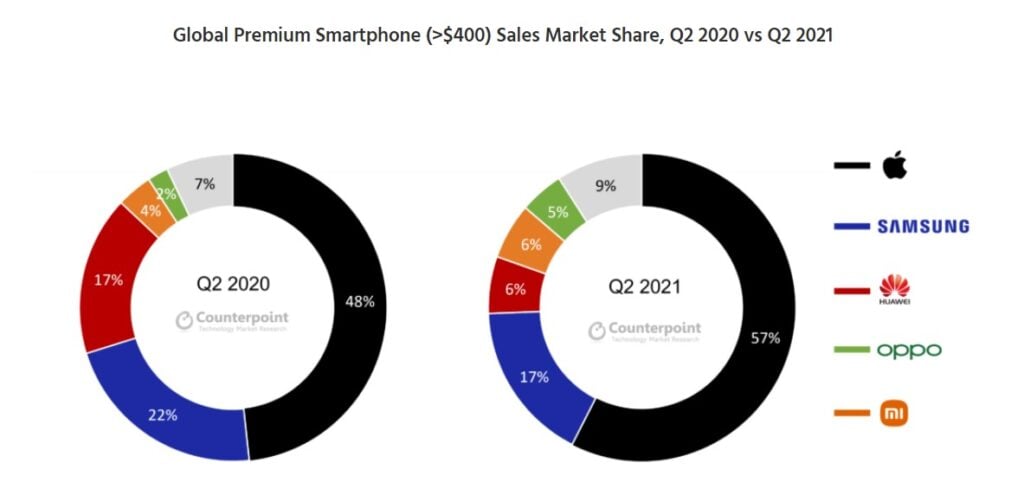

According to the latest report from Counterpoint Research’s Market Pulse service, Apple continues to rule the premium segment with over 50% market share in all major smartphone markets in Q2 2021. Brands like OnePlus, Xiaomi, and Oppo have captured a big share of the market too but behind all this, there’s a big contribution of Huawei‘s controversy that eventually led to its decline.

What used to be a 17% market share in Q2 2020 is now at 6% globally for Huawei. This decline gave enough room for Apple and Samsung to expand in the segment. While Apple managed to be resilient in component procurement and do well, Samsung was terribly hit by production disruption in Vietnam due to the Covid crisis. However, aggressively priced Samsung Galaxy Z Flip3 and Z Fold3 are helping Samsung take back what they lost in the last couple of months at a quick pace.

Well, Apple wasn’t the only brand to benefit from the gap that Huawei left in the premium segment, brands like Xiaomi and OPPO have had their fair share of gains too. Both the brands are investing and marketing heavily in the premium segment in Europe and China. Oppo with its Reno and Find series and Xiaomi driving the sales with the Mi 11 series. In fact, Xiaomi has managed to occupy the third spot in multiple markets, with a major chunk in Europe. As for OnePlus, it got a big room after LG‘s exit from the smartphone market and has clinched the third spot in North America.

Honor alongside other Chinese brands will join the segment with its Magic series in China and outside to gain some share in the premium segment, which may further reduce Huawei’s market share.

Despite this decline, Huawei continues to have a presence in the top 3 brands in Q2 2021 in the premium segment globally. With the increasing penetration rate of 5G devices, Huawei will have more chances of growing further, but the downside is the limited outreach the company has.

The premium segment has been opened up and a lot of new entrants are competing against some big names. After the global chipset shortage is resolved, we may see brands ramping up their sales numbers.

Related: