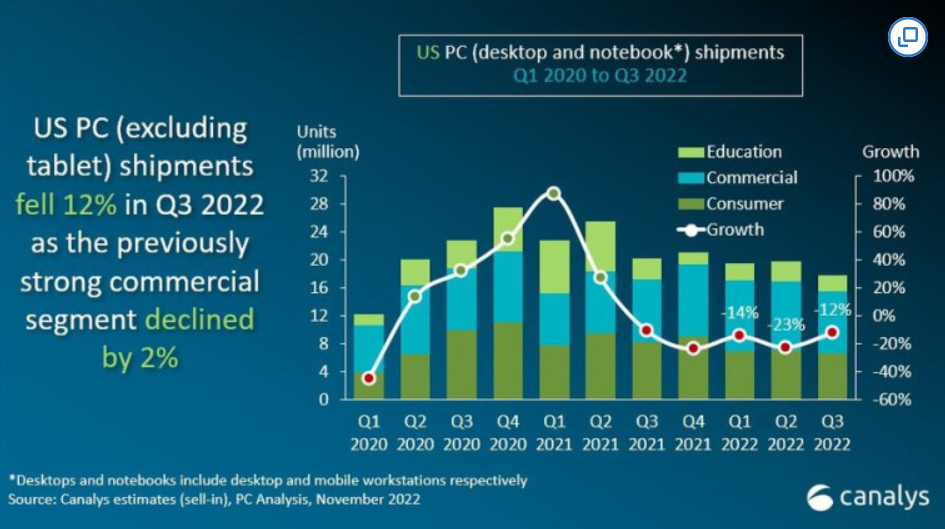

Canalys has published its report for the PC shipment in the US market during Q3 of 2022. The report claims that the PC shipments in the market fell sharply by 12.1% in the third quarter over year-on-year growth. The report further reveals that laptops, in particular, have been around a 12% decline in the market and the desktop market, on the other hand, has seen a small 1% rise in the number of shipments. Dell, HP, Apple, Lenovo and Acer were among the top manufacturers.

Surprisingly, only Apple and Acer have witnessed some shipment growth. The remaining brands on the list have all seen a significant drop in their market share. More conservative business expenditures, along with weaker demand from the consumer and education sectors, were the main causes of the significant decline in laptop shipment volume. Although the consumer and education sectors are two of the product’s biggest clients, their demand in the third quarter was not actually sufficient.

Even though the third quarter was extremely difficult for PC suppliers, the fourth quarter’s prospects aren’t any better. The American holiday season should boost sales a little, but generally, Canalys predicts that the market will continue to decline. People are reducing back on their purchases of technology devices as a result of rising prices. The claims seem to be a little disappointing for the manufacturers present in the US markets.

According to the analyst, things will start to improve in 2023. It predicts that demand from the educational sector will begin to slowly increase in the following year, with the bulk of equipment upgrades taking place in 2024. There’s a long way to go until that. From a macroeconomic standpoint, the Federal Reserve is continuing to raise interest rates, which could result in additional job losses and increase loan costs, further reducing disposable income. The length of the recovery period will determine when consumer demand for PCs will start to increase.

According to Brian Lynch, a Canalys Research Analyst, “the U.S. PC market was already in a protracted phase of recession as both consumer and educational demand suffered with inflation and saturation.” The business sector, which was once robust, has now started to dwindle and posted its first year-over-year loss in 2022.

Related

- Heliconia Spyware Hitting Chrome, Firefox and Microsoft Defender; Google Warns

- Zebronics Zeb-sound Bomb X1 3-In-1 Audio Device With Tws Earphone, Speaker, Torch Launched in India

- Tata reportedly in talks to buy Wistron’s iPhone plant in India