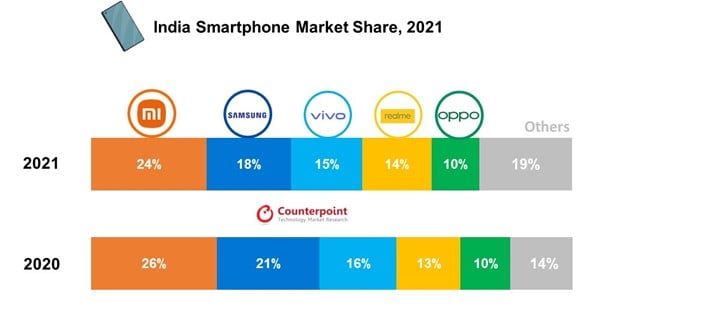

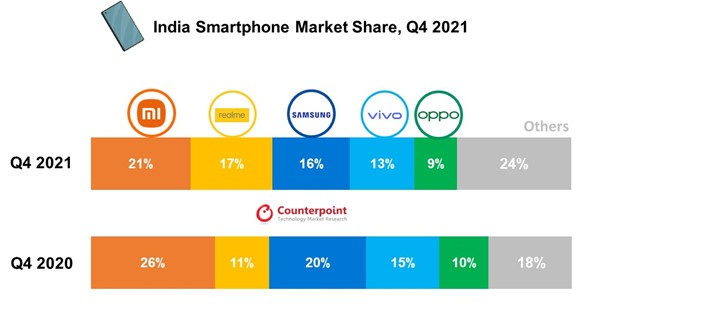

The Indian smartphone market grew 11% YoY, reaching the highest-ever shipments of 169 million units in 2021, and Xiaomi stayed in the lead with almost a quarter of the market share. The festive season didn’t help much during the December quarter, though, with shipments declining 8% YoY owing to supply issues.

Most of the growth was driven by high replacement demand fuelled by increasing smartphone affordability in the mid and high ranges due to offers, discounts, and better financing options (via Counterpoint Research).

The revenue set a new record too, crossing $38 billion in 2021, which is a growth of 27% over 2020. Average selling price rose 14% YoY in 2021 to reach its highest ever at $227 (~₹16,900).

“The price hikes in the budget segment due to component price rise, increasing focus of OEMs on the premium segment, and increased demand for mid-range and premium smartphones due to increasing uses and availability of financing options contributed to the increasing ASP,” research analyst Shilpi Jain says.

Local manufacturing contributed nearly 98% of shipments in 2021, which is an 8% rise compared to 2020. PLI (Production Linked Incentive) schemes have been a great booster to the Indian smartphone manufacturing industry and have attracted the likes of Apple and Samsung.

Moving on to brand-wise distribution, Xiaomi stayed at the top spot, recording a 2% YoY growth. The company grew 258% in the premium segment, thanks to the Mi 11X series, even as component shortages hit hard in the second half of the year.

Samsung remained at the second position in 2021 with an 8% decline in shipments, owing to supply chain disruptions, reduced focus on the entry-level segment, and fewer mid-range launches. This was kind of made up by the Korean company being the top 5G smartphone seller in Q4 2021.

Next up is the fastest growing brand in 2021 — realme — with 20% YoY growth. It also managed to grab second place in Q4 2021 for the very first time.

vivo emerged as the top 5G smartphone company in 2021 with a 19% share, growing 2% YoY, mostly thanks to its Y series and V series.

OPPO stood fifth with 6% YoY growth and was actually the fastest growing brand in the premium segment.

Transsion Group brands comprising itel, Infinix, and TECNO oversaw YoY growth of 55% last year and crossed a landmark 10 million shipments for the first time in the Indian smartphone market in a single year.

Apple registered 108% YoY growth in shipments, becoming one of the fastest-growing brands in 2021, and led the premium segment with a 44% share. OnePlus reached its higher-ever shipments in 2021, crossing the 5-million mark with 59% YoY growth, fuelled by the Nord series.

RELATED:

- Vivo T1 5G India launch scheduled for February 9

- Realme 9 Pro+ variants, price for India leak

- Redmi Note 11S, Redmi Note 11 India price tipped

- Infinix Zero 5G India launch teased, here’s what to expect

- OPPO Reno7 Indian/global edition renders, specs leak reveals its different from China’s Reno7 series