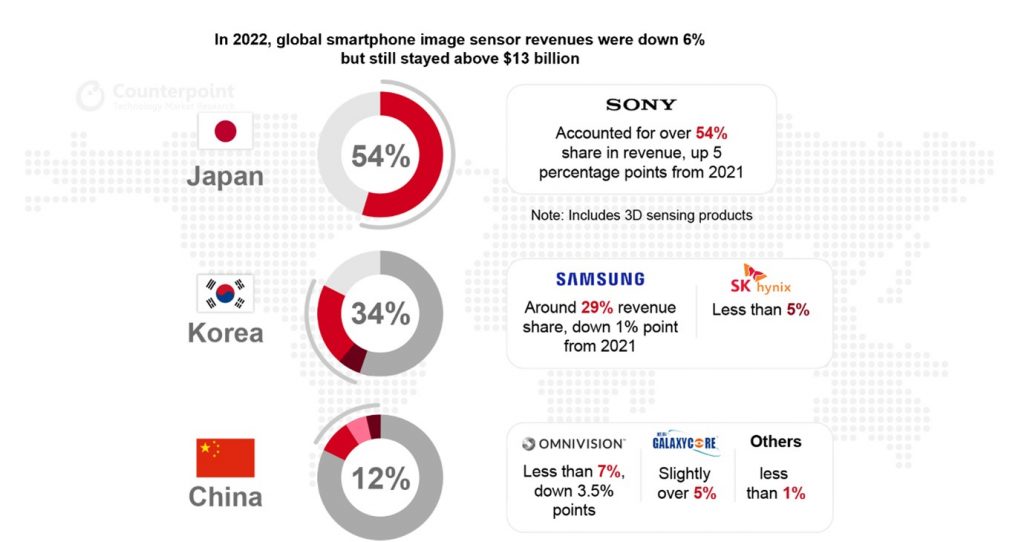

In 2022, the global smartphone image sensor market faces a downturn, with annual smartphone shipments falling by nearly 11%, and the trend of multi-camera adoption slowing down. This led to a contraction in CIS (CMOS image sensor) sales and a correction of oversupply in inventory, especially for 8MP and Low megapixel sensor. According to Counterpoint’s Smartphone Camera Tracker, global smartphone image sensor shipments are down 15% compared to 2021, with all major suppliers seeing declines of varying degrees. However, there are a few vendors who manage to stand out in this regard Challenging market.

Sony was the only major vendor to achieve growth, thanks to Apple’s camera upgrades

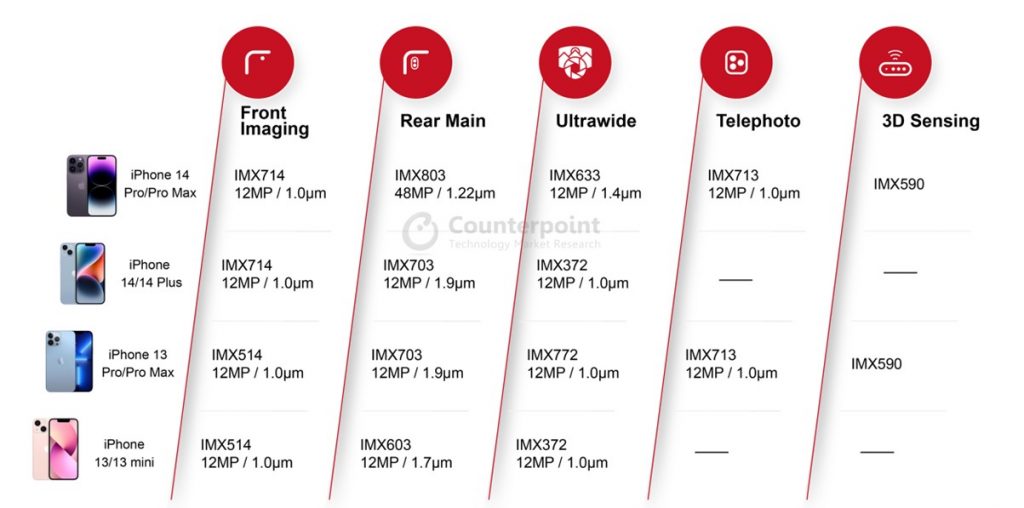

Sony was the only major vendor to report year-over-year revenue growth thanks to Apple’s camera upgrades. Apple, which contributes an estimated half of Sony Mobile’s CIS revenue, further improved iPhone camera specs during the year. The iPhone 14 Pro and Pro Max come with a new A 48MP image sensor for the main rear camera, a larger ultrawide sensor, and a front-facing sensor with autofocus. As a result of these upgrades, Sony estimates that each unit adds more than $6, or about $300 million in sales, in the second half of 2022.

In the Android camp, Samsung LSI also benefited from the trend of camera enhancements and improved product mix, partially offsetting the sharp decline in shipments. Samsung has a first-mover advantage in mass-producing sub-0.7μm high-resolution sensors, with expected shipments of 200 million units An affordable 50MP image sensor in 2022.

The 0.64μm-based Samsung S5KJN1 has achieved great success and is widely used in rear main cameras in low- and mid-range smartphones as well as front-facing or ultra-wide-angle cameras in high-end models. Samsung also continues to dominate the 100MP and Higher than sensors and raising the bar with the commercialization of 200MP sensors (ISOCELL HP1 @ 0.64μm HP3 @ 0.56μm).

On the other hand, OmniVision Galaxycore and SK Hynix see double-digit YoY revenue declines in 2022. The performance of these vendors is more vulnerable to shrinking mobile CIS demand. The smartphone CIS market will become more consolidated in 2022 in terms of revenue. sony Its share widened to just over 54%. The top two vendors accounted for approximately 83% of the total market revenue. Market consolidation is expected to continue in 2023.

Despite declining shipments and revenue in 2022, the mobile CIS market is expected to quickly return to growth as long as the camera system remains at the heart of smartphone upgrades. This will lead to improvements in resolution sensor size and even the integration of artificial intelligence functions. This The high-end camera market will be very competitive through 2023, with Sony’s large-area 50MP sensors and Samsung’s new 200MP series expected to battle it out for design wins.

RELATED:

- Global Notebook Computer Market Records Lowest Shipments in a Decade

- Global Smartphone Market Records Lowest Shipments in a Decade: Canalys

- Oppo Find X6 Series Render Reveals New Design With Circular Camera Module & Periscope…

- Mysterious Honor Phone with 100MP Camera Emerges in Leaked Renders

- OPPO A78 5G Launched with 90Hz Display, Dimensity 700, & 50MP Dual Cameras

(source)