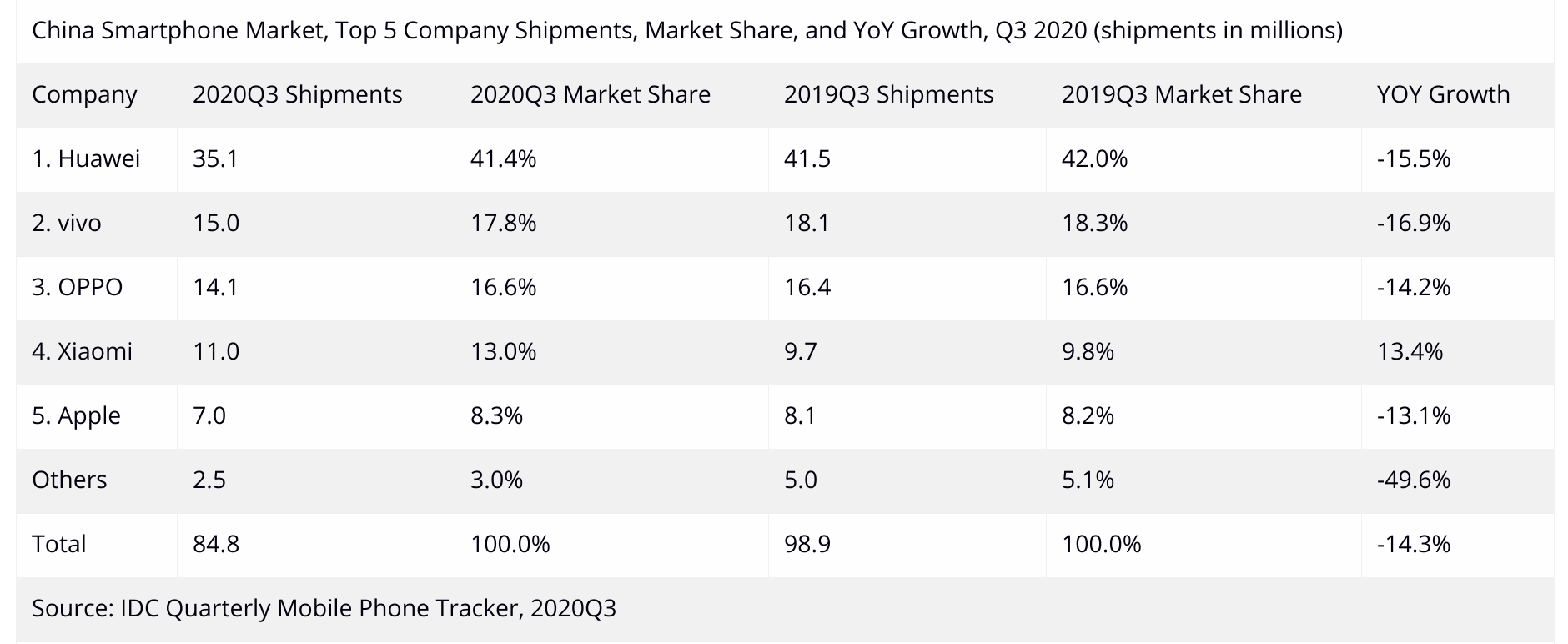

Last week, Counterpoint Research released its report on the China Smartphone Market Q3 2020. Now, a week later, IDC (International Data Corporation) publishes its own report. According to the firm, brands shipped 84.8 million units and the entire market witnessed 14.3% YoY decline. The drop in shipments was due to soft demand, Huawei’s supply constraints, and delayed flagship launches from both Apple and Huawei.

Despite supply issues, Huawei maintained its lead in the third quarter of 2020 with 35.1 million units in shipments and 41.4% market share. The company managed to do it by lowering the production of some popular models like the Mate30 series.

In the second place, vivo shipped 15 million units garnering 17.8% share. The company focussed across different price segments with 5G-enabled Y series in the sub-$300 category as well as S7, iQOO 5, and X series of phones in the mid-range and high-end segments.

EDITOR’S PICK: Xiaomi surpasses Apple to become the world’s third biggest smartphone brand

Whereas, OPPO focussed more in the $200-$400 5G handset segment by shipping less sub-$150 phones. The brand came third with 16.6% share and 14.1 millions units in shipments.

Further, Xiaomi shipped 11 million units gaining a 13% market share. Nevertheless, it was the only brand in the top 5 list to achieve a 13.4% YoY while others declined by up to 16.9%. The company’s Redmi 9 and Redmi K30 series performed well in Q3.

