Chinese chipmaker Semiconductor Manufacturing International Corporation (SMIC) has secured the number three position in the global foundry market, based on sales figures for the first quarter of 2024. The achievement comes despite ongoing trade restrictions imposed by the US government.

According to a report by tech research firm Counterpoint, SMIC captured 6% of global chip foundry revenue in Q1. That places them behind industry leader Taiwan Semiconductor Manufacturing Company (TSMC) with a dominant 62% market share, and South Korea’s Samsung Electronics at 13%.

SMIC’s growth can be attributed to its strategic shift towards focusing on its domestic client base like Huawei. The company’s financial results show that for the first quarter, 82% of its $1.75 billion revenue came from mainland clients. That’s a steady rise compared to 75.5% in Q1 2023 and 80% in Q4 2023.

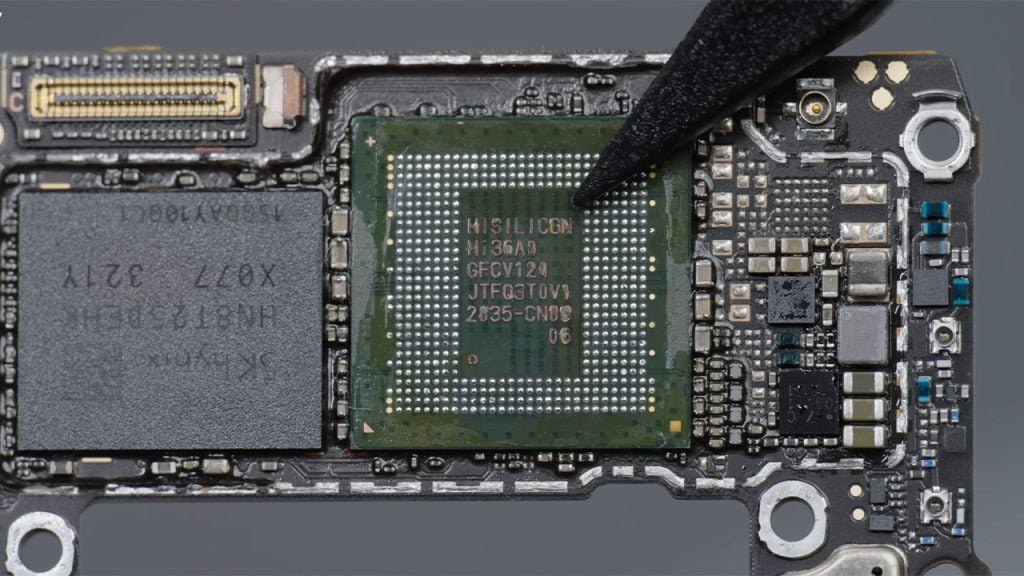

The growth for SMIC isn’t without any hurdles. A teardown of Huawei’s Mate 60 Pro 5G smartphone last year revealed that the phone has an advanced Kirin 9000s processor allegedly manufactured by SMIC.

It sparked concerns in Washington, prompting calls for an investigation into how such a chip could be produced in China given existing US restrictions.

Both SMIC and Huawei have remained tight-lipped on the matter, while the processor itself became a symbol of China’s defiance against US sanctions on social media.

The broader foundry market, as reported by Counterpoint, experienced a 5% decline in revenue for Q1. This slowdown is attributed to a sluggish recovery in demand for non-AI semiconductors used in smartphones, IoT devices, and automotive applications.

On the other hand, the demand for AI chips continues to surge. Counterpoint analyst Adam Chang highlights a rise in capital expenditure by cloud service providers and enterprises, further solidifying the trend. This robust demand for AI chips is expected to extend through 2025, contrasting with the sluggishness in other sectors.

Nvidia, a leading player in the AI chip market, exemplifies this trend. Their latest financial report reveals a staggering 400% increase in revenue from the sale of graphics processing units (GPUs) to data centers in the quarter ending April 28th, 2024.

Related:

- Huawei’s HiSilicon ships 8 million Kirin SoCs in Q1 2024, surpasses Google in revenue

- Xiaomi Redmi Buds 6 Active with 14.2mm dynamic driver, Bluetooth 5.4 goes on sale in China for $14

- Boat Airdopes 800 TWS earbuds powered by Dolby Audio are now available at a special launch price

- Realme Buds Wireless 3 Neo With Google Fast Pair, 32-Hour Battery Life Launched In India

- OnePlus Nord CE 4 Review: Yet Another Winner

- HUAWEI MateBook X Pro 2024 Review: New Era of a MateBook

- Redmi 13 4G design, price, and key details leaked

- Sonos Officially Unveils the Ace Headphones with Active Noise Cancelling, 40mm Drivers, Starting at $449

(Via)