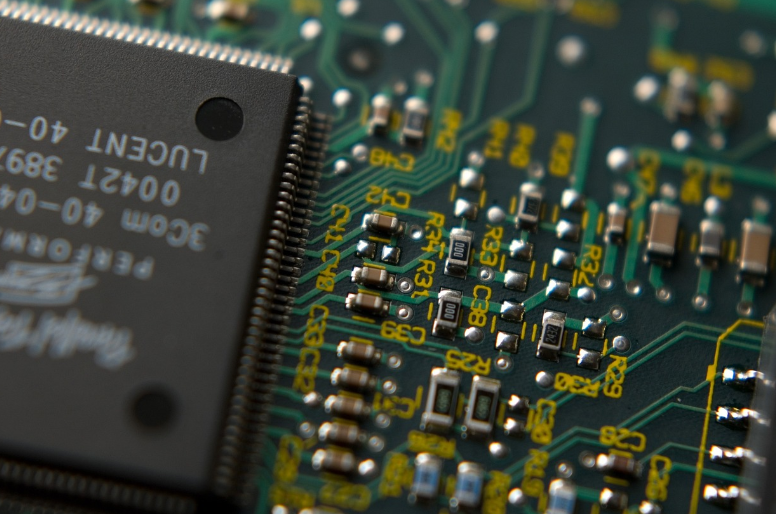

China has experienced a significant 14.6% decline in semiconductor imports from the United States during the first nine months of 2023 compared to the same period in the previous year. This drastic reduction, amounting to 355.9 billion units of integrated circuits (ICs), is attributed to stringent US export controls imposed due to concerns about China’s rapid advancements in the AI sector through American technology infusion. The total value of IC imports plummeted by 19.8% year on year, reaching $252.9 billion, reflecting the impact of these restrictions on China’s economy.

Remarkably, despite export bans, China’s demand for advanced semiconductors for AI projects has given rise to an underground market for smuggled graphics processing units (GPUs). Notably, Nvidia’s A100 and H100 devices have been making their way into the country, circumventing official channels.

The US government’s attempts to restrict specific chip exports to China, initiated in August of the previous year, have not entirely curtailed the under-the-counter trade of certain products from chip giants Advanced Micro Devices and Nvidia. This situation underscores the challenges faced by the US in attempts to limit China’s access to cutting-edge AI technology while addressing trade imbalances.

Furthermore, China’s imports from major semiconductor supply chain players South Korea, Japan, and Taiwan have also dwindled. Imports from South Korea witnessed a substantial 23% decline, while imports from Japan and Taiwan fell by 16.3% and 20% respectively. This broader reduction emphasizes the impact of global supply chain disruptions on China’s semiconductor industry.

Analysts are now eyeing the potential revitalization of China’s smartphone industry, despite US sanctions, with the imminent release of new 5G handsets by Huawei Technologies. This development could breathe new life into an industry that has experienced declining manufacturing activity, providing a glimmer of hope amidst the prevailing challenges.

Related:

- US is Doubling Down on AI Chip Exports to China, Leaving Consumer-Level Chips Alone

- iPhone 15 launch sales in China dip by 4.5% compared to last year – A blip or blame it on Huawei?

- Apple ex-supplier Ofilm, becomes a key Huawei Contractor

(via)