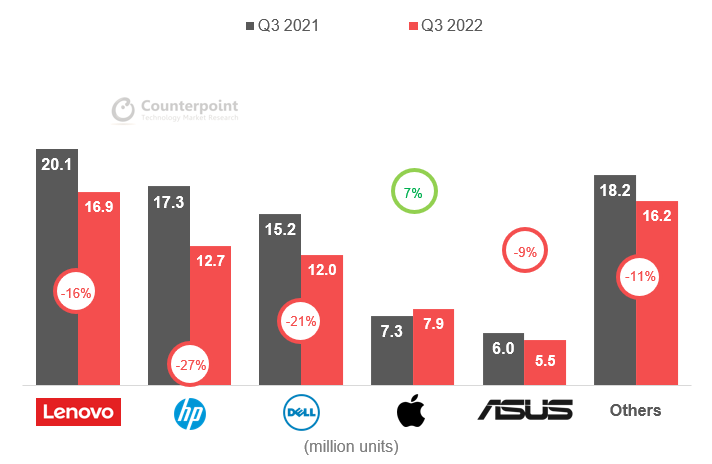

Global PC shipments in the third quarter of the year fell 15.5 percent year-on-year basis as per Counterpoint Research data. Q3, 2022 is the period between July to September. PC OEM’s shipped 71.1 million units in this year’s Q3. Counterpoint states that this is another wave of huge YoY decline after the severe annual and sequential falls of 11.1 percent in Q2, 2022.

The decline in the third quarter of 2022 is attributed largely due to demand weakness across both consumer and commercial markets, mainly driven by global inflation. OEMs and ODMs have a negative outlook on Q4 2022 and the first half of 2023 despite the issue of a component shortage being resolved. Counterpoint in conversation with supply chain members said that the largest inventory numbers were in Q3, 2022. PC OEMs believe that the destocking process will continue into 2023.

As for the OEMs, Apple registered a 7 percent YoY growth in shipments. This is because the Cupertino-based giant announced a new product late in Q2 and shipments were restocked after lockdowns in China. ASUS had a 9 percent year-on-year decline in shipments whereas Lenovo dropped 16 percent. Both companies had a market share of 5.5 and 16.9 percent respectively in Q3, 2022. HP sold 12.7 million units in Q3 with an 18 percent share. It fell 26.5 percent on a YoY basis. Dell recorded 17 percent share and 20 percent drop in shipment.

Chipmaker AMD hinted that the PC market weakness has already negatively impacted its profits and outlook, while Taiwanese brands Acer and Asus both stated that the PC sector will not recover until H2 2023.

Counterpoint says that “Among all PC product segments, we believe Arm-based PCs and gaming PCs are poised to weather the market downturn best, with the help from Apple’s M-series offerings as well as incremental R&D efforts from chip makers and the wider ecosystem.”

Related:

- Xiaomi leads the Indian smartphone market in Q3, total market shipments down by 6%

- Apple’s upcoming 14-inch and 16-inch MacBook Pro models to reportedly launch next month

- Xiaomi Book Air 13: The Company’s Thinnest Laptop to Launch on October 27