US smartphones saw unusually high demand in Q1 2021. The demand was driven by various factors, including the pandemic. But as the pandemic situation is stabilizing, smartphone sales are also declining.

A new report by Counterpoint research reveals that the US smartphone market declined by 6% YoY in Q1, 2022. This data came from the firm’s US Monthly Smartphone Channel Share Tracker.

“While Q1 2022 did see weaker sales compared to last year, this needs to be seen in context. It is not a sign of the market contracting because last year’s Q1 was unusually high due to several factors driving demand,” said Jeff Fieldhack, Research Director with Counterpoint.

Premium device sales dropped post the holiday quarter. Persistent supply bottlenecks impacted both 5G and LTE devices. The tax season sales were also lower as Q1 2021 saw an additional stimulus money bump, as per the report.

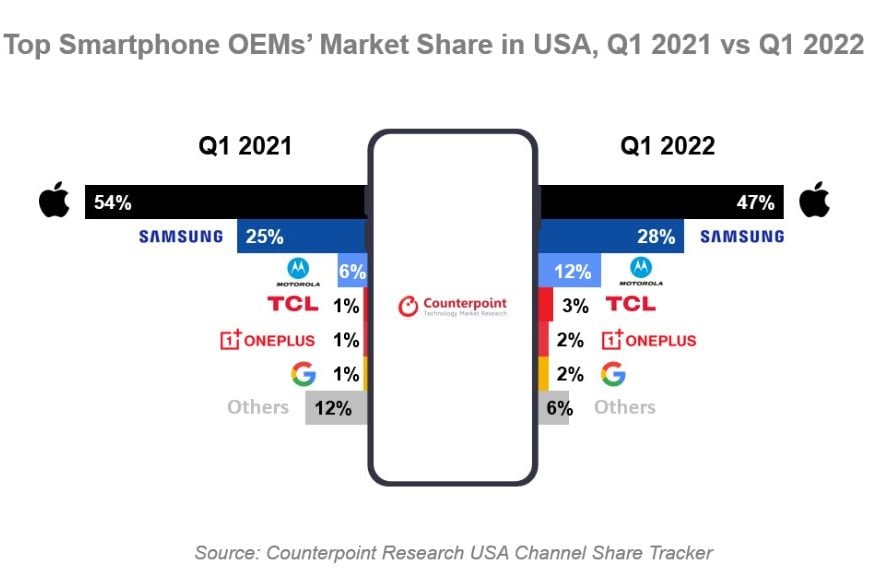

Apple dominated the US smartphone market with a 47 percent market share, followed by Samsung with a 28 percent market share and Motorola with a 12 percent market share.

Apple’s iPhone 12 series sales pushed into Q1 2021 due to its staggering launch. This resulted in more premium demand in a typically slow quarter.

Apple’s revenue surpassed $14 billion. iPhone 13 sales accounted for over 80% of total sales in the quarter.

“Looking at Q1 2022, there were still solid performances from Apple and Samsung, with Motorola, Google, TCL and OnePlus seeing YoY increases in volumes due to LG’s exit,” Fieldhack added.

The report also sheds light on smaller manufacturers who are beginning to capture more market share due to LG’s exit. Motorola has seen significant growth this year. It has become the third-largest smartphone brand in the country, with a 12% market share.

OnePlus witnessed a comparatively slower quarter overall as the increased low-end competition resulted in fewer sales.

“There will also be massive network migrations occurring as 2G and 3G sunsets come to fruition this year. This will certainly give a lift to smartphone sales as carriers will need to move millions of subscribers to LTE or, preferably, 5G smartphones,” said Senior Research Analyst, Maurice Klaehne.

Related:

- Worldwide Tablet and Chromebook shipments decreased significantly in Q1 of 2022: IDC

- Apple announces free repairs for Watch Series 6 units with blank screen problem

- Apple launches new Self Repair Service for iPhone 13, iPhone 12, & iPhone SE

- This is probably why Apple wont make an iPhone 14 Mini