Lastly, Apple stood at the fifth place with an 8.3% market share and 7 million units in shipments. The American tech giant’s iPhone 11 continued to sell well in both offline and online channels.

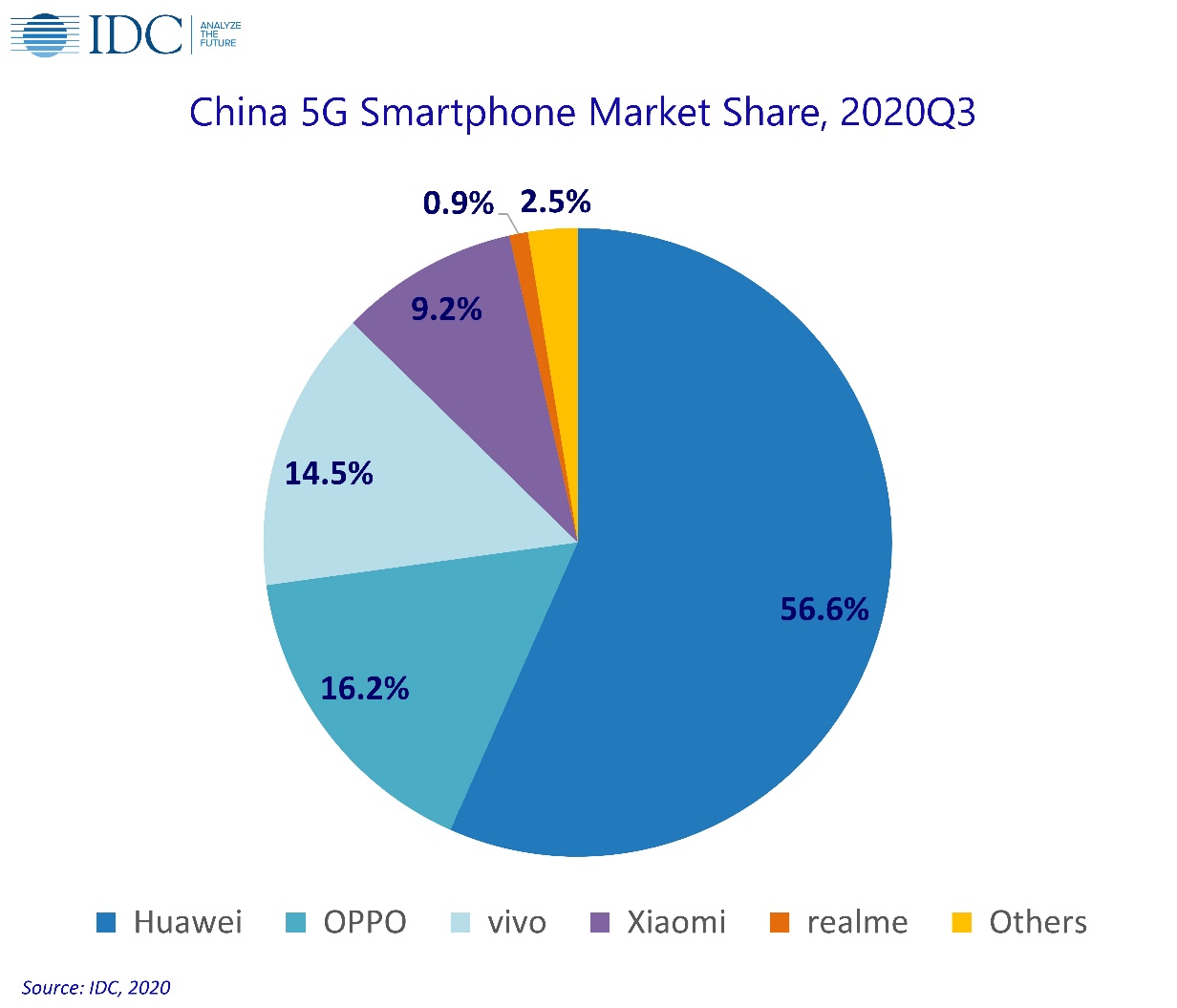

Having said that, the report also mentions that China has so far shipped a total of 117 million units of 5G smartphones since 2019. Out of this figure, a whopping 49.7 million units shipped in Q3 2020 itself. Huawei also led this segment, followed by OPPO, vivo, Xiaomi, and realme respectively.

UP NEXT: IDC: India Smartphone Market shipped 54.3 million units in Q3 2020; sub-$200 phones accounted for 84%