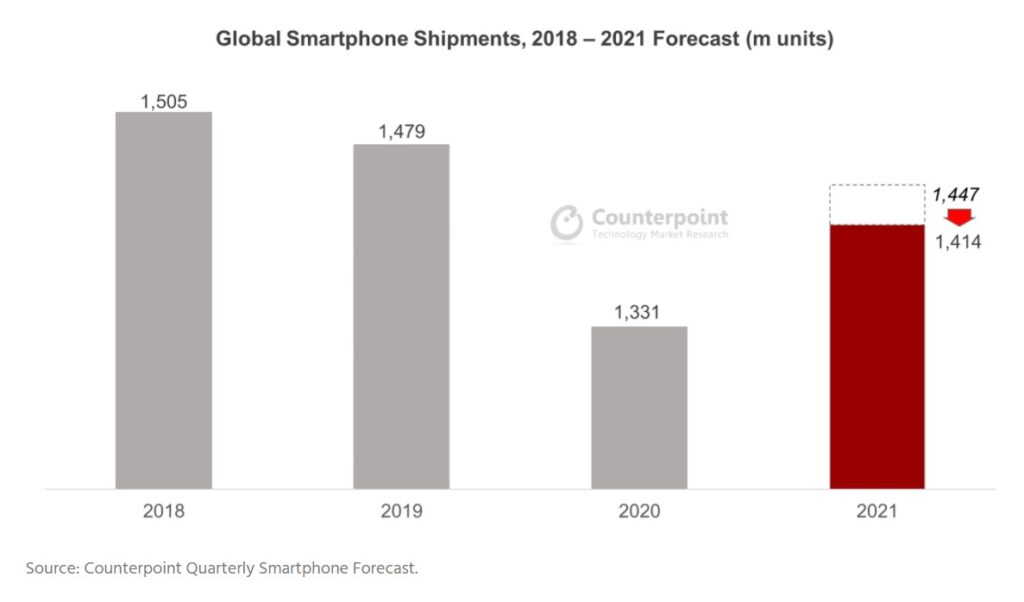

Counterpoint Research has dropped its smartphone shipments expectations for the second half of 2021 from its earlier prediction of 1.45bn to about 1.41bn units. This signals an annual growth of only 6%, down from the previously expected figure of 9%. The fresh figures are from the analysis firm’s latest Global Smartphone Quarterly Shipment Forecasts report.

This is due to multiple smartphone OEMs having received only 80% of their requested volumes on key components during Q2 2021, with some even claiming a figure of just 70%. The impact of the semiconductor shortage will also not be going away any time soon as the situation seems to be getting worse as we move through Q3 2021. Counterpoint Research believes 90% of the industry is affected and this has impacted the second half smartphone shipments forecast for 2021.

The smartphone industry was set for a strong rebound this year following the recovery from the COVID-19 situation that had hit the market hard in 2020. Smartphone vendors placed large component orders from the end of last year, and consumer demand from delayed replacement purchases had boosted the market in the first quarter. But as already stated, the semiconductor shortage resulted in a lot of unmet expectations.

It is worth mentioning here that semiconductor shortages have been plaguing the market since Q4 2020. But advanced planning and order placing along with the hoarding of certain components had ensured temporary growth, despite shortages in components like DDIs and PMICs.

Foundries have been running at max capacity for several quarters and components that were once being fully stored in warehouses are now bottoming, with new components not coming in as requested.

In the case of processors, one of the most crucial elements in smartphones, the shortages occurred due to low yield rates in newly established fab lines. This alone has caused quite a chain reaction with AP vendors like Qualcomm and Mediatek suffering because of their reliance on these foundries. They are now supplying fewer processors which is in turn affecting smartphone companies.

Tom Kang, Research Director at Counterpoint Research commented, “the semiconductor shortage seems to affect all brands in the ecosystems. Samsung, Oppo, Xiaomi have all been affected and we are lowering our forecasts. But Apple seems to be the most resilient and least affected by the AP shortage situation”.

RELATED: