The US-China trade war continues to rage on unabated. US President Donald Trump just days ago slammed a new 10% tariff on $300 billion worth of Chinese goods imported to the US. The new tariff saw Apple’s stocks fell by 2% over uncertainty, as the company produces all its products in China. The Cupertino-based company had previously stated that these types of taxes could affect the prices of all future products.

However, long-standing Apple analyst Ming-Chi Kuo has predicted that the US company already has plans on ground to absorb the extra expense. Thus, the new tariff regime won’t lead to a price increase for Apple products at least in the short to mid-term. This was contained in the analyst’s latest investor note which takes a look into Apple’s supply chain logistics and the consequences of the latest tariffs imposed on China by the Trump administration.

EDITOR’S PICK: Throwback Tech Thursday: We Revisit the Best Selling BlackBerry Curve Series

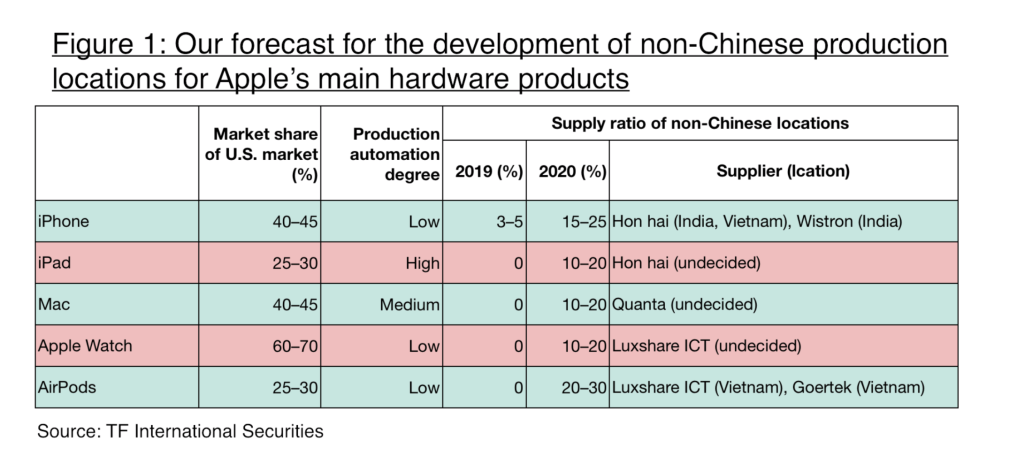

Further, Kuo thinks Apple will work to boost its non-Chinese production so it can match the demand of the US market thus avoiding the extra tariffs altogether. According to him, Apple’s advanced production automation coupled with the firm’s dominant market share in the US will help it stay afloat. The analyst gave predictions on all of Apple’s profitable product categories in the company’s portfolio. For the iPhone, he predicts that demand in the US will be fully met by its production facilities in India and Vietnam as early as next year. iPad demand will be met easier by the non-Chinese facilities thanks to its high degree of production automation.

The analyst gave predictions on all of Apple’s profitable product categories in the company’s portfolio. For the iPhone, he predicts that demand in the US will be fully met by its production facilities in India and Vietnam as early as next year. iPad demand will be met easier by the non-Chinese facilities thanks to its high degree of production automation.

The Mac line of products will take a longer period extending to 2021 before Apple’s production facilities outside China will be able to meet US demand. Apple’s AirPods and Apple Watch will be assembled in more production locations outside China heading forward so their market demand will also be met.

UP NEXT: Amazon Germany lists the Motorola One Action ahead of the official release

(source)