Huawei endured a turbulent 2020 in Europe and the United States especially. The stringent sanction regime initiated by the US-led to similar restrictions across Europe, especially in the 5G segment, where the company had already established a seemingly unassailable lead. These moves significantly affected the company’s outlook, but recent research by Counterpoint Research has also shown that consumers in Europe may have also been hurt by the exit of the company, as mid-range 5G smartphones average prices from Europe reflected.

The European market did not have any mid-range 5G smartphones as of Q1 2020. Still, the scenario gradually changed so that, by the third quarter of 2020, 5G mid-rangers accounted for about 20% of the segment, and this has risen steeply to 50% of all smartphones sold in Europe at the end of the first quarter of 2021.

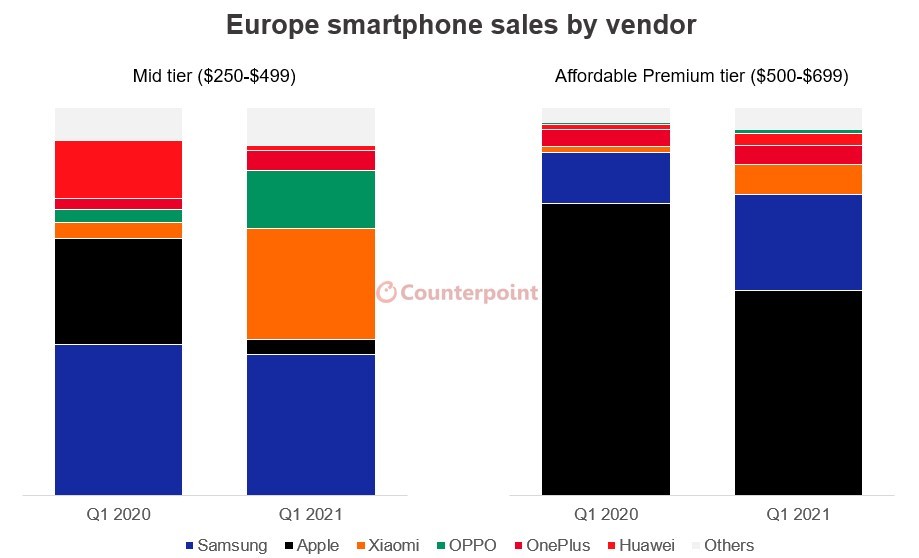

The price range considered by the researchers at Counterpoint Research was the $250-$500 range. Huawei enjoyed a great degree of prominence in the mid-range segment of Europe before the decline last year, with its market share virtually extinguished by Q1 2021. Of all the listed vendors, Xiaomi saw the biggest YoY growth in the mid-tier segment, obviously due to its robust offering and aggressive marketing.

Huawei’s loss also translated to growth for other Chinese brands like Oppo, who moved swiftly to bridge the gap resulting from Huawei’s exit. These brands have recorded massive improvements in their European operations. Xiaomi, Oppo, Vivo and other brands on the fringes of the 5G market in Europe are all pursuing robust strategies to break into the mid-range and premium segment of the 5G market in Europe with some flagship offerings.

However, Apple and Samsung remain the clear leaders across the 5G segments in Europe, although the Chinese contingent continues to pursue a share of the spoils in the highly lucrative market.

RELATED:

- Nokia C30 renders and specifications leaked

- Redmi Note 10T pricing and variant for India leak ahead of July 20 launch

- vivo Y72 5G entire specs leaked ahead of July 15 India launch

- OnePlus Nord 2 press renders reveal a single punch-hole display

(source)