The China Smartphone Market is undergoing changes ever since HUAWEI was banned by the US. At first, the telecom giant’s market share grew due to increased patriotism. However, with no access to crucial suppliers, the company’s share began to drop gradually. Additionally, in order to survive, it had to sell its sub-brand HONOR. Now, the market is helmed by OPPO and vivo but the fastest-growing brand is none other than realme.

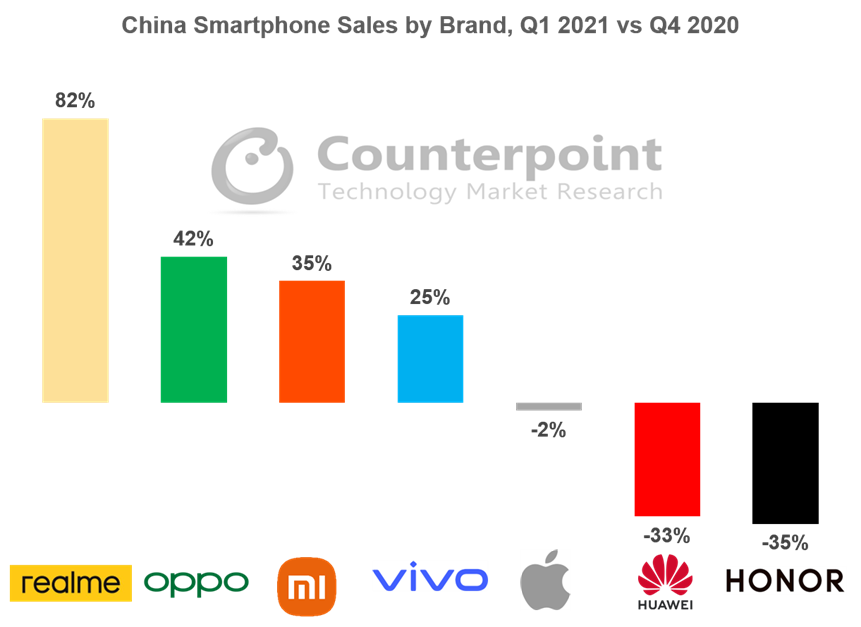

According to Counterpoint Research, the China Smartphone Market grew 5% in Q1 2021. However, despite that, the sales of current leading smartphones grew double-digit QoQ due to the fall of HUAWEI and HONOR.

Above all, realme, which only ranked 7th, was the fastest-growing brand in the first quarter of 2021. The company’s sales incremented by a whopping 451% YoY and 82% QoQ.

Senior Analyst Yang Wang of Counterpoint says that realme’s success lies in its effective marketing strategy. The brand’s products are targeted at budget-conscious Gen Z customers, who prefer premium features for social media, photography, and gaming. A better understanding of its customers helped realme to become the fastest brand to hit 50 million shipments last year.

As per Counterpoint, realme’s best-selling phones in China in the last 12 months were its Q2, V3, V5, and V15 series of devices. These handsets are priced between $150 and $250. Due to the success of these as well as similar 5G-ready smartphones, the ASP of the China Smartphone Market could drop below $200 or even $150 in the coming quarters.

Mr. Wang notes that mid and budget segments will be a ‘key battleground’ in the next few quarters. Since realme already sells plenty of devices in this price segment ($100-$500), it has a competitive edge.

As far as top players are concerned, offline-centric OPPO and vivo are battling to claim the crown. Whereas. Online-centric Xiaomi ranks third. Lastly, the performance of all the brands in the rest of 2021 will depend on their supply chain management as the global semiconductor shortage continues to worsen.

RELATED:

- Realme Buds Wireless 2 launched in Malaysia, with ANC and low latency gaming mode

- Realme Pocket Bluetooth Speaker with 6-hour battery life launched for RM 79 ($19)

- Realme Watch 2 Pro launched in Malaysia, features GPS and 90 sports modes

- Realme Buds Wireless 2 Neo announced in Sri Lanka for 8,999 LKR (~$46)