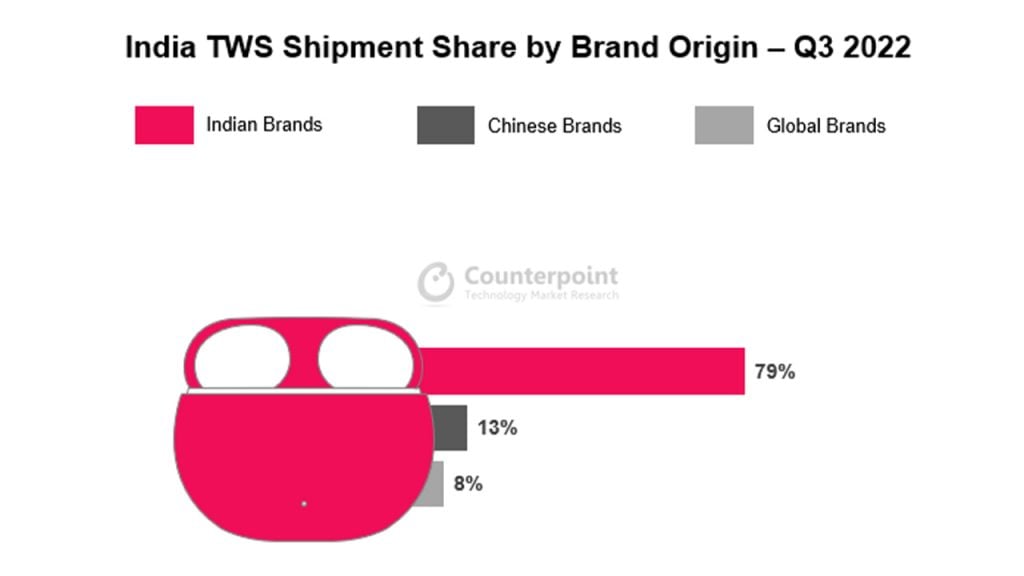

India has one of the largest technology markets in the world. While this situation increases the country’s importance for big brands, it also leads to the growth of domestic ones. It seems that domestic brands have even managed to outperform their rivals. According to the third Q3 report of 2022, the market share of Indian brands in TWS shipments has reached an impressive 79%.

Indian brands break record with 79% share in TWS market

According to the latest research from Counterpoint’s IoT Service, India’s TWS (True Wireless Stereo earbuds) shipments doubled YoY in Q3 2022. The biggest reason for the increase was high demand, new launches and considerable discount periods. The companies with the highest sales were the domestic brands of the country, and their total market share reached 79%.

Indian brands such as boAt, Noise, Mivi, Boult Audio and Ptron grew 143% year-on-year in the third quarter of 2022. Indian brands also have a high share of 95% in the low-price segment (< INR 2,000 or < $ 50). However, it was not only domestic companies that grew; Chinese brands also saw an increased share of 13% in Q3 2022. The biggest shareholder was OnePlus and Nord Buds CE. Domestic manufacturing saw a record 288% quarterly growth this year, contributing to 34% of the total shipments.

On the other hand, global brands were present in the report with premium models as always. Brands such as Samsung, JBL and Apple achieved 9% annual growth.

Commenting on brand performance, Senior Research Analyst Anshika Jain said, “The top five TWS brands in India – boAt, Noise, Mivi, OnePlus and Boult Audio – accounted for almost 70% of the total shipments. OnePlus made a comeback in the top five driven by two recent launches – Nord Buds and Nord Buds CE – at an affordable price point. Indian brands showed the fastest YoY growth of 143% to reach their highest shipments ever in Q3 2022.

“Launching multiple devices according to customer needs, effective marketing tactics and aggressive participation in sales events have been their major growth drivers. Moreover, strong growth was observed in Q3 due to festive season sales and a focus on local manufacturing. People also use these devices for gifting purposes during festivals like Raksha Bandhan and for corporate gifts.”

- Blaupunkt BTW09 Moksha TWS Earbuds Launched in India with Hybrid ANC, 60 Hours Battery

- Vivo TWS 3 series earbuds officially teased, with Spatial Audio & True Hi-Fi audio

- Realme teases the Buds Air 3S TWS earbuds launching alongside the Realme 10 series

- Vivo X90 Series, TWS 3 Launch Date Confirmed, X90, X90 Pro Could be First…

- Vivo TWS 3, TWS 3 Pro Renders Leaked, Design Revealed Before Launch

(Source: Counterpoint)