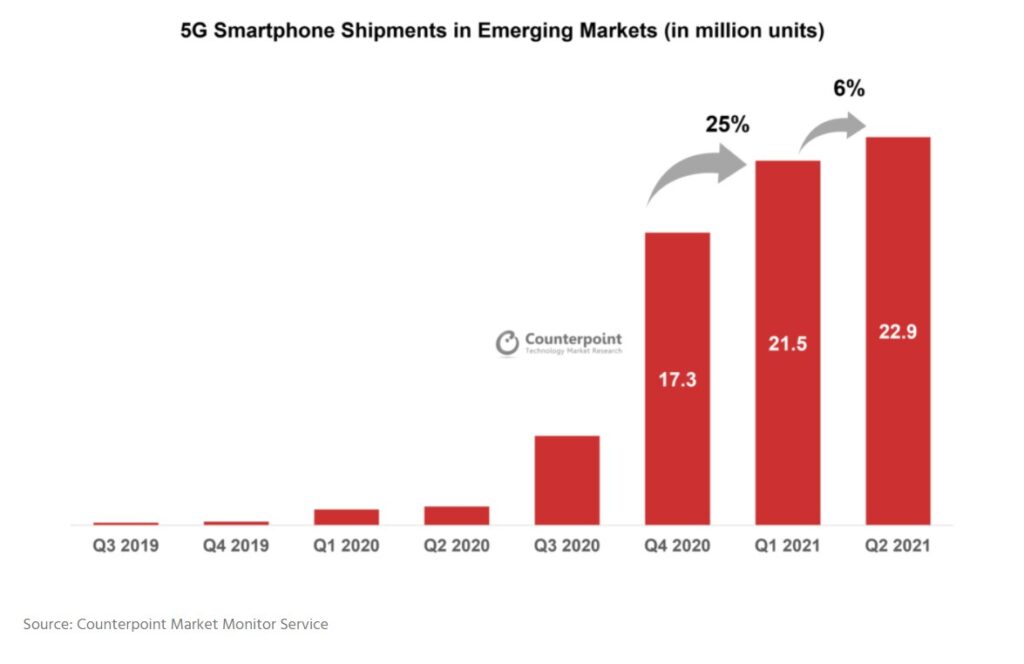

5G smartphone shipments in Q2 2021 rose 6.5% QoQ in emerging markets, even as the total shipments in such regions dropped by 5% in the same time frame, as per the latest data from Counterpoint Market Monitor Service.

