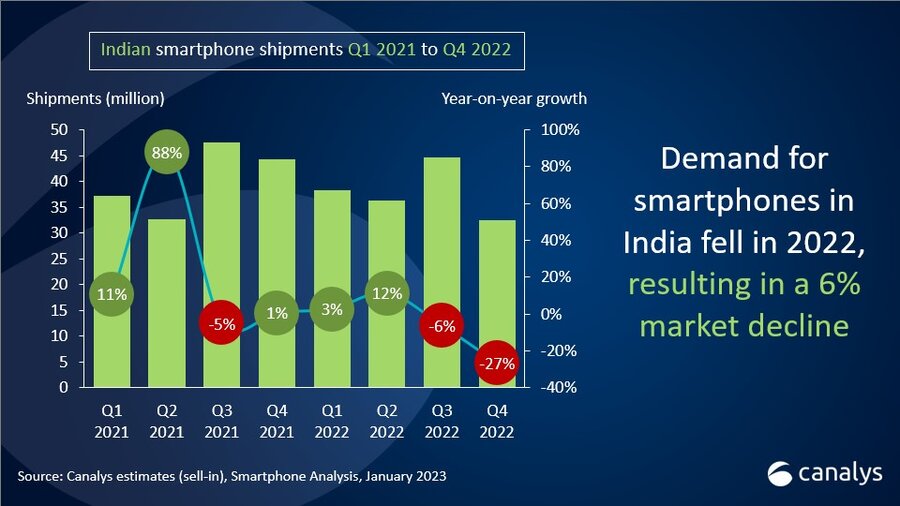

According to Canalys research, smartphone shipments in India declined by 6% in 2022 to 151.6 million units. The decline was due to subdued demand due to intermittent supply issues and global macroeconomic headwinds. Notably, the Indian smartphone market experienced its first-ever decline as shipments fell 27 percent to 32.4 million units in the fourth quarter.

India Smartphone Shipments Experiences First-Ever Q4 Decline! Xiaomi Loses Leadership Position

In the fourth quarter of 2022, Samsung shipped 6.7 million units and accounted for 21% of the market share, ranking first for the first time since the third quarter of 2017. Vivo shipped 6.4 million units mainly through offline channels, ranking second. Xiaomi, which has topped the list for 20 consecutive quarters, dropped to third place with shipments of 5.5 million units.

Xiaomi is still the largest manufacturer throughout the year, but OPPO and realme maintained the fourth and fifth positions with shipments of 5.4 million and 2.7 million units, respectively. Canalys’ Sanyam Chaurasia analyst attributed the drop in shipments to cooling domestic consumer spending, as well as delays in purchases as consumers already had the latest technology they bought during the pandemic. This has resulted in smartphone brands struggling with inventory management And must focus on supplier channel management strategy.

Chaurasia also pointed to poor e-commerce sales in the fourth quarter for suppliers that primarily focus on online channels, with a massive build-up of product inventories. On the other hand, manufacturers that focus on offline channels in third- and fourth-tier cities, such as vivo and OPPO were able to grow year-on-year.

Despite the decline in shipments, Chaurasia remains optimistic about India’s long-term potential. He noted that India’s economy is expected to recover in 2024, when the government holds general elections and may boost consumer purchasing power. Canalys expects Indian smartphone market to grow modestly in 2023, driven by 5G device replacement cycle State governments deal with smartphone penetration and introduction of new use cases.

| Vendor | Q4 2022 shipments (million) | Q4 2022 market share | Q4 2021 shipments (million) | Q4 2021 market share | Annual growth |

| Samsung | 6.7 | 21% | 8.5 | 19% | -21% |

| vivo | 6.4 | 20% | 5.6 | 13% | 13% |

| Xiaomi | 5.5 | 17% | 9.0 | 20% | -40% |

| OPPO | 5.4 | 17% | 5.0 | 11% | 9% |

| realme | 2.7 | 8% | 7.6 | 17% | -65% |

| Others | 5.7 | 18% | 8.5 | 19% | -32% |

| Total | 32.4 | 100% | 44.2 | 100% | -27% |

| Vendor | 2022 shipments (million) | 2022 market share | 2021 shipments (million) | 2021 market share | Annual growth |

| Xiaomi | 29.6 | 20% | 40.2 | 25% | -26% |

| Samsung | 28.6 | 19% | 30.1 | 19% | -5% |

| vivo | 25.4 | 17% | 25.8 | 16% | -2% |

| OPPO | 22.6 | 15% | 20.9 | 13% | 8% |

| realme | 20.9 | 14% | 24.3 | 15% | -14% |

| Others | 24.5 | 16% | 20.2 | 13% | 22% |

| Total | 151.6 | 100% | 161.5 | 100% | -6% |

RELATED:

- Redmi Note 12 Series Breaks Records with $37 Million in Sales in One Week

- Sony Achieves Revenue Growth Thanks to Apple’s iPhone 14 Series in 2022

- Foldable Phone Market Set to Grow by 30% in 2023, Reaching 17 Million Units

- Tecno Seeking Partnerships with Leading Lens Makers to Advance Smartphone Camera Technology

- Huawei Enjoy 50z Now Available For Purchase In China; Price Starts At 1,199 Yuan ($172)

(source)