%, reaching 23 million units

(source)