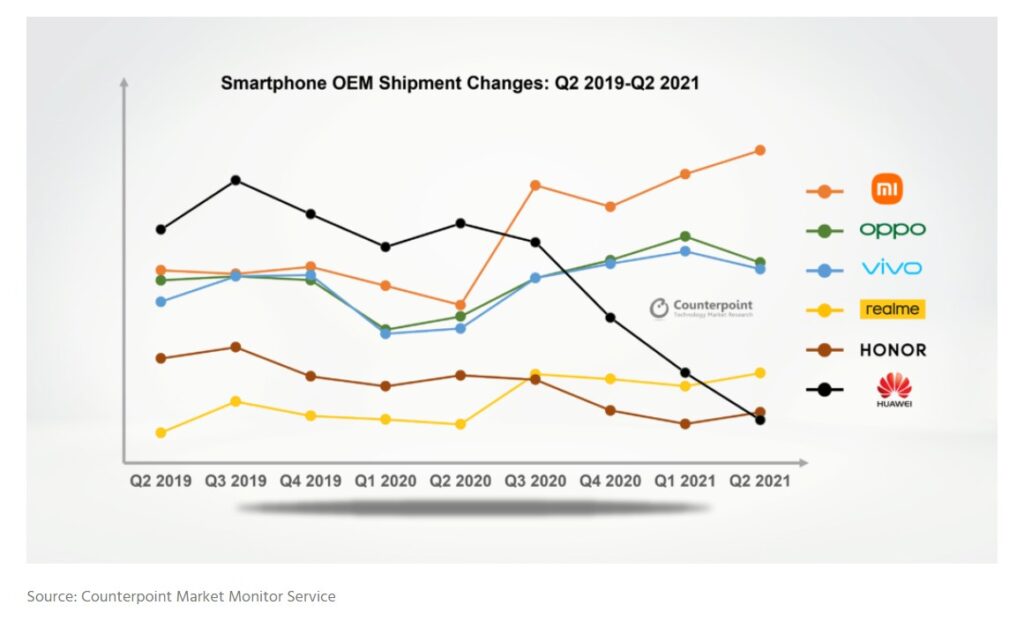

The enthusiasm generated by Apple‘s first 5G-capable device, the iPhone 12, as well as the introduction of 5G models in the budget segments by OEMs such as OPPO, Vivo, Xiaomi, and Realme, can be linked to the increase in 5G shipments. In addition, emerging economies, particularly Southeast Asia and the Middle East, are catching up in terms of 5G infrastructure, which is driving up demand for low-cost 5G phones (via: Counterpoint).

Increasing Share of 5G in Shipments

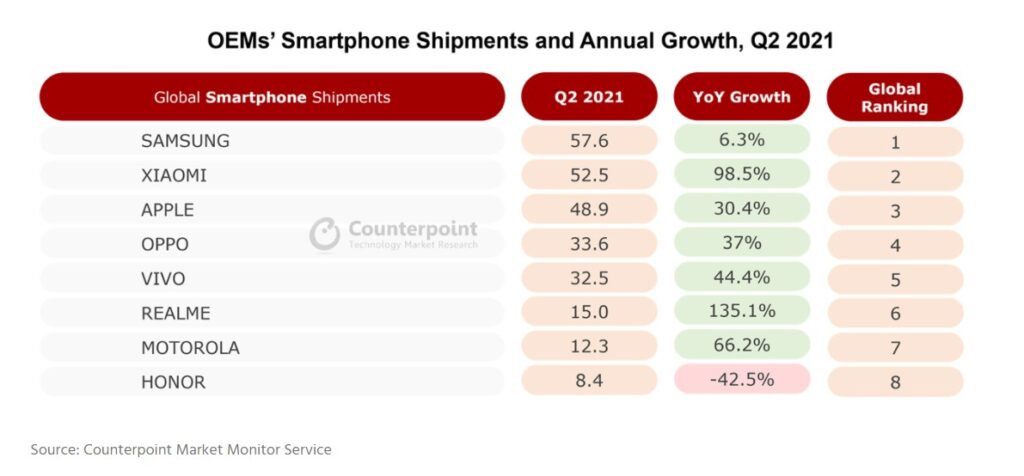

Smartphone OEMs, particularly in emerging markets, are now prioritizing 5G products in their portfolios. Take Realme for example, whose 5G share in its emerging market smartphone shipments went up from 8.8% in Q1 to 15.9% in Q2. The brand has seen the most substantial growth among the competition with a 135% YoY global shipment increase to 15 million in Q2 2021.

The OEM now ranks sixth for the first time. Realme’s global scene is quite positive as well where its 5G device shipments have risen by 37.0% in Q2, up from an increase of 22.7% in Q1.

5G Battle Heating up in Emerging Markets

5G smartphones are turning standard in the developed markets, particularly in countries like the US. However, the same cannot be said about emerging markets where 4G smartphones continue to be sold, particularly in the more wallet-friendly end of the spectrum. This means that such markets have the maximum potential for growth.

The Indian market serves as a great example for this case and has seen 75.5% QoQ growth in 5G device shipments. It will likely continue to demonstrate similar growth rates until the rest of the year and beyond.

Countries in Southeast Asia will also likely see a 5G shipment increase in the second half of 2021. But the real difference will be made in 2022 when 5G will go live commercially.

With more and more affordable 5G offerings hitting the market, the involved OEMs should witness a considerable jump in their market shares. No OEM would like to miss out on this wave and we should hence be seeing the decline of 4G-only phones.

RELATED:

- iQOO Z5 5G launched with 120Hz display, Snapdragon 778G, 5,000mAh battery

- Samsung Galaxy F42 5G confirmed to launch in India on September 29 via Flipkart

- Xiaomi 11 Lite NE 5G to come with Netflix Dolby Vision in India, claims report

- OPPO F19s India launch date revealed, OPPO Reno6 Pro 5G Diwali Edition might tag along