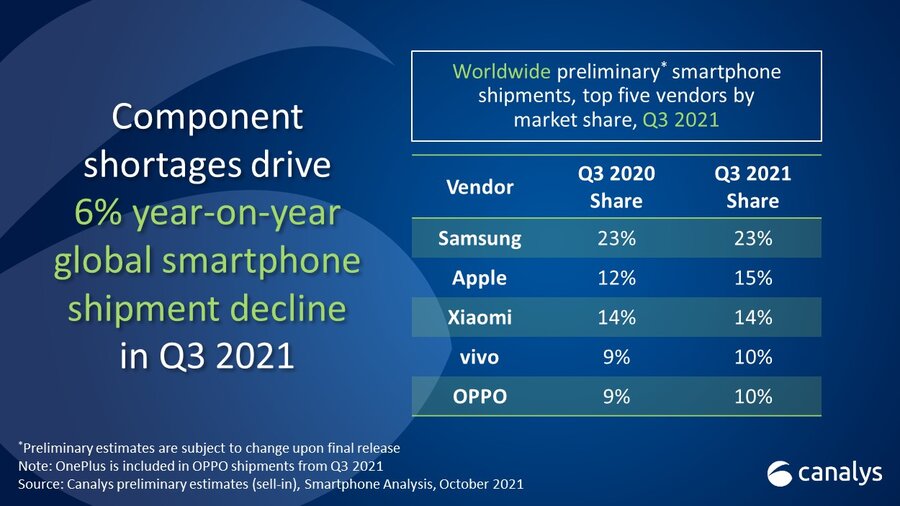

The global smartphone market is reeling under the weight of the semiconductor shortage as vendors struggle to meet demand. Samsung was the leading vendor with a 23% share. Xiaomi lost the 2nd place it had gained earlier this year after Apple grabbed it thanks to strong demand for the iPhone 13.

As a result, the Chinese smartphone giant currently stands at 3rd with a market share of 14%. The 4th and 5th rankings are currently held by vivo and OPPO currently, both with a 10% share each (via: Canalys).

Ben Stanton, Canalys Principal Analyst remarks that the chipset famine has truly arrived: “The smartphone industry is striving to maximize production of devices as best it can. On the supply side, chipset manufacturers are increasing prices to disincentivize over-ordering, in an attempt to close the gap between demand and supply.”

However, the chip shortage will likely be continuing well into 2022 despite the measures. This, combined with high global freight costs, will be pushing the device retail pricing even higher.

Along with this, the chip shortage is also prompting last-minute changes with regard to device specification and order quantities from the smartphone vendor end. This is critical for them since they have to select from the existing pool of available components.

Unfortunately though, it leads to confusion and inefficiency when communicating with retail and distributor channels, continued Stanton. Many channels are nervous heading into important sales holidays, such as Singles’ Day in China, and Black Friday in the west.

Smartphone channel supplies are already low, and as more customers anticipate similar sales cycles, the oncoming surge of demand will be impossible to meet. Customers might expect less aggressive smartphone discounts this year. Smartphone firms with tight margins, on the other hand, should consider bundling other devices, such as wearables and IoT, to provide strong incentives for customers.

RELATED:

- Apple MacBook Pro 2021 possible designs revealed with latest renders: slim bezels & more

- Apple iPhone 13 Pro battles the Nokia 3310 in a drop test, results may surprise you!

- Samsung Galaxy S22 to come with ultra-narrow bezels, will be Snapdragon 898 frontrunner

- Xiaomi CIVI Review: Xiaomi’s most beautiful phone ever