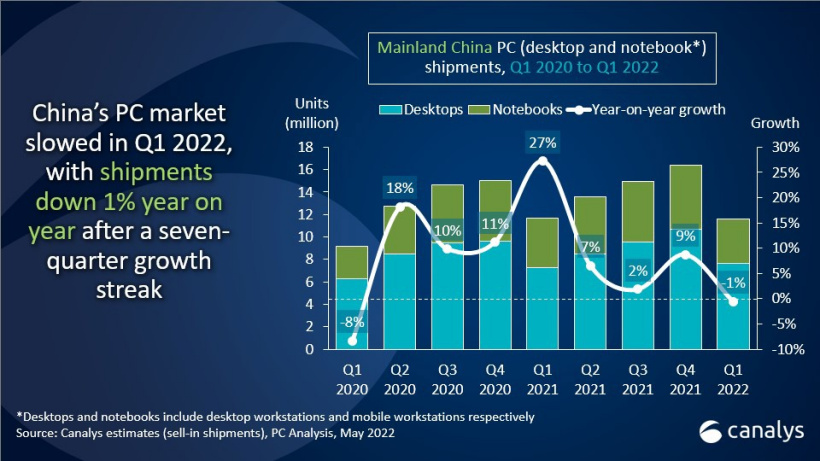

After a seven-quarter streak of net positive growth for the PC Market in Mainland China, Q1 2022 finally marks an end to the PC market growth in the region.

In Q1 2022, PC shipments in the country fell by 1% QoQ to 11.7 million units. Among these units, desktop PC shipments fell by 11% to 3.9 million units, while notebook laptop shipments continue to rise by 6% to 7.7 million units.

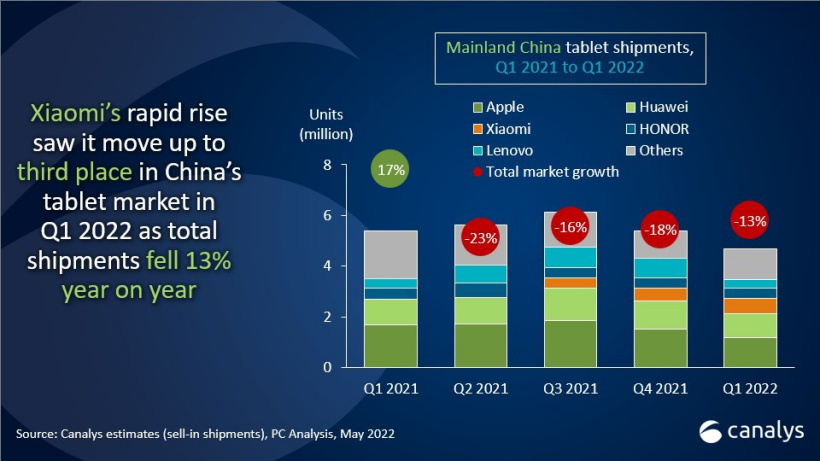

As for the tablet shipments in the region, shipments have continued to trend downward by 11%, to a new low of 4.7 million units. The main reason for this downward trajectory is the demand for tablets in both the general and enterprise markets.

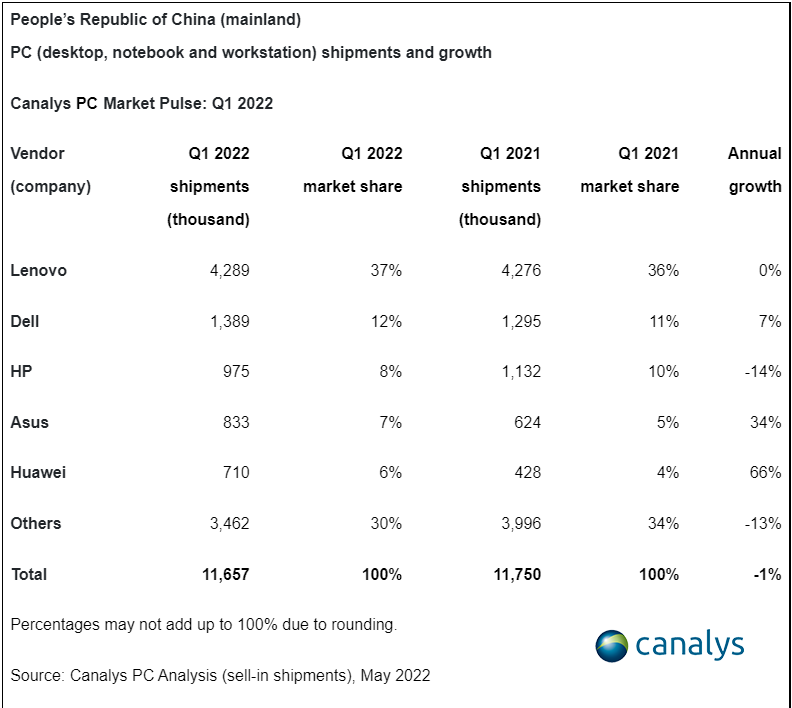

Coming to market share, the PC Market in China for Q1 2022 was led by Lenovo with over 37% market share at 4.289 million units, then Dell in second with 12% market share. Coming in at third and fourth are HP and Asus respectively, while Huawei rounds out the Top 5 with 0.71 million PC shipments.

Huawei saw the biggest sales growth YoY with 66% positive net growth. The brand’s presence had grown from 428 thousand shipments in Q1 2021 to 710 thousand shipments in the region.

On the Chinese tablet market front, Apple is on the top with 1.2 million shipments amounting to 26% of the region’s market share, but Huawei comes in at a close second with 20% market share. Rounding out the top 5 are Xiaomi with 13% in third place, HONOR with 9% in fourth, and Lenovo with 7% in fifth.

In the report, Emma Xu, an analyst at Canalys, said: “While the first quarter of 2022 remained relatively strong, China’s PC industry faces further challenges on both the supply and demand sides as the impact of the country’s COVID-19 lockdown intensifies.”

“The supply shortage of key components such as SoCs has persisted. By the first quarter, production and logistics conditions deteriorated mainly due to the lockdown of key cities such as Shanghai and Kunshan. At the same time, business and consumer activities were restricted amid a deteriorating economy, threatening domestic demand for PCs, weakening consumer spending and constraining business demand, especially from SMEs. This will challenge China’s PC makers for the rest of 2022. Public sector procurement will also be curtailed as the government plans to tighten budgets this year.”

Emma had also remarked: “But the education sector in China will likely remain a bright spot, as the goal of closing socioeconomic disparities and improving vocational education programs will drive investment that favours the technology market. Finally, the competitive landscape for Chinese PC sellers will be more favourable for local brands. The government currently has security concerns over the use of hardware and software developed by foreign entities. Suppliers such as Huawei and Tongfang will see unprecedented opportunities as core players in China’s ‘start-up’ industry, which is focused on developing domestic IT Innovation.”

RELATED:

- Lenovo Xiaoxin Pad 2022 launched with 10.6-inch display, Snapdragon 680

- Lenovo launches new powerful and Compact gaming laptops under the Legion 7 series

- Huawei is No Longer in Partnership with Leica

- Xiaomi Black Shark 5 and 5 Pro Coming to the Global Market on June 8th

(Via)