Amidst shifting market dynamics that have seen prominent Chinese brands like OnePlus and Realme strategically withdraw from the TV industry, Super Plastronics Pvt. Ltd. (SPPL), based in Noida, continues to hold a significant presence in the Indian market. SPPL is known to hold a wide number of licensed brands, including Thomson, Kodak, Blaupunkt, Westinghouse, and White-Westinghouse (Electrolux’s trademark).

In a conversation with Mrs. Pallavi Singh Marwah, Vice President of SPPL, we delve into the strategic positioning of these brands, especially in a declining Indian TV market this year. SPPL maintains ambitious revenue targets, aiming for 700–800 crores in the current financial year (2023–24). Mrs. Marwah offers insights into SPPL’s journey within the consumer electronics industry.

1. How do Thomson, Kodak, Blaupunkt and Westinghouse brands under SPPL compete and collaborate? Are they sold both online and offline?

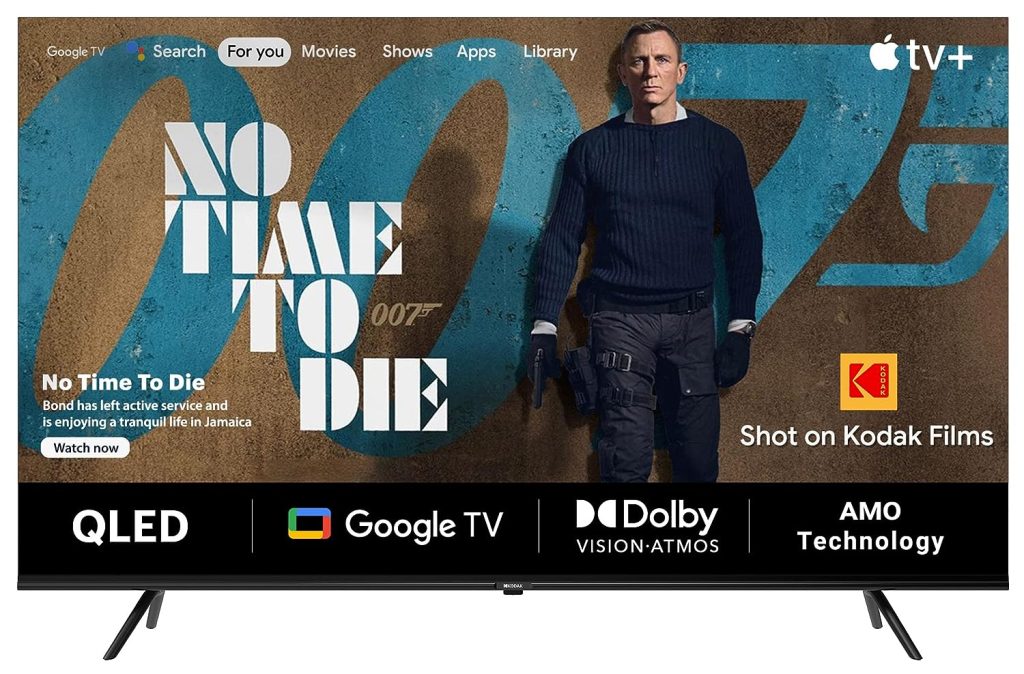

Each brand under our umbrella is strategically positioned to cater to distinct customer segments. Thomson, for instance, is an online-exclusive brand available solely on Flipkart, while Westinghouse is exclusively sold on Amazon. In contrast, Kodak is accessible on both online platforms and through offline retail stores, dealers, and distributors. These brands are priced in accordance with their target audiences, and our range of televisions and products is designed with each brand’s long-term strategy in mind.

Blaupunkt as a brand has been present in India through its audio licensees for almost 25-30 years. It is also a brand that the middle age resonates with since high-end audio systems in cars were by Blaupunkt. It is a brand that we position as a premium one and has better audio quality since that is the brand’s forte.

2. Could you elaborate on software differences among Thomson, Kodak, Blaupunkt, and Westinghouse TVs and their unique features for diverse user preferences?

Since all these televisions are based on the Android platform, there’s limited flexibility to make extensive changes to the software. However, differentiation occurs through various introduced variants. For instance, there are distinctions like an Android-based TV or a Google TV that influence the user experience. Furthermore, differences exist in backlight technology, including Full HD, Ultra-HD, 4K, and QLED variants, which enhance the customer’s viewing experience. These factors help cater to diverse customer preferences and set each brand apart.

3. What drove the decision to increase manufacturing capacity to 2 million units annually, and how does the new greenfield manufacturing facility at Hapur contribute to this expansion?

The decision to expand our manufacturing capacity was driven by the fact that our current manufacturing facility was consistently operating at or above its maximum production capacity. To meet the growing demand for our products, the new manufacturing facility in Hapur was established. This additional space not only allows us to keep up with the increasing production requirements but also opens the door for us to potentially start manufacturing other product categories within our own facilities, which can further enhance our overall production capabilities and flexibility.

4. With SPPL’s success in FY 2022–23, what are the key factors that have contributed to the company’s growth in the smart TV market?

