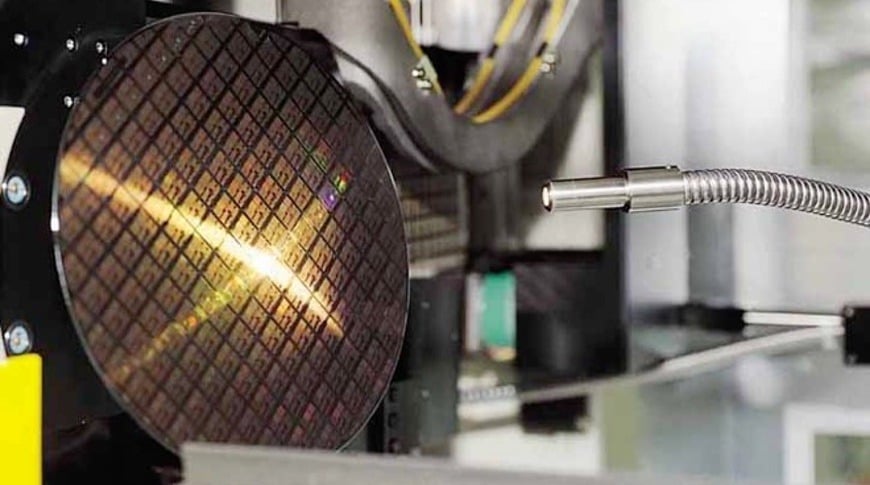

The prices for semiconductors is expected to rise well into next year, while major chip manufacturers like TSMC are expected to hike chip rates as well. This arrives amid a global shortage of semiconductors that has affected various industries across the globe, including brands like Apple.

According to a NikkeiAsia report, the prices of semiconductors have been on the rise since the last quarter of last year. The rates began rising with a supply shortage, following which, TSMC announced its biggest price hike in a decade. As of right now, the world’s largest contract chipmaker account for over half the global foundry market and has built chips for major tech giants like NVIDIA, Apple, Qualcomm, and others. The company is also known for its advanced chip technology and generally charges a fees 20 percent higher than its rivals.

Although, due to the shortage in semiconductors and TSMC running on full capacity, smaller foundries have also ramped up their own pricing due to high demands. These higher prices are due to a number of factors like higher material, logistics costs, and even the race between brands to acquire a steady chip supply. Notably, the Taiwanese chipmaker was slower than most other foundries in raising its prices, but that can also be attributed to the premium that it already charges.

A major implication of the rising price of semiconductors is the hike in cost of consumer electronic products like smartphones. Apple is a major client for TSMC, so rising prices might affect its iPhones and iPads as well. But, the Cupertino based brand could offset some of these costs due to its relation with the chipmaker as a major client.

RELATED:

- Samsung seeks to take on Apple iPad Pro with new Galaxy Tab S8 Ultra

- Apple A15 chip in iPhone 13 still dominates Android rivals in performance: Report

- Apple iPhone 13’s Satellite Communication feature to be reportedly available only in select countries