Smartphones’ importance in 2020 meant chipset giants like Qualcomm, MediaTek witnessed growth towards the second half of the year. Among this, the latter anticipates that it will ship 500 million 5G chipsets next year. Now, a Counterpoint report says that more than 100 million smartphones were sold in Q3 2020 with MediaTek getting the most share.

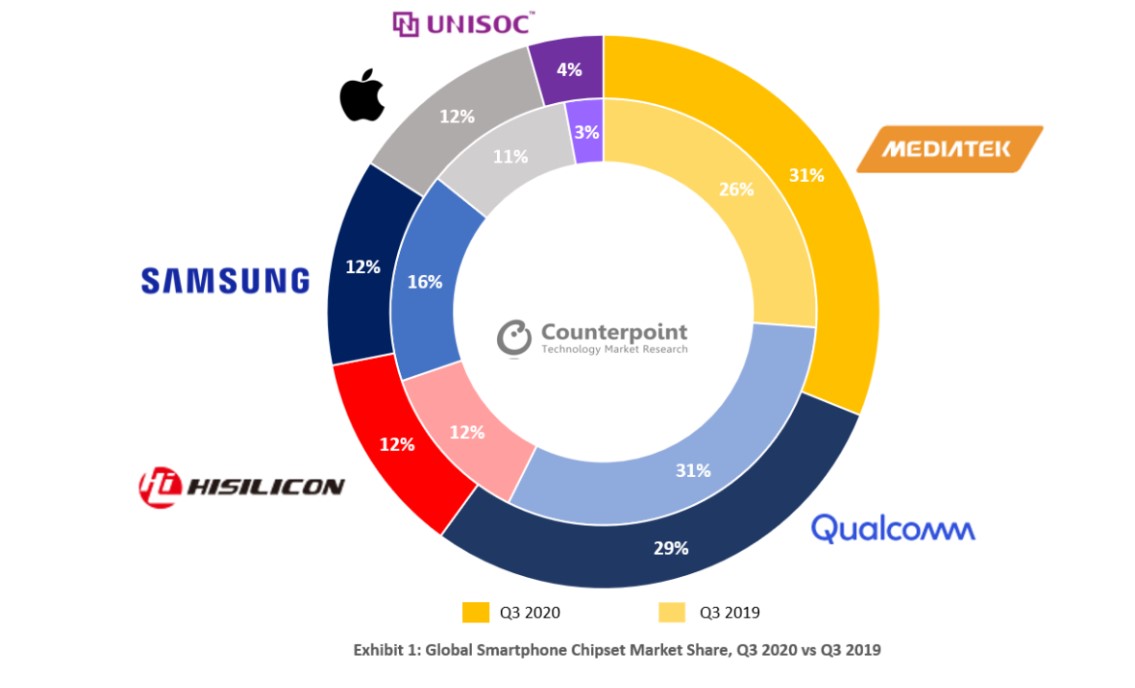

According to the report, MediaTek grabs 31% of the Global Smartphone chipset market share in Q3 2020. Although it didn’t top the 5G category, it overtakes Qualcomm by 2% and also clocks a 5% YoY growth. With this, it gets the crown of biggest chipset vendor for the first time.

Previously, a report on the Application Processor market revealed that MediaTek was trailing behind Qualcomm at a 26% share in Q2. That said, it has gained a lot of grounds on Smartphone chipsets. And it has reportedly happened due to the sale of $100-$250 phones in India and China.

Anyway, the rest of the share is occupied by giants like Samsung, Huawei’s HiSilicon, Apple, and UNISOC. Among this, Apple, HiSilicon, Samsung’s share sits at 12% each while UNISOC gets 4% of the market share. Also, if you notice closely, Huawei’s HiSilicon remains unchanged from 2019 despite showing a declining trend due to the US ban.

Coming back, the report says Qualcomm was the biggest 5G vendor for Q3. Although only 17% of the devices sold in Q3 were 5G, the company gets a resounding share of 39%. With Smartphone production reviving in Q3, and other equipment sales jumping by 30%, companies have managed to outsell themselves compared to previous quarters.

Research Director Dale Gai says MediaTek has raised the bars with its mid-range chipsets and has managed to power 3x more Xiaomi phones compared to 2019. This, along with good performance in LATAM(Latin America) and MEA(Middle East, Africa), leveraging the ban on Huawei meant it’s progress steered faster.

Just like Research Analyst Ankit Malhotra says, MediaTek also managed to power the World’s cheapest 5G-smartphone realme V3, and Europe’s cheapest 5G-device realme 7 5G. However, it still has a lot of ground to capture in the area where its rival Qualcomm has been dominating. Despite the pressure from Apple’s 5G iPhone 12 series and MediaTek, Report says Qualcomm has the potential to get back in Q4.

UP NEXT: Realme has launched MediaTek powered 5G smartphones in Taiwan