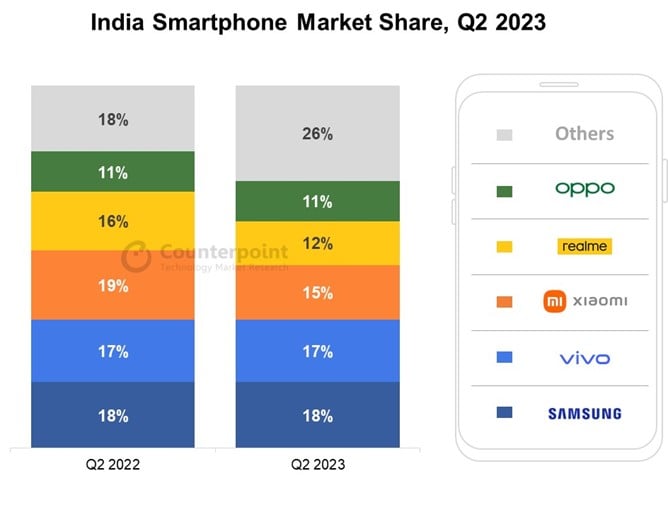

India’s smartphone market faced a 3% YoY decline in Q2 2023, but the premium segment (>Rs. 30,000) soared with a remarkable 112% YoY growth, contributing 17% to overall shipments. Samsung retained its lead in the market and surpassed Apple to regain the top spot in the premium segment with a 34% share.

Apple Continues to Dominate Ultra-Premium Category in India

Apple, however, continued to dominate the ultra-premium (>Rs. 45,000) segment with a 59% share, making India one of its top five global markets. Vivo maintained its second position in the overall market and experienced YoY growth, while OPPO excelled in the upper mid-tier range with a 21% market share. OnePlus emerged as the fastest-growing brand in India’s smartphone market with a 68% YoY growth.

The rise of the premiumization trend was fueled by value-based incentives, aggressive promotions, and easy credit availability through financing schemes. 5G smartphone shipments surpassed 100 million cumulative units, growing 59% YoY, driven by expanded 5G networks and affordable devices. Offline channels are gaining ground, and their share is expected to reach 54% by 2023, as brands like Xiaomi, Realme, Samsung, and Apple leverage both online and offline channels for customer engagement.

The market also saw a rise in 4G feature phone shipments, reaching 10% of the overall feature phone market in Q2 2023. This growth was driven by JioBharat and Itel Guru series launches, with the segment projected to reach 18% by the end of 2023.

Overall, while the Indian smartphone market declined slightly, the robust growth of the premium segment and the popularity of 5G devices indicate positive momentum for the industry. Brands are capitalizing on the festive season and 5G upgrades to attract consumers, setting the stage for further developments in the upcoming quarters.

RELATED:

- Samsung Crystal Vision 4K TVs With IoT Sensors, 4K Upscaling Launched In India

- Samsung starts OLED panel production for iPhone 15 series, BOE faces challenges

- OnePlus 11 vs Nothing Phone (2): Specs Comparison

- How to Send Video Messages on WhatsApp

- How to Send Video Messages on WhatsApp

(Source)