The company’s growth in the smart TV market in the past fiscal year can be attributed to a strong focus on backward integration. We’ve taken significant steps, such as setting up Surface Mount Technology (SMT) machines in-house. This move aligns with our ongoing effort to bring outsourced jobs back within the company, gradually progressing towards the goal of establishing a fully self-sustained, “Made in India” manufacturing unit.

5. Can you share insights into the current state of the Indian TV market and the challenges or trends that SPPL is navigating in this industry?

The Indian TV market is currently experiencing a decline this year, which presents our most significant challenge. We are striving to maintain our price points despite the increasing inflation, even though this impacts our profit margins. It’s worth noting that this year is seen as a recovery year for the industry as a whole, and we are working to navigate through these challenges and emerge successfully.

6. Could you elaborate on SPPL’s revenue targets for 2023–24 and beyond, along with their strategies and desired market share by 2024?

In the current financial year (2023-24), our target is to achieve a gross revenue of approximately 700-800 crores, with an even higher goal set for the following year, anticipating a 15% increase. To reach these targets, we’ve developed a strategic roadmap that includes expanding into additional product categories that can be manufactured in India.

Specifically, regarding televisions, our aim is to secure a 10-12% market share by the end of 2024. These targets are part of our broader growth strategy as we continue to evolve and expand within the Indian consumer electronics market.

7. With Xiaomi leading the smart TV market, what unique value does SPPL bring to consumers in India?

While Xiaomi’s TVs are built around their PatchWall platform, our televisions stand out by being entirely based on the Android/Google software. This distinction offers consumers a different user experience and access to the broader Android ecosystem, providing unique value in terms of software, apps, and integrations.

8. How is SPPL preparing for the festive sales season, especially with the ICC Men’s Cricket World Cup coinciding, and what expectations do you have in terms of sales during this period?

In preparation for the festive sales season, coinciding with the ICC Men’s Cricket World Cup, we’ve taken several measures. We’ve introduced a special-edition TV and washing machine to align with the spirit of the World Cup. Additionally, we’ve established a partnership with Hotstar, offering free 7-day trials to our consumers.

We anticipate a notable increase in sales during this period due to the World Cup’s popularity and the festive atmosphere. These initiatives and the excitement surrounding the event are expected to contribute to a positive sales outcome.

9. Beyond TVs, SPPL has introduced washing machines under the White-Westinghouse brand. Can you tell us more about your foray into home appliances and the market response?

We’ve extended our product offerings into home appliances with the introduction of washing machines under the White-Westinghouse brand. Currently, both brands, White-Westinghouse for appliances and Westinghouse for televisions have only one category each.

While it’s still early in our journey into the home appliance market, we are actively exploring opportunities to expand our product range and offerings within this segment. The market response has been positive, and we are committed to growing our presence in the home appliance sector as part of our overall brand expansion strategy.

We are also looking into refrigeration, air conditioner manufacturing, air coolers, and air purifying systems.

10. Considering the growing demand for environmentally friendly products, does SPPL have any sustainability initiatives or plans related to eco-friendly manufacturing or materials?

In response to the growing demand for environmentally friendly products, SPPL has taken concrete steps to promote sustainability. We’ve adopted sustainable packaging practises for our products and prioritize energy efficiency in their design, assisting consumers in conserving energy. Our commitment to eco-friendliness extends to our washing machines, which are engineered to use less water during a single wash compared to conventional models. Additionally, we actively foster environmentally responsible behaviors among our employees, emphasizing the importance of reducing, reusing, and recycling materials. Our dedication to creating a more sustainable and eco-friendly future is evident in both our products and everyday operations.

Here’s the Indian TV market’s current status:

In Q1 2023, the Indian TV market witnessed an 8 percent year-over-year decline, the first in six years. This was attributed to factors like rising inflation, supply chain disruptions, and the ongoing war in Ukraine. Conversely, in Q3 2023, the market rebounded with 33 percent year-over-year growth, driven by the festive season, increased disposable incomes, and the introduction of innovative TV models, as reported by Counterpoint Research.

Xiaomi currently leads the Indian TV market with a 23 percent market share, followed by Samsung in second place at 19 percent, and LG at 12 percent. Notably, SPPL brands such as Thomson, Kodak, and Blaupunkt rank among the top 10 players in the industry.

The Indian TV market is poised for an exciting and challenging journey in the coming months, with a projected shipment of 16 million units in 2023. It is expected to remain dynamic, offering both opportunities and hurdles for manufacturers and consumers alike.

RELATED:

- Blaupunkt launches new 4K QLED TVs in India in 43″ & 55″ variants

- Westinghouse WH65GTX50 Quantum Series 65-inch 4K Google TV Rose Gold color unveiled in India

- Kodak to launch 43-inch Matrix TV variant with 4K Ultra HD QLED display in India

- Thomson FA Series And Oath Pro Max 4K TVs Launched In India

- Redmi Smart Fire TV 4K 43 review: Elevating entertainment with Fire OS, impressive display, and immersive audio

- Best Amazon Echo in 2023: Echo Show, Studio & More