The rise of Android phones has no doubt have some effects on Apple‘s iPhone sales globally. Just last week Wednesday, the US company announced that it is slashing its revenue forecast for the first fiscal quarter (2018Q4) to $84 billion, down from the previous forecast of between $89 billion and $93 billion. The company also adjusted its gross sales margin to 38%, compared to the previous forecast of 38% to 38.5%. The announcement saw Apple’s stock price plummeting by 10% the following day. Apple’s CEO Tim Cook n an open letter to investors marshalled out several factors that were responsible for the company’s revenue to fall short of expectations. Some of the reasons adduced include a lower-than-expected iPhone sales, poor performance in the Chinese market, and a stronger US dollar.

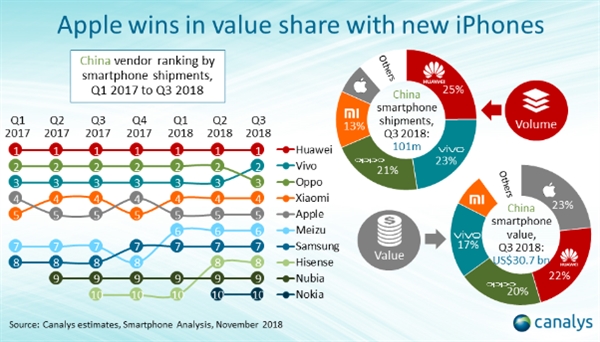

Despite the revelation of the poor performance in the Chinese market, a fresh report by research firm Canalys shows that Apple’s performance in the Chinese market in the previous quarter (2018Q3) was good, at least in terms of revenue. The report put the gross revenue of the Chinese smartphone market was 30.7 billion US dollars, and just five brands enjoy the larger share of this bounty, namely Apple, Huawei, OPPO, Vivo and Xiaomi. Among the lot, Apple and Huawei grabbed the largest revenues, with Apple’s revenue accounting for 23% of the total revenue while Huawei had a 22% share. It should be noted that Apple’s impressive performance is mainly due to the release of iPhone XS, iPhone XS Max at the end of the quarter, and the popularity of older models such as iPhone X and iPhone 8. While Huawei is benefiting from the hot sale of P20 and P20 Pro and the strong performance of its Honor branded mobile phones.

Read Also: AnTuTu’s top 10 Android phones with best performance for December 2018 released

In terms of shipments, Huawei topped the market with an estimate of 101 million shipped units, representing 25% market share. This is closely followed by Vivo with a 23% market share, Oppo with 21% market share and Xiaomi with a 13% market share. Apple came in at the fifth spot but higher revenue than the rest. The report by Canalys also shows that Samsung came in at the seventh spot in China despite maintaining its lead in the global market. Finally, Nokia also broke into the top 10 phone makers in China in terms of market share in Q3 2018. As it stands, Apple, Samsung and Nokia are the only three foreign mobile phone vendor with substantial influence in China. This again put a spotlight on the growth of Chinese domestic brands.

(via)