Smartphone sales in Indonesia saw a 6% decline in Q3 2021 owing to the rise in COVID-19 infections in the country. The global semiconductor shortage was also a major contributor.

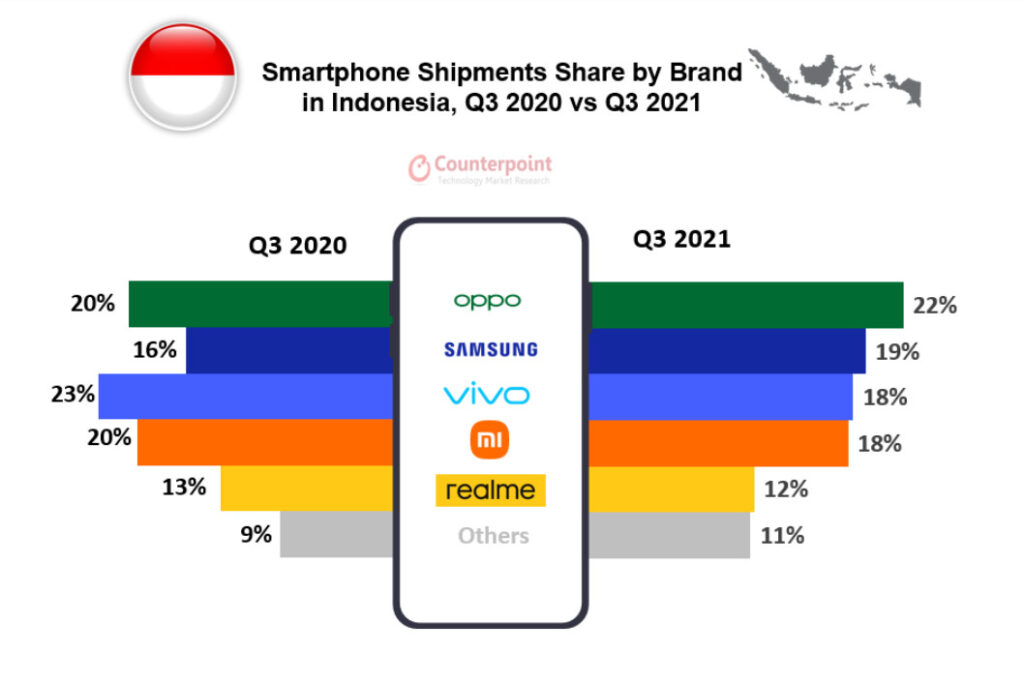

It appears that smartphone sales have a lot to do with the amount of components OEMs are able to secure for themselves. As such, OPPO, which was the least affected by component shortage during the period, has grabbed the top spot with a 22% share (via Counterpoint Research).

Samsung ranks second thanks to its performance improvement driven by new launches. Steady recovery from production issues related to COVID-19 lockdowns in Vietnam played a role as well. The South Korean company is followed by vivo, Xiaomi, and realme.

The third spot in terms of smartphone shipments during Q3 2021 is held by vivo with a share of 18% – a decline from the top spot during the same period last year.

Xiaomi’s ranking saw a drop as well in Q3 2021 compared to both Q3 2020 as well as Q2 2021 due to component shortages. The scarcity led the brand to increase prices on four models – Redmi 9A, Redmi 9C, POCO M3 Pro 5G, and Redmi Note 10 5G – in mid-October.

Consumer demand did show signs of recovery towards the end of Q3 2021 though, thanks to the reduction in daily COVID infections, and economic activities returning to normal as a result. However, the chip shortage is here to stay for another year or so and will continue to be a huge growth limiter in the smartphone industry.

Apart from this, 5G smartphones saw a huge rise in sales with shipments jumping from 7% in Q2 2021 to 14% in Q3 2021. The figures will be increasing further well into Q4 2021 and beyond. Multiple operators like XL Axiata, Telkomsel, and Indosat are either testing 5G prior to launch or have already launched commercial 5G. This also acted as a boost in 5G smartphone shipments.

Moving on to online sales, the online proportion of total shipments did not change much during the first two months of Q3. However, shopping festivals like 9.9 did give a boost to the channel in September. All in all, online shipments made up 16% of the total shipments in Q3 2021, and the figure is expected to rise to over 20% towards the end of the year.

RELATED:

- Samsung will reportedly move part of its smartphone production capacity from Vietnam to India

- Motorola teases smartphone with “incredible photography experience”; likely to be Moto G200

- Infinix Smart 5 Pro entry-level smartphone goes official; features 6.52-inch FHD+ display, 2GB RAM, and Android 11 Go Edition

- Smartphone with 150W charging now coming soon, as if 120W wasn’t fast enough

- Xiaomi rumored to launch two mini smartphones