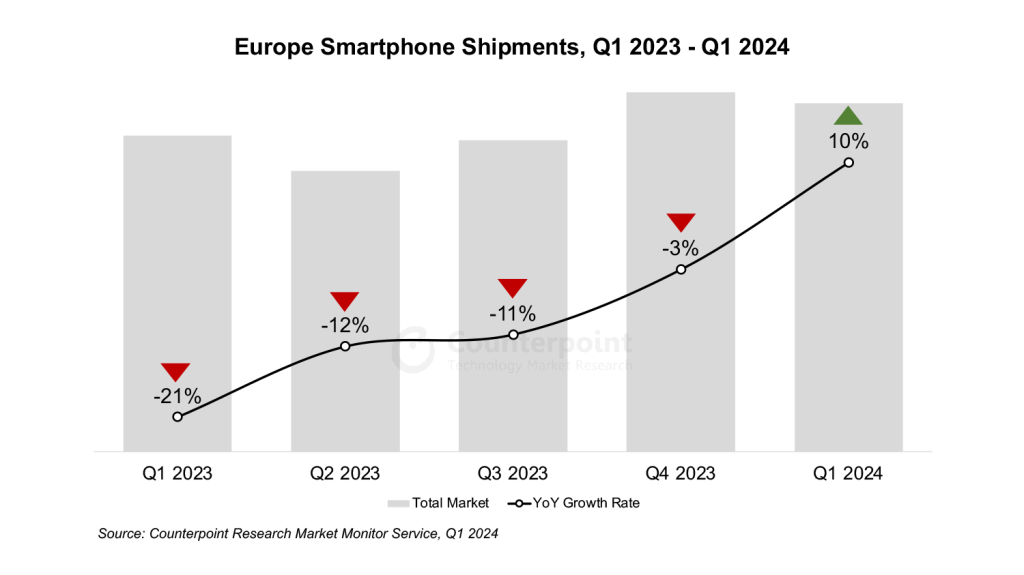

The European smartphone market showed encouraging signs of life in the first quarter of 2024, shaking off a prolonged slump with a 10% year-on-year increase in shipments, according to Counterpoint Research. This marks the first positive growth since the third quarter of 2021, suggesting a potential turning point for the region.

Top Brands Drive Market Growth Amid Recovery

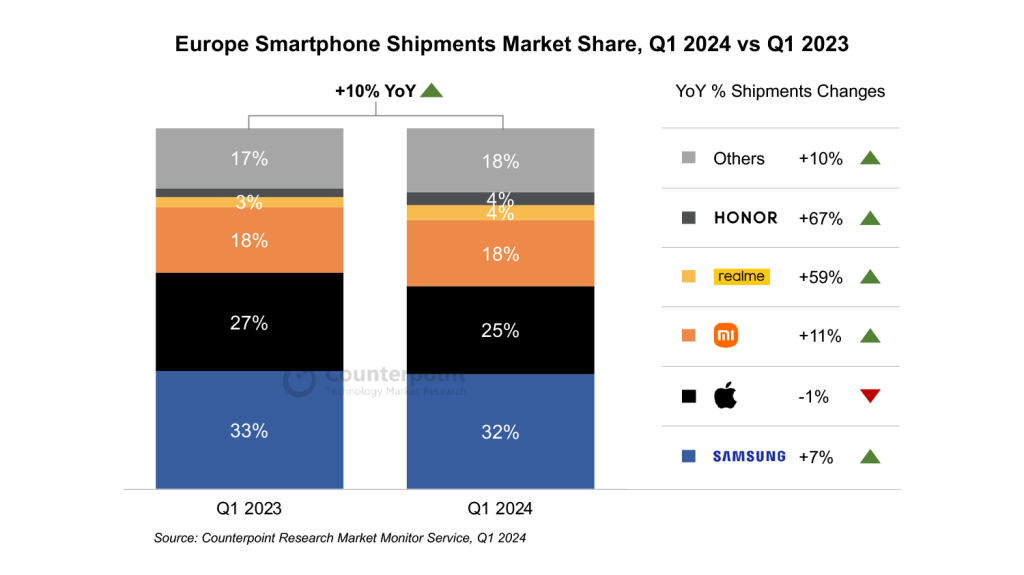

Tech giants Samsung, Apple, and Xiaomi maintained their dominance, but the story within the top three is one of contrasting fortunes. Samsung, with a 7% shipment increase, emerged as the market leader with a 32% share. This marks a welcome turnaround after a period of decline, likely fueled by the success of their AI-powered Galaxy S24 series. The launch of the new A35 and A55 models towards the end of Q1 could further bolster their position in the coming months.

Apple, on the other hand, experienced a slight 1% dip in shipments despite holding a strong 25% market share. This can be attributed to the natural sales cycle of iPhones, with iPhone 15 sales tapering off due to seasonality. The absence of a new iPhone SE model in 2024 suggests further declines until the highly anticipated iPhone 16 launch later this year.

Xiaomi displayed consistent growth with an 11% shipment increase, solidifying its position as the third-largest player with an 18% share. Their success story was particularly prominent in Western Europe, especially in Spain and Italy, driven by the well-received Redmi Note 13 series. However, Xiaomi faced challenges in Central and Eastern Europe, where rising competition from Samsung and Tecno pushed their market share to its lowest since early 2022.

Beyond the established players, the report highlights some interesting trends. Realme saw a significant 59% growth, fueled by strong performance in Western Europe and a rebound in key markets like Italy and Spain. Their affordable C series remained bestsellers, with the new Realme 12 finding traction as well.

Another notable player is Honor, which achieved a remarkable 67% growth, surpassing Oppo to capture the coveted fifth position in Europe for the first time. This impressive feat was driven by their success in Western Europe, where shipments doubled year-on-year thanks to exciting devices like the Magic V2, Magic 6, and Honor 90.

While the recovery is promising, Counterpoint Research analyst Jan Stryjak cautions against excessive optimism. The 2023 slump was significant, and the European market is still far from pre-pandemic levels. Growth is expected to continue at a modest pace throughout the rest of 2024, but catching up to pre-pandemic numbers will likely take longer.

RELATED:

- Samsung to outsource 67 million smartphones from Chinese ODMs in 2024

- Tipster shows Galaxy Z Fold 6’s external screen with symmetrical bezels

- 6 Amazing One UI 6.1 AI Features You Can’t Ignore

- Creality Falcon2 Pro 60W Laser Engraver: Exclusive Limited-Time Deal

- Xiaomi Router BE5000: Affordable WiFi 7 for High-Speed Connectivity now at GeekWills

(Source)