COVID-19 and the resultant global lockdown may have had a deep impact, but the PC monitor market has continued to grow well over a year later.

The latest figures from International Data Corporation’s Worldwide Quarterly PC Monitor Tracker are out (via: IDC) and show that worldwide shipments were just over 35 million units in the second quarter of 2021. This is an increase of 11.2% compared to the numbers from the same quarter in 2020 when COVID-19 lockdowns were in full force.

The demand has been stronger than ever this year. However, supply was constrained by various challenges that affected not only the PC monitor production but much of the electronics industry at large.

Components such as ICs that go into display panels remained limited. This, combined with rising transportation costs and logistical challenges, led to price hikes. Buyers fulfilling urgent demand and hedging against expected shortages further contributed to the hike.

Company Highlights

The share of commercial shipments saw a drop in Q2 2021 compared to a year ago, losing out to growing demand from home users. Much of this was driven by gaming monitors alone. Another reason for the drop is that the commercial segment was bought more thanks to the lifting of COVID curbs which led to a recovery in office occupancy.

But perhaps, it is the low-tier vendors ranking below the top 5 PC monitor companies, that benefitted the most from the growth in demand from home users. Such brands captured almost 36% of the market share compared to their 32.2% share from a year ago.

As clear from the above table, Dell Technologies continues to top the 2021 worldwide PC monitor shipments list with over 7,549,000 million units sold in Q2 2021. Lenovo follows with 4,164,000 units. However, the latter has seen a significantly higher YoY growth, or almost double to be precise – where Dell has seen an 18.6% increase in shipments in Q2 2021 when compared to Q2 2021, Lenovo has seen a growth of 35.2%.

Looking ahead, IDC expects to see stabilization in monitor component pricing as demand wears off and component shortages ease out a bit in the second half of this year.

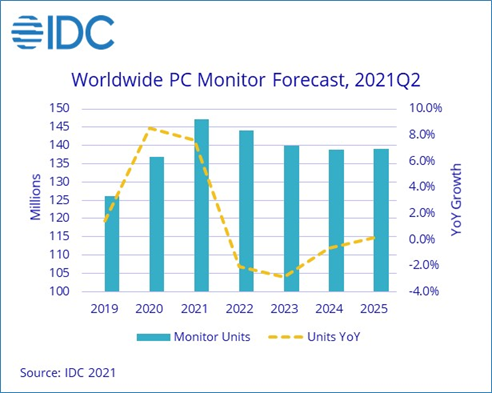

Shipments are predicted to peak at a little over 147 million units, the highest level since 2012. Following that, volumes are expected to decline in the coming years, eventually stabilizing at 139 million by 2025.

“The second quarter capped five consecutive quarters of positive year-on-year growth, four quarters of which were growth in the double digits. Such momentum has never been seen in the history of our monitor coverage,” said Jay Chou, research manager for IDC’s Worldwide Quarterly PC Monitor Tracker.

“However, we believe the market will soon reach an inflection point. Demand will begin to cool in the latter half of 2021, with small declines in 2022 thru 2024. Nonetheless, long-term assumptions have already shifted for the better compared to pre-COVID times as location-agnostic modes of work/study become more popular, thus enlarging the installed base,” he added.

RELATED:

- ViewSonic VX series 4K gaming monitors launched with 144Hz displays & stereo speakers

- Skyworth launched new “Closer to Reality” 4K TVs and Gaming Monitor at 2021 Autumn Product Launch

- Samsung launches new Monitor with a pop up Webcam for remote workers and students

- Lenovo launches new series of Professional and Gaming Monitors

- Dell CEO believes that the chip shortage could last a few years