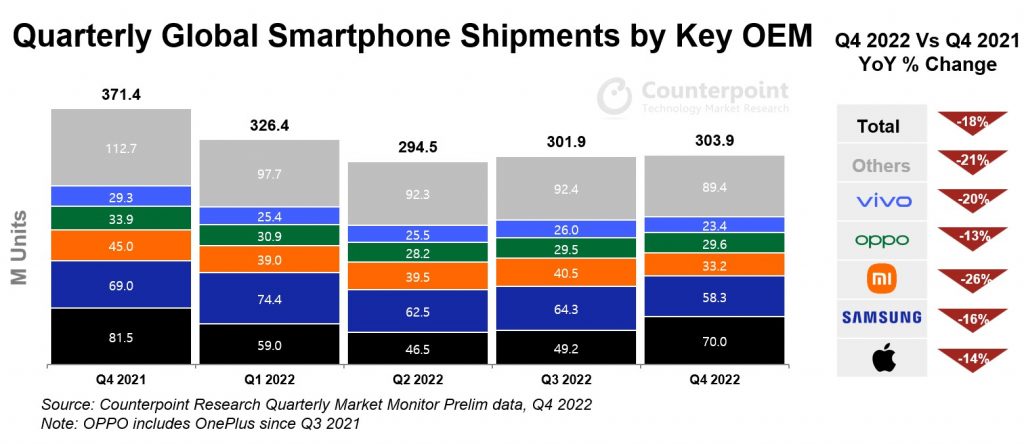

The Q4 2022 smartphone market faced a sharp decline, with shipments dropping 18% YoY (Year on Year) to the lowest level since 2013, despite a 1% QoQ (Quarter to Quarter) growth to 303.9 million units. Full-year 2022 shipments also dipped to 1.2 billion units, the lowest number since 2013.

Counterpoint’s Senior Analyst Harmeet Singh Walia noted that various factors such as the war in Ukraine, inflation, economic uncertainty, and macroeconomic challenges weakened consumer sentiment. This, in turn, decreased the frequency of smartphone purchases, leading to double-digit decreases in shipments for the top smartphone manufacturers, impacted by the cost-of-living crisis, labor market shortage, and declining consumer purchasing power. Consequently, smartphone revenue and operating profit saw a dip, although not as severe as the decline in shipments. In 2022, Apple sold a total of 224.7 million units, with Q4 being the biggest quarter for the company. However, Samsung sold a total of 259.5 million units, still remaining at the top for yearly smartphone shipments globally.

According to Counterpoint’s Market Monitor service, the overall average selling price rose 5% YoY in 2022 due to an increased mix of premium phone offerings from major OEMs. While there was a 9% decrease in revenue, annual smartphone revenues reached $409 billion, the lowest since 2017. Apple was only one of the top five smartphone OEMs to see growth. Research Director Jeff Fieldhack praised Apple’s performance, since the company outperformed a struggling market in terms of shipment, revenue, and operating profit growth. In 2022, Apple achieved its highest-ever shares of 18%, 48%, and 85% in these metrics, respectively. This was attributed to the proficient management of production issues and strong iPhone Pro series sales.

Additionally, premium devices, favored by well-informed smartphone users, saw less impact from economic and geopolitical uncertainties. Research Director Tarun Pathak also highlighted the premiumization trend driven by Samsung with its foldable smartphones. Samsung was the only top five OEM besides Apple to see a 1% growth in revenue, despite a 5% shipment decline and 1% operating profit decrease, in 2022. Samsung outperformed market projections, resulting in a slight increase in its operating profit share to 12% in 2022.

Chinese smartphone giants, including Xiaomi, OPPO, and Vivo, faced significant challenges due to domestic lockdowns and global economic and geopolitical difficulties, resulting in more than 20% decline in shipments and double-digit declines in revenue and operating profit. They have yet to make a significant impact in the premium market.

The market is expected to remain under pressure in the first half of 2023 before recovery sets in and market trends start stabilizing.

RELATED:

- Made in India TV Shipments Record 33 Percent YoY Growth In Q3, 2022: Counterpoint

- Smartphone Market Saw the Biggest Fall in Holiday Quarter in 2022

- Apple Hits a New Milestone, Reaches 2 Billion Active Devices Worldwide

(Source)