Europe’s smartphone market has mostly recovered from the effects of the pandemic but is held back from the chip shortage now. Q3 2021 phone sales were thus overall 1% lower compared to the same period last year.

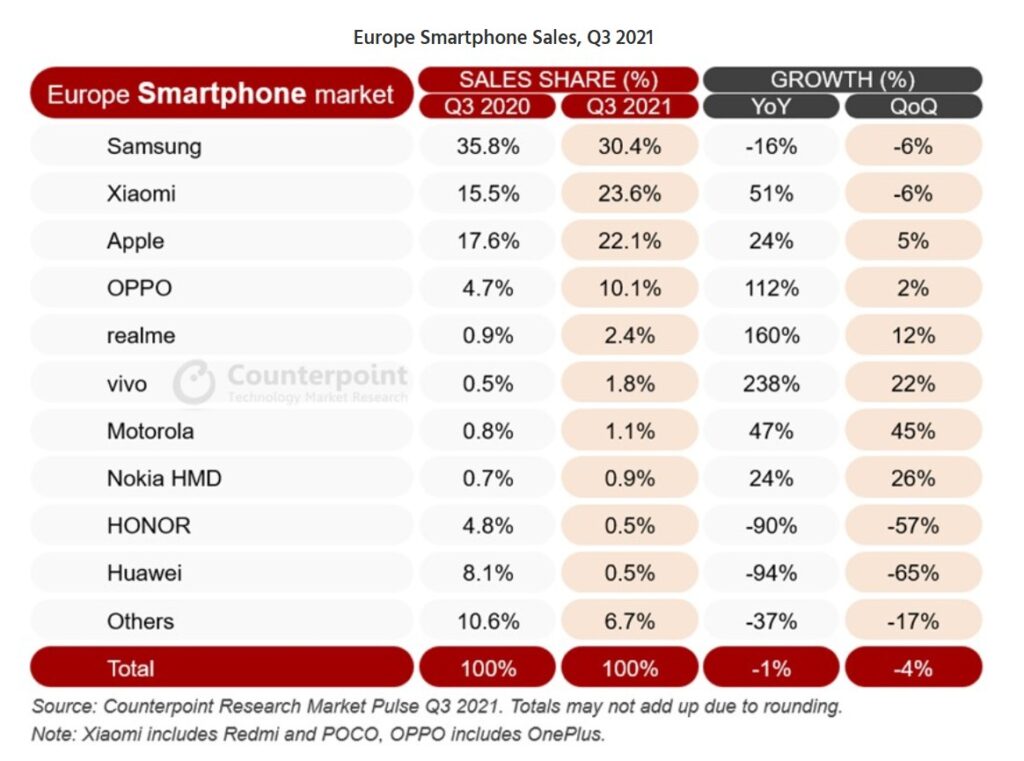

Not every brand was equally affected though. It’s the Chinese smartphone brands, particularly the subsidiaries of BBK Electronics, that have outshone the rest (via Counterpoint Research). vivo, realme, and OPPO have each recorded triple-digit growth in Q3 2021 vs Q3 2020 with figures of 238%, 160%, and 112% respectively in Europe. These three have also gained in terms of market share with OPPO jumping from 4.7% to 10.1%, realme from 0.9% to 2.4%, and vivo from 0.5% to 1.8%. OPPO has gained hugely with the merger with OnePlus.

However, the market share of these three is rather tiny in the continent, which explains the triple-digit figures. The big players have continued to be Samsung, Xiaomi, and Apple. Although, Samsung’s market share has declined from 35.8% to 30.4%. Xiaomi and Apple on the other hand recorded 51% and 24% growth respectively.

Counterpoint Research Associate Director Jan Stryjak said, “realme is one of the fastest growing brands in Europe and has firmly established itself as a top-five vendor with strong sales in Russia, Spain, and Italy. vivo is also growing fast, albeit from a smaller base, while Motorola and Nokia are staging a comeback. HONOR also has set sights on the European market in the hopes of a reversal of fortunes with its first major launch in the region in over a year in October.”

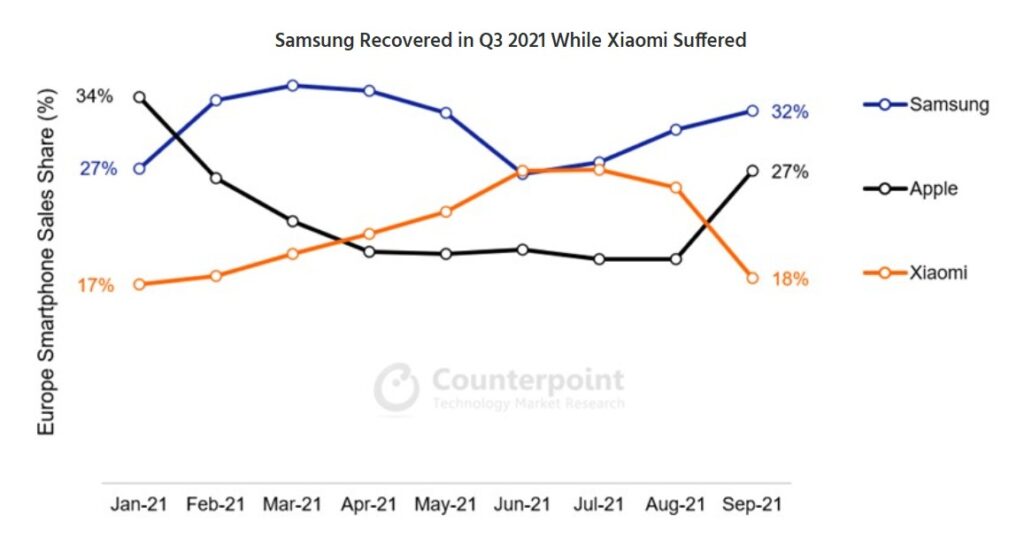

But when it comes to QoQ figures for growth in terms of sales, Xiaomi and Samsung have suffered declines of 6% each. Samsung could have been hit even worse had it not been for the success of the Galaxy Z Flip 3 particularly in Western Europe. Apple has seen a respectable 5% growth, on the other hand, boosted by the launch of the iPhone 13 towards the end of the quarter.

Xiaomi and Apple had a mixed quarter at the end of the quarter. Xiaomi suffered a major setback in September 2021 as a result of significant component constraints. Apple’s iPhone 13 launch was a huge success. Despite going on sale at the end of September, the iPhone 13 seemed to be more popular than the iPhone 12 from the previous year. Apple could have a record-breaking Q4 in Europe if it can keep up with demand – a difficulty in some markets.

RELATED:

- LG’s exit helps Motorola become the third largest smartphone brand in the US

- Huawei’s next-gen foldable smartphone could launch in February next year

- Xiaomi to commence manufacturing smartphones in Pakistan by January 2022

- Samsung reportedly developing Exynos 1280 chipset for entry-level smartphones

- China 4G smartphone shipments grew for the first time in last 2 years: IDC