True Wireless earbuds are rapidly turning into a trend these days and it is spreading like wildfire. At the moment, most of the top Chinese brands like Xiaomi, Meizu, Huawei and Vivo, Razer, 360 have at least a TWS earbud under their names. OPPO will join the trend soon but the market is largely dominated by Apple, so says the latest market data for Q3 2019 released by Counterpoint Research.

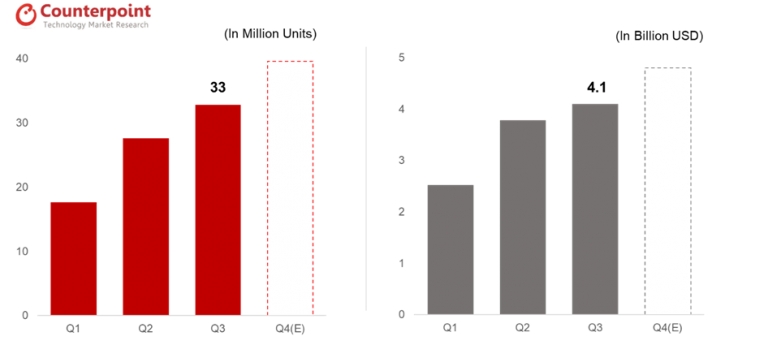

The data shows that the global market size for true wireless headsets reached 33 million units raking in USD 4.1 billion in revenue in Q3 2019. This figure represents a 22% QoQ growth, according to the findings of Counterpoint Research’s Hearables Market Tracker. The US accounted for the largest chunk of the market at 31%, with over 10 million units sold. This is the first time in a single quarter such massive sales would be recorded and is another testament to the growth of the segment. The world’s second-largest market China also saw some improvements with a 44% QoQ growth in Q3.

EDITOR’S PICK: First Samples from the 108MP Mi Mix Alpha is here & we are not impressed!

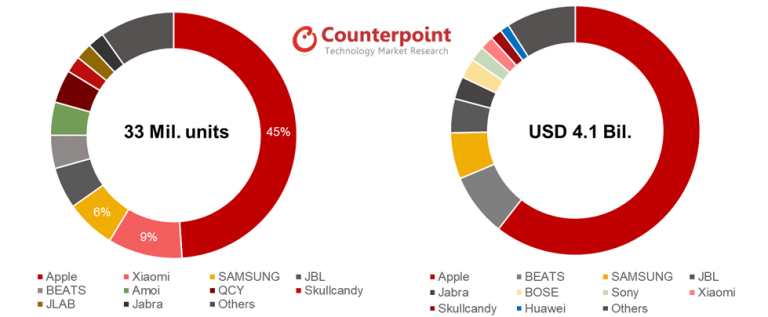

In terms of specific brands, Apple maintained its supersonic leadership of the market even though market shares fell from 53% in the previous quarter to 45%. Apple continued its leadership by growing sales of the second-generation AirPods. Xiaomi beat Samsung to clinch the second spot. Xiaomi’s rise from the fourth place is attributed to a rise in sales volume mainly from the Chinese market where the Redmi Airdots has seen massive patronage as a great budget product with a price point around $20. Samsung slipped to third place with a 6% share.

JBL and Beats completed the top 5 hearables brands, ranked fourth and fifth, respectively. The market share of their new premium models, such as the JBL TUNE 120 released in July, and Beats Powerbeats Pro in May, have increased significantly, boosted by favorable market reviews of sound quality and design by consumers. Amoi, a new Chinese brand, is also striking. Its F9 product has gained popularity, mainly from the Chinese domestic market. Amoi attained the global sixth position, surpassing QCY, the former leader in the low-end market.

Since new powerful models, such as Apple’s AirPods Pro, Amazon Echo Buds, Microsoft Surface Earbuds, and Jabra Elite 75t have recently been released, consumer interest is increasing. Given the recent growth momentum and the effect of year-end promotions, such as Singles’ Day, Black Friday and Christmas, the Q4 market is expected to show further high growth. Thus, Counterpoint Research expects the annual market to reach 120 million units in 2019.

UP NEXT: Samsung takes back lead in the Smartphone Display Market with record-high AMOLED Sales

(source)