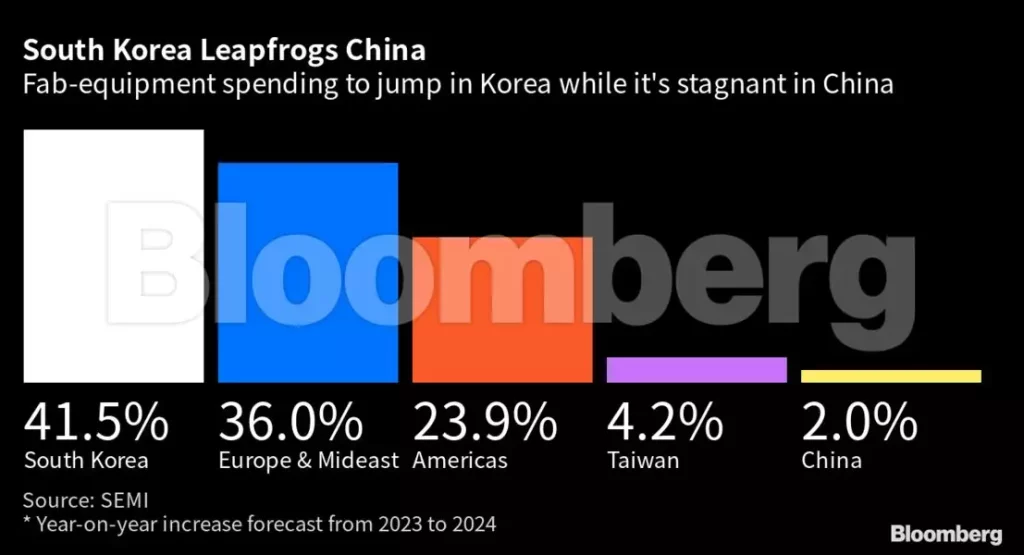

South Korea is set to overtake China in spending on advanced chipmaking equipment in 2024, a significant shift signaling the impact of US export controls on the global semiconductor supply chain. Data from SEMI, a US-based global semiconductor association, reveals that South Korea’s investment in fab equipment will likely increase by 41.5% to $21 billion, while China’s spending will only grow by 2% to $16.6 billion. Here are the details…

South Korea beating China in chip spend to reshape global semiconductor supply chain

South Korea is set to overtake China in spending on advanced chipmaking equipment in 2024,.This shift highlights China’s ongoing struggle to secure essential machinery for improving its chips. The US-imposed restrictions have made it increasingly difficult for China to access equipment from leading manufacturers like ASML Holding NV of the Netherlands. With Dutch and Japanese governments also joining the US in imposing export restrictions, advanced chips and equipment from companies such as Nvidia Corp. and Tokyo Electron Ltd. are now largely inaccessible to Chinese buyers.

As a result, US chipmaking equipment suppliers, including Applied Materials Inc., Lam Research Corp., and KLA Corp., are projected to lose billions in sales this year due to the US restrictions on China. Semiconductor foundries are crucial in the race for economic and political dominance, as they manufacture cutting-edge chips required for artificial intelligence, self-driving vehicles, and other advanced technologies. For example, OpenAI’s ChatGPT was created by assembling tens of thousands of Nvidia’s A100 chips, which are banned for sale in China, into a functional supercomputer.

Recognizing the importance of foundries and the increasing concerns from the US, South Korea is now focusing on building foundries within its own borders. Earlier this month, President Yoon Suk Yeol announced plans to invest in a chipmaking cluster south of Seoul, with Samsung Electronics Co. committing to invest 300 trillion won ($230 billion) over the next two decades. Furthermore, Samsung is constructing a semiconductor plant in Texas to expand its foundry business, particularly in the US market.

Taiwan, home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co., is expected to maintain its global lead in fab equipment spending. SEMI predicts that fab equipment spending in Japan will rise to $7 billion in 2024, following the recent lifting of export curbs to South Korea as diplomatic ties and tech supply chains were restored between the two US allies.

RELATED:

- How to disable MIUI Optimization?

- Nubia Z50 Ultra Full Review: Men will definitely love it

- ISRO successfully launches another 36 OneWeb satellites with LVM3 rocket

- LG OLED evo C3 Gaming TV with 4K 120Hz display now up for pre-order…

- Xiaomi Q4 revenue Crashes by 22.8%: Is the future looking Dim for China’s Tech…

(via)