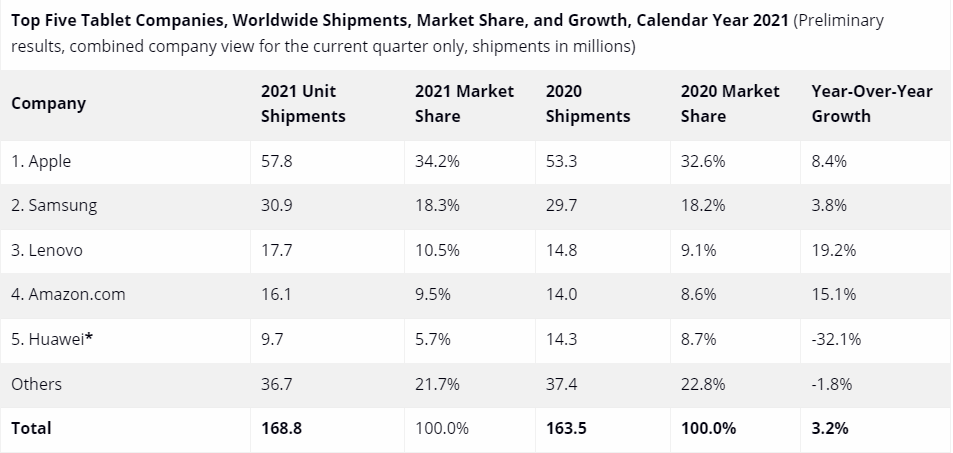

As we enter the third year of the ongoing global pandemic, tablets remain in high demand for work and school needs. The latest report from the International Data Corporation (IDC) has revealed that although the fourth quarter of 2021 saw a decline in shipments of tablets by 11.9% when compared to Q4 2020, total shipments grew by 3.2% when accounted for the whole year.

So let’s take a look at the shipment numbers of top tablet and Chromebook manufacturers to figure out who came out on top in 2021.

Apple remains dominant in the tablet market with its iPad offerings. The Cupertino giant retains the top spot with 57.8 million units shipped in 2021. The brand enjoyed a 34.2% market share and experienced an 8.4% yearly growth. Apple also shipped the most tablets in Q4 2021 at 17.5 million, however, the brand experienced an 8.6% decline in shipments when compared to Q4 of 2020.

In the second spot, we have Samsung with 30.9 million tablet shipments in 2021. The South Korean giant commanded an 18.3% market share and enjoyed a 3.8% yearly growth in the tablet segment. Samsung shipped 7.3 million tablets in Q4 2021 which was a 21.6% decline compared to Q4 2020.

Lenovo came in third with 17.7 million tablets shipments in 2021, which amounted to a 19.2% yearly growth compared to 2020. The company shipped 4.6 million tablets in the last quarter of 2021 which was 1.6 million sell than the volume shipped by the brand in Q4 of 2020.

Amazon shipped 16.1 million Fire Tablets in 2021 giving it the fourth-largest tablet market share at 9.5%. The brand grew 15.1% compared to 2020 and even enjoyed a positive growth of 1.3% in Q4 shippings year-on-year.

On the fifth position, we have Huawei and Honor who suffered a 32.1% decline in shipments at 9.7 million units shipped in 2021. However, the initial decline in shipping volume somewhat stabilized in Q4 of 2021, with the brand shipping 2.5 million tablets compared to 2.9 million shipments in Q4 2020.

The sharp decrease in the yearly shipping numbers is most likely due to the recent sanctions by the U.S. which prevents the brand from doing business with any American companies like Qualcomm and even Taiwan’s TSMC, which is the leading contract manufacturer for chipsets in the world.

Despite the market moving past its peak demand for tablets, senior research analyst Anutoopa Nataraj has stated that the shipments will remain above pre-pandemic levels as virtual learning, remote work, and media consumption remain priorities for users.

RELATED:

- Apple iMac Pro to have design similar to 24-inch M1 iMac and pack M1 Pro/Max chipset

- Samsung Galaxy Tab S8 series promo images and key specs leaked

- Apple’s upcoming iPad Pro 2022 could be powered by 3nm M2 chipset

- Apple iPad 10th gen to reportedly launch at end of 2022, will reuse old design