The Indian smartwatch market set quite some records last year, overseeing 274% YoY growth in shipments. This was paired by Q4 2021 becoming the market’s biggest-ever quarter, with QoQ growth of over 8%.

The figures come from Counterpoint Research which said that the growth can be attributed to increased health awareness, affordable prices, growth of new entrants, discount schemes, and plenty of launches throughout the year.

The majority of shipments (86%) were driven by the sub-Rs 5,000 segment, compared to 59% in 2020. The main reason for this is the fact that many of the features like SpO2 monitoring, which were earlier present in the Rs 3,000 to Rs 5,000 segment, have begun making their way to the ~Rs 2,000 price point.

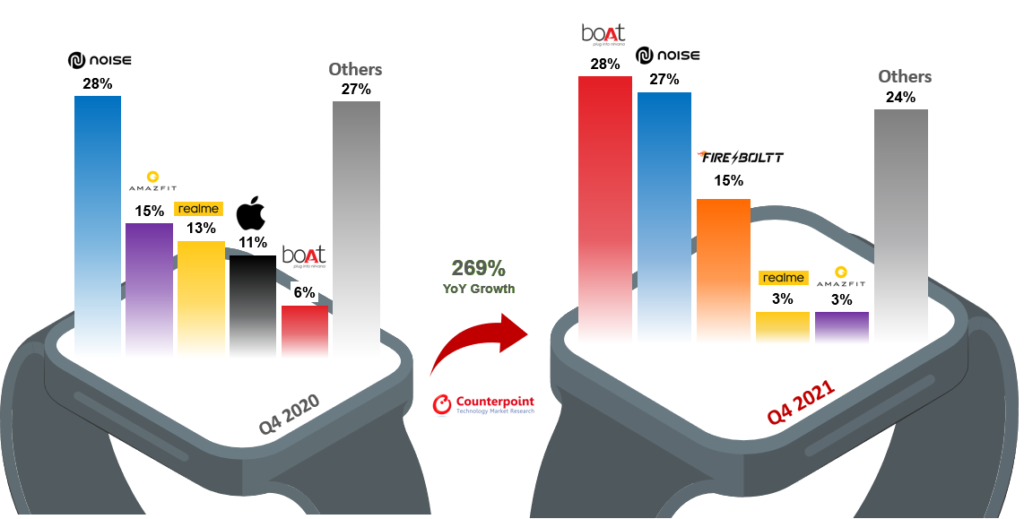

Commenting on market trends, research associate Harshit Rastogi said, “Indian players led the market by capturing over 75% share. The top three brands captured two-thirds of the total smartwatch market in 2021, compared to just half in 2020. The market saw over 10 new entrants in 2021, intensifying the competition. The market is estimated to grow by around 50% in 2022 considering the high demand and brands’ dedicated efforts to bring additional capabilities to their devices.”

Noise led the overall Indian smartwatch market in 2021 with a 27% share and over 278% YoY growth. Four out of the top 10 models last year were from the company, with the ColorFit Pro 2 being its most popular offering. Portfolio expansion toward lower prices and emphasis on community building were the main drivers.

Next up is boAt, capturing the second spot in 2021 with a 26% share. The company, with its 10+ models, actually grabbed first place in Q4 2021. The boAt Storm was its best seller.

Fire Boltt, a relatively new entrant in the smartwatch space, quickly managed to capture the third position with over 20 models spread over a wide price spectrum. The Indian brand also entered the Middle East in 2021.

Other major players in the market were realme, Amazfit, Samsung, Apple, and Dizo, each recording significant YoY growth.

The smartwatch market in India is primarily driven by online channels (78%), with Flipkart and Amazon accounting for 48 percent and 43 percent of total shipments.

More wearables are expected to be manufactured in India this year, thanks to customs duty rates adjustments with Budget 2022.

RELATED:

- Ambrane FitShot Zest smartwatch launched in India at a price of ₹2,999 ($40)

- Realme 9 Pro, 9 Pro+ pricing for India appear through retail box images

- Truke Air Buds & Air Buds+ with up to 48h playback launched in India

- ASUS ROG Fusion II 500 & Fusion II 300 gaming headsets unveiled in India

- iQOO 9 Pro ditches 2K display for India, features FHD+ display instead: Report