As per Counterpoint Research’s Global Smartphone ODM Tracker and Report, smartphone shipments from original design manufacturer (or independent design house) companies grew 6.4 percent year-on-year basis in 2021. This is due to the pickup of 4.5 percent YoY in the overall global smartphone market in 2021. The rise in ODM/IDH shipments is also in times of COVID-19 and component shortages.

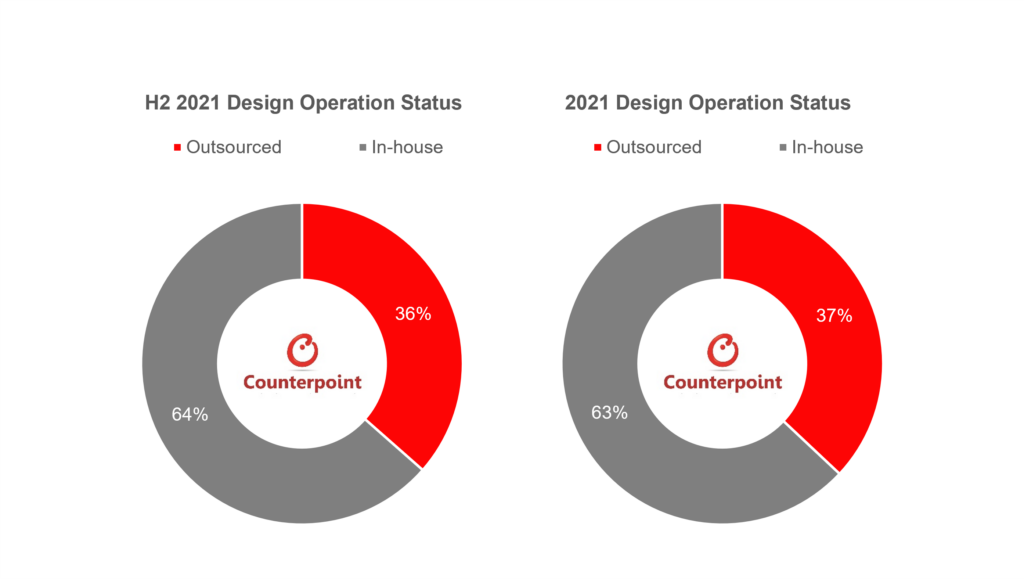

The report also adds that the share of smartphone shipments from outsourced designs increased to 37 percent, which is 1 percent up from 36 percent in 2020.

Senior Research Analyst Ivan Lam stated that the ODMs managed to achieve decent growth despite the impact of the COVID-19 pandemic and the supply of 4G chipsets on the global smartphone market. The growth was driven by brands like Xiaomi, Lenovo/Motorola, and Transsion. Since Xiaomi logged a 31 percent year-on-year growth in shipments in 2021, key ODMs for the brand benefitted the most. Another analyst added that Huawei’s decline impacted the big three, as the brand’s outsourced orders dropped 78 percent YoY. However, these were offset by Honor in the second half of 2021 whose orders dropped 11 percent YoY. Referring to the ‘Big 3’, Huaqin, Longcheer, and Wingtech dominated the market with 70 percent of the global ODM/IDH smartphone shipments.

Smartphone OEMs are aggressively investing in India with companies like Foxconn, Pegatron, Wistron, and more setting up manufacturing facilities and expanding assembly lines to India, North Korea, and Southeast Asia.

Original Design Manufacturers seem to be moving away from IDH services and focusing more on production and assembly services. Leading ODMs are also setting up production lines in India, Southeast Asia, and Brazil.

Related: