Last year, Apple announced its buy now, pay later service called Apple Pay Later following the popularity of services like Affirm, Afterpay, and Klarna, among others in the US.

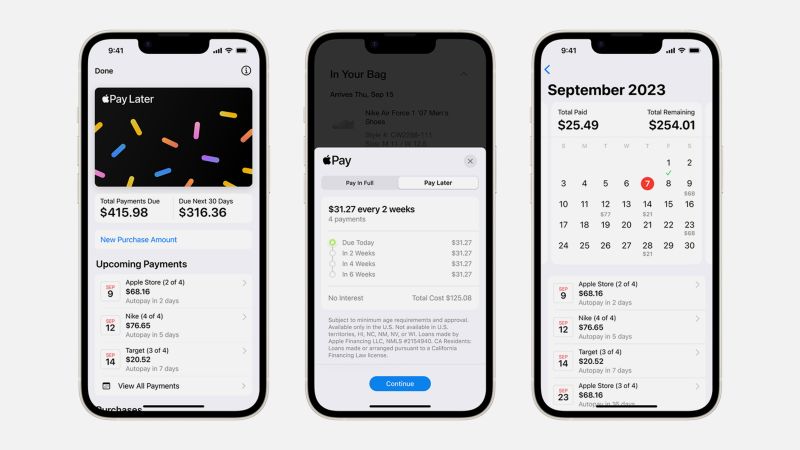

Now, the company has finally launched the Apple Pay Later service in the United States, which will allow users to split the payment into four installments over the course of six weeks.

With this new financing service, the Cupertino-based technology giant is promising a seamless and secure way to split the cost of a purchase without paying any interest on it. The user will be able to apply for Apple Pay Later loans of $50 to $1,000 for online and in-app purchases on the iPhone or iPad through Apple Pay.

Commenting about this, Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said, “Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions.”

Currently, the service will be available only to randomly selected users who will get early access to a prerelease version. The company adds that it is planning to offer this feature to all eligible users in the coming months.

RELATED:

- Apple CEO Tim Cook meets China’s Li Qiang to show lasting commitment to the Chinese market

- Apple is Rolling Out iOS 16.4 to iPhones & iPads, New Emoji, Features & More

- Apple Car to Feature Components from iPhone 3D Sensor Supplier

- Apple iPhone 15 lineup with eSIM-only version to launch in more countries

- Apple Autonomous Vehicle Program Grows to Over 200 Drivers with One Minor Collision